The US is using its dominance of a niche petroleum gas as a bargaining chip in its trade war with China.

America supplies China with almost all of its ethane, a product of the shale boom that’s used as a building block for making plastics. But the commerce department is now ordering shippers to apply for export licenses, and has told at least one, Enterprise Products Partners LP, that it intends to withhold permits for three China-bound cargoes.

The trade war is throwing a spotlight on how the US and China rely on each other for certain commodities — dependencies that both nations are seeking to leverage as they negotiate terms to resolve their dispute. In this case, America is the world’s biggest producer of ethane, which is converted into ethylene for plastics factories, and China is its largest customer.

The commerce department has cited risks that petroleum products like ethane could be diverted to the military, copying the playbook deployed by Beijing in justifying restrictions on what it calls dual-use items such as rare earths and other critical minerals.

“Ethane is no longer just a byproduct of shale — it’s now a geopolitical weapon,” said Julian Renton, lead analyst covering natural gas liquids at East Daley Analytics. “China bet billions building infrastructure around US ethane, and Washington is now questioning whether that bet should continue to pay off.”

America’s shale revolution and China’s rapid industrialization have coincided this century to create a market where cheap energy byproducts are parlayed into millions of tons of materials used as trash bags and shampoo bottles, car seats and computer keyboards.

But companies that prospered from cooperation are now caught in the crossfire of an increasingly antagonistic trade relationship between Washington and Beijing. Chinese firms such as Satellite Chemical Co. operate giant petrochemical plants that process US ethane almost exclusively. US producers like Enterprise Products Partners and Energy Transfer LP rely on exports, almost half of which go to China, to augment sales in their heavily saturated domestic market.

Joint Venture

Energy Transfer and Satellite formed a joint venture in 2018 to construct a new export terminal on the U.S. Gulf Coast to provide ethane for the Chinese company’s plants. It’s an example of how infrastructure that facilitates the ethane trade — from specialized terminals and pipelines to expensive tankers purpose-built to carry the fuel — can revolve around long-term relationships between a single buyer and seller, said Renton.

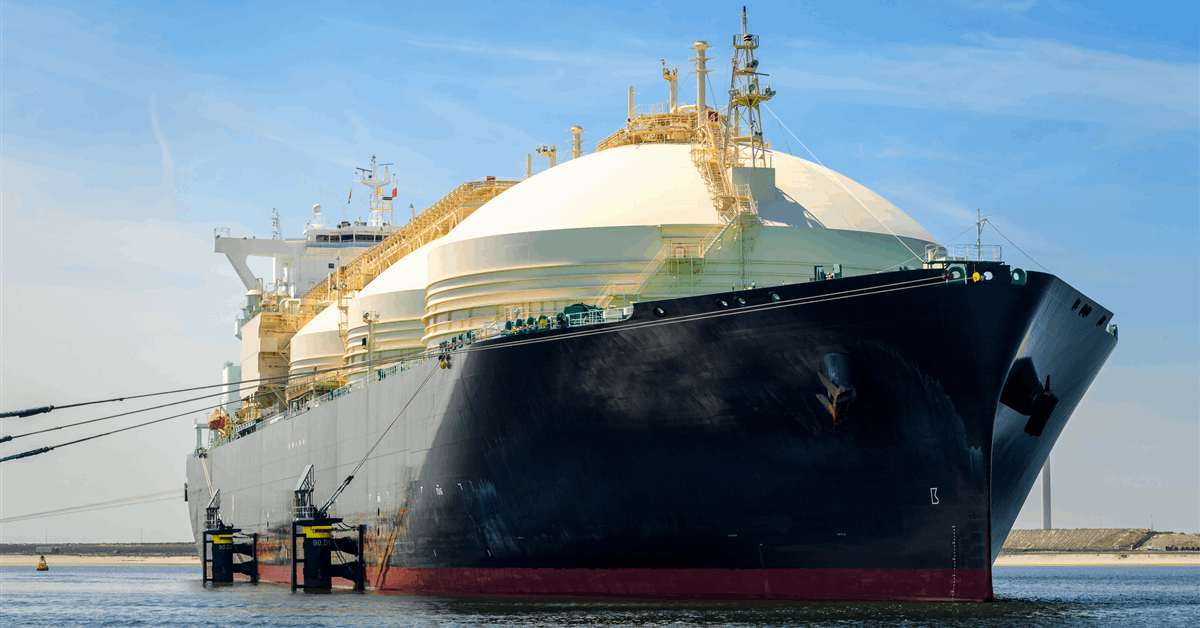

The vessels that ship the gas, dubbed Very Large Ethane Carriers, are another case in point. There are about 30 in the world, according to Kpler ship-tracking data, plying dedicated routes.

There’s not much of a spot market to absorb dislocations in supply or demand, said Renton. “These aren’t oil tankers that can pivot mid-ocean,” he said.

At least one VLEC is now idling off the Gulf Coast waiting for its next move, which looks dependent on the US government’s approach to licensing. But there’s more at stake than the fate of a few cargoes.

“It throws a wrench into multi-billion dollar, multi-decade commercial planning cycles,” said Renton.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.