The US is preparing a fresh round of sanctions on Russia’s energy sector to increase the pressure on Moscow should President Vladimir Putin reject a peace agreement with Ukraine, according to people familiar with the matter.

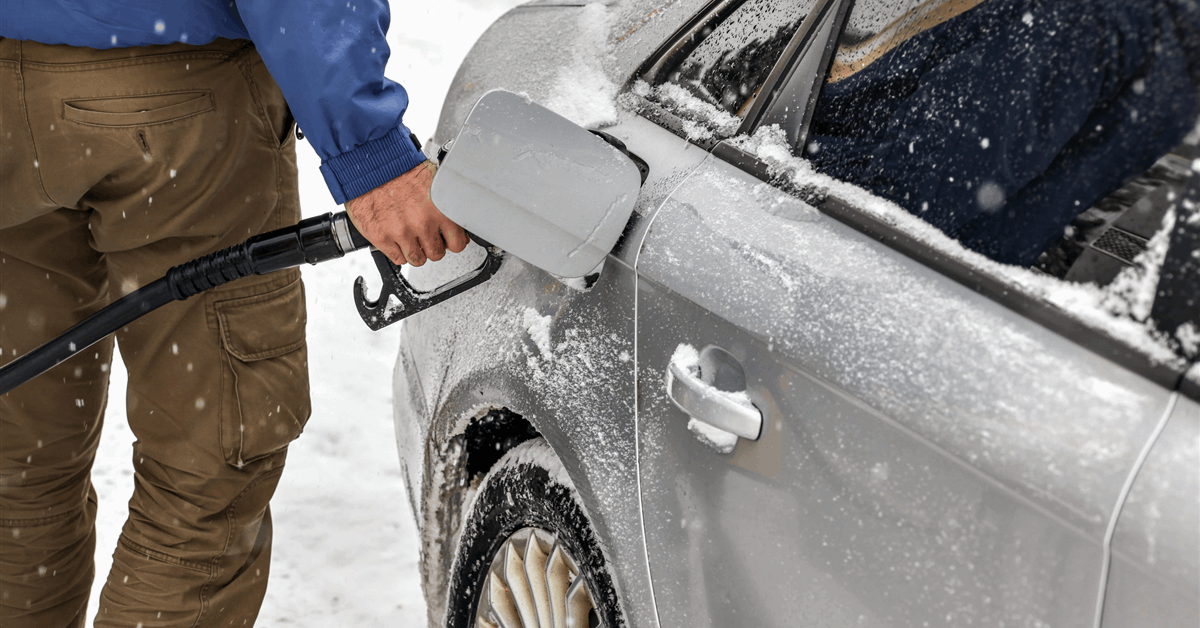

The US is considering options, such as targeting vessels in Russia’s so-called shadow fleet of tankers used to transport Moscow’s oil, as well as traders who facilitate the transactions, said the people who spoke on condition of anonymity to discuss private deliberations.

The new measures could be unveiled as early as this week, some of the people said.

Treasury Secretary Scott Bessent discussed the plans when he met a group of European ambassadors earlier this week, the people said. “President Trump is the President of Peace, and I reiterated that under his leadership, America will continue to prioritize ending the war in Ukraine,” he wrote in a post on the social media platform X after the meeting.

The people cautioned that any final decision rests with President Donald Trump. A request for comment placed with the Department of Treasury outside of business hours wasn’t immediately returned.

The Kremlin is aware that some US officials are mulling plans to introduce new sanctions against Russia, Putin’s spokesman Dmitry Peskov told reporters Wednesday, according to the Interfax news service. “It’s obvious that any sanctions are harmful for the process of rebuilding relations,” he said.

Oil briefly rose after the news. Brent futures advanced as much as 70 cents a barrel to trade as high as $60.33, before paring their advance.

My thanks to @EUAmbUS Ambassador Neliupšienė for hosting discussions this morning with the 27 EU Ambassadors to the United States.

President Trump is the President of Peace, and I reiterated that under his leadership, America will continue to prioritize ending the war in… pic.twitter.com/3SfQiL4lvw

— Treasury Secretary Scott Bessent (@SecScottBessent) December 15, 2025

A raft of sanctions imposed on Russia since it launched its full-scale war against Ukraine in 2022 haven’t changed Putin’s calculus so far. However, measures targeting Moscow’s oil majors and trade have seen crude prices plummet to their lowest levels since the invasion began, adding significant strain on the country’s already troubled economy.

The discussions over further measures come as US and Ukrainian negotiators made some advances this week toward the terms of a potential peace accord. US envoy Steve Witkoff was in Berlin for two days of talks with Ukrainian President Volodymyr Zelenskiy and European leaders over the latest proposals.

US, Ukrainian and European officials hailed significant progress over a set of US-backed guarantees to ensure Kyiv’s post-war security.

Sticking points remain over the future status of territories in eastern Ukraine, the use of frozen Russian central bank assets and the management of the Zaporizhzhia nuclear power plant, some of the people said. Kyiv also wants to see in writing exactly what its allies would do should Russia re-invade Ukraine.

Russia has demanded that Ukraine cede areas of the Donbas, which includes the Donetsk and Luhansk regions, and that Putin’s troops and proxies have tried and failed to occupy since 2014. US proposals have suggested turning the unoccupied area into a de-militarized or free economic zone under special administration.

It’s unclear whether that land would be de facto recognized as Russian under those plans and what, if any, concessions Moscow is prepared to offer in return. Kyiv and many of its allies have balked at the prospect of ceding territory to Russia and withdrawing troops from areas critical to Ukraine’s defense.

US officials also see immobilized Russian assets as part of any future peace arrangement, some of the people said, just as European leaders are set to decide later this week whether to tap the frozen assets to provide military and economic aid to Ukraine. Moscow has reacted furiously to that prospect, a sign, some of the people said, that it is trying to impede the move from materializing and is angling for an easing of sanctions on its increasingly ailing economy.

With negotiations weighed down by difficult questions over territory and security guarantees, attention is shifting to Putin’s response, with little indication so far that he’s ready to end his attacks or alter his goals.

Russian Deputy Foreign Minister Sergei Ryabkov said this week he’s “very much confident” the war is nearing an end. Still, he told ABC News in an interview that Moscow’s territorial demands remain unchanged — and ruled out the deployment of NATO troops to Ukraine under a peace accord.

“I’m pretty sure we’re on the verge of resolving this terrible crisis,” Ryabkov said, without elaborating. “We are prepared to have a deal, to use the word of President Trump, and my hope, keep fingers crossed, would be that it comes sooner rather than later.”

Swaths of sanctions on Russia have done little to boost the price of oil, a market that’s moving into a surplus that’s only expected to grow next year. Brent futures are down 20% this year and tumbled to the lowest since Feb. 2021 on Tuesday.

The US has already sanctioned four top Russian producers and, along with other Group of Seven nations, hundreds of tankers involved in transporting Moscow’s oil.

Witkoff and Jared Kushner, Trump’s son-in-law, held five hours of talks with Putin at the Kremlin on Dec. 2.

Zelenskiy said on Monday that he has an agreement with the US to make security guarantees legally binding through a vote in Congress as part of any deal to end the war. He also said that he expects the US to consult next with Russia, while Ukrainian negotiators may return to the US for further talks in the coming days.