Voyager Midstream Holdings LLC has completed the purchase of a non-operating stake in a Texas natural gas liquid (NGL) pipeline from Phillips 66.

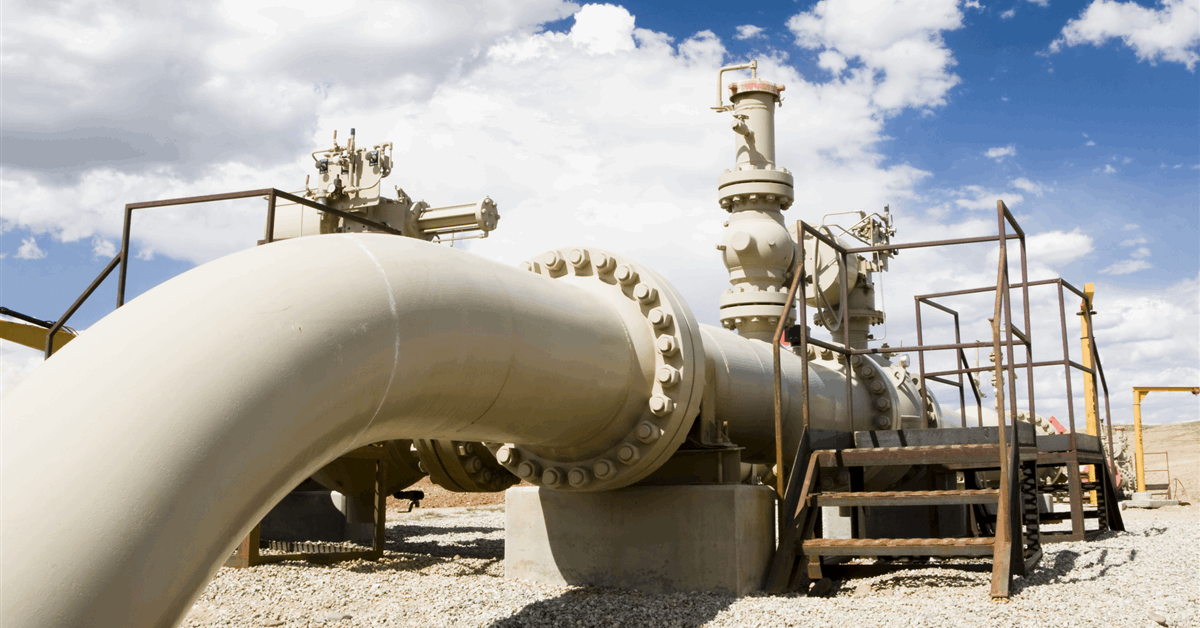

The 254-mile Panola Pipeline, operated by Enterprise Products Partners LP, transports Y-Grade NGLs from Panola County to fractionation facilities in Mont Belvieu city.

“Voyager’s interest in the Panola Pipeline is a strategic fit with the company’s existing footprint in East Texas and North Louisiana”, Houston, Texas-based Voyager said in an online statement, referring to assets also acquired from Phillips 66.

Voyager chief executive Will Harvey commented, “Panola Pipeline is a critical NGL pipeline connecting the major East Texas gas processing complexes and Gulf Coast demand markets”.

“We are excited to work alongside our partners in Panola Pipeline to safely transport liquids to satisfy growing demand for NGLs along the Gulf Coast”, Harvey added.

Voyager did not disclose the financial details of the transaction.

It said that in conjunction with the acquisition, it has entered into a credit facility with the Bank of Oklahoma. “This credit facility, along with existing equity commitments from Pearl, provides Voyager with substantial flexibility and capital to continue growing its business in support of its customers”, it said.

Pearl Energy Investments launched Voyager in 2023 as a platform for the acquisition and development of crude oil, natural gas and produced water infrastructure across key basins in North America.

Voyager operates about 550 miles of natural gas pipelines and associated compression. It also has 400 million cubic feet a day of cryogenic gas processing capacity and 12,000 barrels per day of liquid fractionation capacity.

It also operates Carthage Hub, a gas trading and delivery hub capable of handling over 1 billion cubic feet per day. Carthage Hub interconnects multiple markets across the United States including LNG markets in Texas and Louisiana.

All of these were acquired from Phillips 66 in the fourth quarter of 2024.

“Located in Panola, Rusk and Harrison counties in Texas and Caddo parish in Louisiana, this acquisition positions Voyager in the core of the prolific Haynesville Shale”, Voyager said September 3.

Phillips 66 has exceeded a divestment plan targeting $3 billion of asset monetization. The divestment plan aimed to support its shareholder return target and other long-term priorities while focusing investment on low-cost but high-return projects.

“We intend to continue to optimize the portfolio and rationalize non-core assets going forward”, chief executive Mark Lashier said December 16 in a company statement announcing the divestment of Phillips 66’s Gulf Coast Express Pipeline stake. “The evolution of our portfolio underscores our position as a leading integrated downstream energy provider, enhancing shareholder value and positioning the company for the future”.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR