In an EBW Analytics Group report sent to Rigzone by the EBW team on Monday, Eli Rubin, an energy analyst at the company, noted that the December natural gas contract “pulled back to $4.268 [per million British thermal units (MMBtu)] intraday Friday before skyrocketing to test $4.509 [per MMBtu] this morning”.

Rubin highlighted in the report that “a cold spell lifted weekend Henry Hub prices to a seven-month high of $3.76 [per MMBtu], LNG exports pushed a step-change higher to a record 18.1 Bcf/d [billion cubic feet per day], and weekend weather forecasts added eight HDDs [heating degree days] since Friday”.

The EBW energy analyst went on to note in the report, however, that gas production set a record high on Sunday as Marcellus producers raised output into the first cold spell of the season.

“Further, current cold weather may end mid-week, with daily weather-driven demand to slide 12.7 Bcf/d by Thursday,” Rubin added.

“U.S. natural gas storage may reach Thanksgiving only slightly below 3,900 Bcf [billion cubic feet],” Rubin continued.

Rubin went on to warn in the report that technical momentum may fizzle after having achieved the $4.50 per MMBtu target.

“Chances for a cold December lie beyond the 1-15 day forecast window,” Rubin pointed out.

“While another test of support is probable within the next 7-10 days, the bullish long-term structural outlook has limited both the duration and magnitude of any pullbacks – and may continue to offer support,” he added.

In an exclusive interview with Rigzone on Monday morning, Art Hogan, Chief Market Strategist at B. Riley Wealth, said the fundamental backdrop continues to move natural gas prices higher.

“Futures rose nearly three percent to around $4.45 per MMBtu, the highest since March and close to levels last seen in December 2022, lifted by strong export demand and record activity at LNG facilities,” Hogan told Rigzone.

“Flows to the eight major LNG plants averaged around 17.4 billion cubic feet per day so far this month, topping October’s record, and are likely to rise further as Europe looks beyond Russian gas and Asian buyers secure long term U.S. supply,” he added.

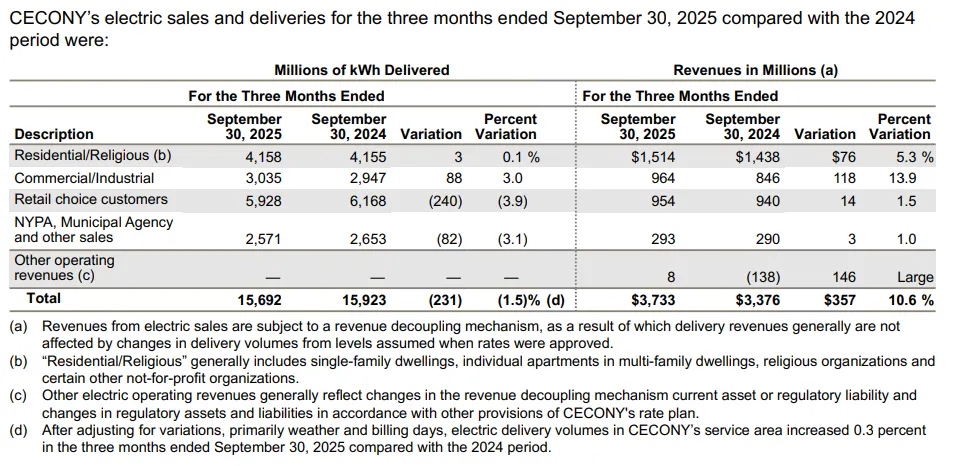

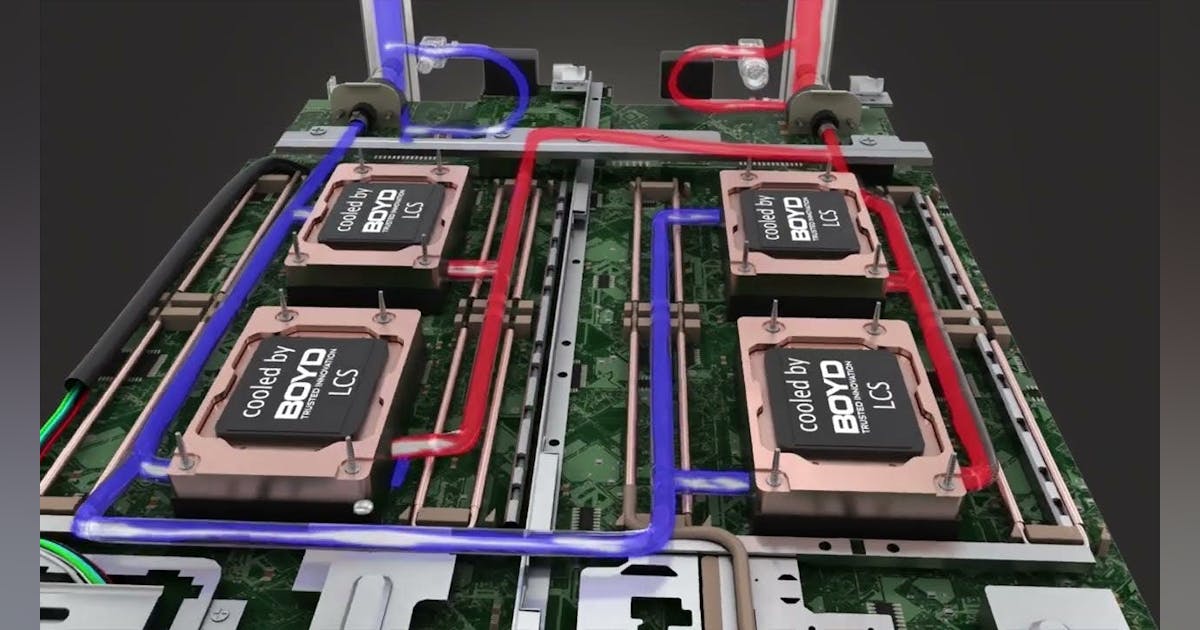

“EIA [U.S. Energy Information Administration] expects both supply and demand to hit new highs in 2025 and 2026, driven by power hungry data centers and surging LNG exports,” he continued.

In a separate exclusive interview with Rigzone this morning, Phil Flynn, a senior market analyst at the PRICE Futures Group, said natural gas “is getting hit with a double barrel blast of cold weather as well as record liquefied natural gas exports last week”.

“Demand for natural gas will be the highest level at this time of year probably in at least a decade and that is making the market more sensitive to the fact that storage, though above average, has to readjust to a world where demand could be above average as well,” he added.

Rubin is an expert in econometrics, statistics, microeconomics, and energy-related public policy, the EBW Analytics Group site states, noting that he is “instrumental in designing the algorithms used in our models, and in assessing the potential discrepancies between theoretical and practical market effects of models and historical results”.

B. Riley Wealth’s website notes that Hogan’s “distinguished financial industry career spans 30+ years, during which he has concentrated on the U.S. equity markets”. The site points out that Hogan has served as a member of the Board of Governors of Boston Stock Exchange, Inc., and a member of the Board of Directors of NASDAQ OMX BX, Inc.

Flynn is described on the PRICE Futures Group website as “one of the world’s leading energy market analysts, providing individual investors, professional traders, and institutions with up-to-the-minute investment and risk management insight into global petroleum, gasoline, and energy markets”. Flynn is also a daily contributor to Fox Business Network, the site highlights.

To contact the author, email [email protected]