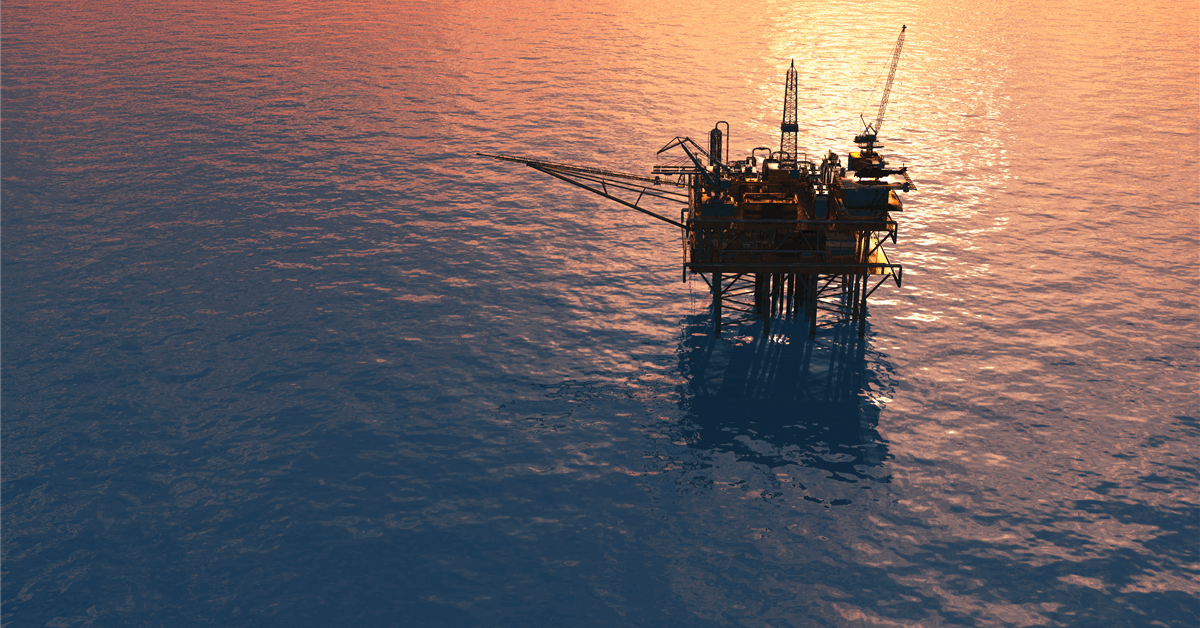

U.S. commercial crude oil inventories, excluding those in the Strategic Petroleum Reserve (SPR), decreased by 3.3 million barrels from the week ending March 14 to the week ending March 21, the U.S. Energy Information Administration (EIA) highlighted in its latest weekly petroleum status report.

This report was published on March 26 and included data for the week ending March 21. The EIA report showed that crude oil stocks, not including the SPR, stood at 433.6 million barrels on March 21, 437.0 million barrels on March 14, and 448.2 million barrels on March 22, 2024. Crude oil in the SPR stood at 396.1 million barrels on March 21, 395.9 million barrels on March 14, and 363.1 million barrels on March 22, 2024, the report outlined. The EIA report highlighted that data may not add up to totals due to independent rounding.

Total petroleum stocks – including crude oil, total motor gasoline, fuel ethanol, kerosene type jet fuel, distillate fuel oil, residual fuel oil, propane/propylene, and other oils – stood at 1.600 billion barrels on March 21, the report showed. Total petroleum stocks were up 3.5 million barrels week on week and up 19.9 million barrels year on year, the report revealed.

“At 433.6 million barrels, U.S. crude oil inventories are about five percent below the five year average for this time of year,” the EIA said in its latest weekly petroleum status report.

“Total motor gasoline inventories decreased by 1.4 million barrels from last week and are two percent above the five year average for this time of year. Finished gasoline inventories increased and blending components inventories decreased last week,” it added.

“Distillate fuel inventories decreased by 0.4 million barrels last week and are about seven percent below the five year average for this time of year. Propane/propylene inventories decreased by 0.2 million barrels from last week and are 11 percent below the five year average for this time of year,” it continued.

U.S. crude oil refinery inputs averaged 15.8 million barrels per day during the week ending March 21, 2025, the EIA noted in its latest report, adding that this was 87,000 barrels per day more than the previous week’s average.

“Refineries operated at 87.0 percent of their operable capacity last week,” the EIA said in the report.

“Gasoline production decreased last week, averaging 9.2 million barrels per day. Distillate fuel production decreased last week, averaging 4.5 million barrels per day,” it added.

U.S. crude oil imports averaged 6.2 million barrels per day last week, according to the report, which outlined that this was an increase of 810,000 barrels per day from the previous week.

“Over the past four weeks, crude oil imports averaged about 5.7 million barrels per day, 11.0 percent less than the same four-week period last year,” the EIA noted in the report.

“Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 589,000 barrels per day, and distillate fuel imports averaged 120,000 barrels per day,” it added.

Total products supplied over the last four-week period averaged 20.2 million barrels a day, up by 0.5 percent from the same period last year, the EIA stated in the report.

“Over the past four weeks, motor gasoline product supplied averaged 8.9 million barrels a day, down by 0.2 percent from the same period last year,” it added.

“Distillate fuel product supplied averaged 3.9 million barrels a day over the past four weeks, up by 1.8 percent from the same period last year. Jet fuel product supplied was up 3.9 percent compared with the same four-week period last year,” the EIA went on to state.

In a report sent to Rigzone on Thursday by the Skandinaviska Enskilda Banken AB (SEB) team, Ole R. Hvalbye, a commodities analyst at the company, said, “commercial crude oil inventories (excl. SPR) fell by 3.3 million barrels, contrasting with last week’s build and offering some price support”.

“Over the past four weeks, total products supplied, a proxy for U.S. demand, averaged 20.2 million barrels per day, up 0.5 percent compared to the same period last year,” Hvalbye added.

“Gasoline supplied averaged 8.9 million barrels per day, down 0.2 percent, while diesel supplied came in at 3.9 million barrels per day, up 1.8 percent. Jet fuel demand also showed strength, rising 3.9 percent over the same four-week period,” he went on to note.

In an oil and gas report sent to Rigzone late Monday by the Macquarie team, Macquarie strategists revealed that they were forecasting that U.S. crude inventories would be down by 2.8 million barrels for the week ending March 21.

“This follows a 1.7 million barrel build for the week ending March 14, with the crude balance realizing moderately looser than our expectations amidst strong implied supply,” the strategists noted in that report.

In its previous weekly petroleum status report, which was released on March 19 and included data for the week ending March 14, the EIA highlighted that U.S. commercial crude oil inventories, excluding those in the SPR, increased by 1.7 million barrels from the week ending March 7 to the week ending March 14.

The EIA’s next weekly petroleum status report is scheduled to be released on April 2. It will include data for the week ending March 28.

To contact the author, email [email protected]