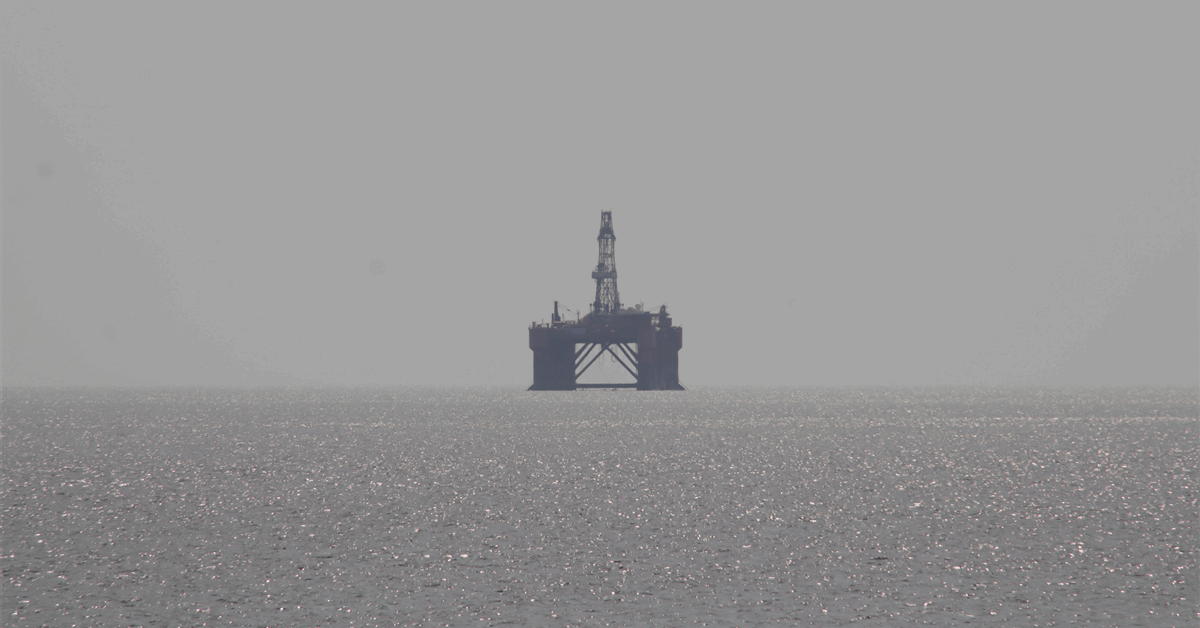

Weatherford International plc said it was awarded a “significant” contract to deliver managed pressure drilling (MPD) services for the Trion project, a deepwater oil production project in Mexico operated by Woodside Petróleo Operaciones de Mexico.

The multi-year contract includes MPD services for an initial eight wells with the potential to expand to 24 wells, the company said in a news release. Financial terms of the contract were not disclosed.

As part of the project, Weatherford said it plans to deploy its Victus intelligent MPD system, which it describes as a solution “designed to enhance drilling safety, efficiency, and performance”. The solution features algorithm-driven pressure control, real-time downhole data for automated responses, and the industry’s first field-proven deepwater riser system for floating rigs, according to the release.

The Trion project is located in deepwater about 8,200 feet (2,500 meters) in the Gulf of America, approximately 112 miles (180 kilometers) east of the coast of Tamaulipas and 18.6 miles (30 kilometers) south of the US-Mexico maritime border, the release said.

Trion is a joint venture between Woodside Petróleo Operaciones de México, S. de R.L. de C.V., who serves as the operator with a 60 percent interest, and Petróleos Mexicanos (PEMEX) with 40 percent.

The contract award “reinforces Weatherford’s market leadership in high-performance MPD and expands its presence in Mexico’s offshore energy sector,” the company said.

Weatherford President and CEO Girish Saligram said, “We are proud to support Woodside Energy on this historic project. The Trion development represents a defining moment for Mexico’s energy sector, and Weatherford is honored to contribute with trusted MPD technologies that improve safety, efficiency, and well delivery. This award further strengthens our position as a trusted partner for complex offshore operations”.

Second-Quarter Results

In the second quarter, Weatherford reported revenue of $1.2 billion, an increase of 1 percent sequentially and a decrease of 14 percent year over year. Operating income was $237 million, an increase of 67 percent sequentially and a decrease of 10 percent year over year. Net income for the quarter was $136 million, an increase of 79 percent sequentially and an increase of 9 percent year over year.

Saligram said in a statement, “Our core operating markets continued to exhibit activity slowdown during the quarter, driven by geopolitical events, supply-demand imbalance concerns, and trade uncertainties. Despite these structural headwinds, the One Weatherford team delivered second-quarter results in line with expectations, reflecting disciplined execution and operational efficiency in a distinctly softer market. The sequential performance demonstrates strong fundamentals and the resilience of our operating model”.

“Revenues increased and adjusted EBITDA was flat despite the previously announced divestiture of certain businesses in Argentina. Adjusted Free Cash Flow also increased, even as receivables continued to build in Latin America due to lack of payments in Mexico. This performance underscores the strength of the new Weatherford operating paradigm and marks a positive departure from past responses to prior market cycle inflections,” he added.

Weatherford’s North America revenue was $241 million, down 4 percent compared to the previous quarter, “primarily from lower Wireline activity in Canada Land, partly offset by higher Cementation Products and Liner Hangers activity,” the company said. The North America segment decreased 4 percent from a year ago, primarily from lower activity across all the segments, partly offset by higher activity in the US offshore segment.

The company’s International segment revenue of $963 million was an increase of 2 percent sequentially and 16 percent year-over-year, the company said in its earnings release.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR