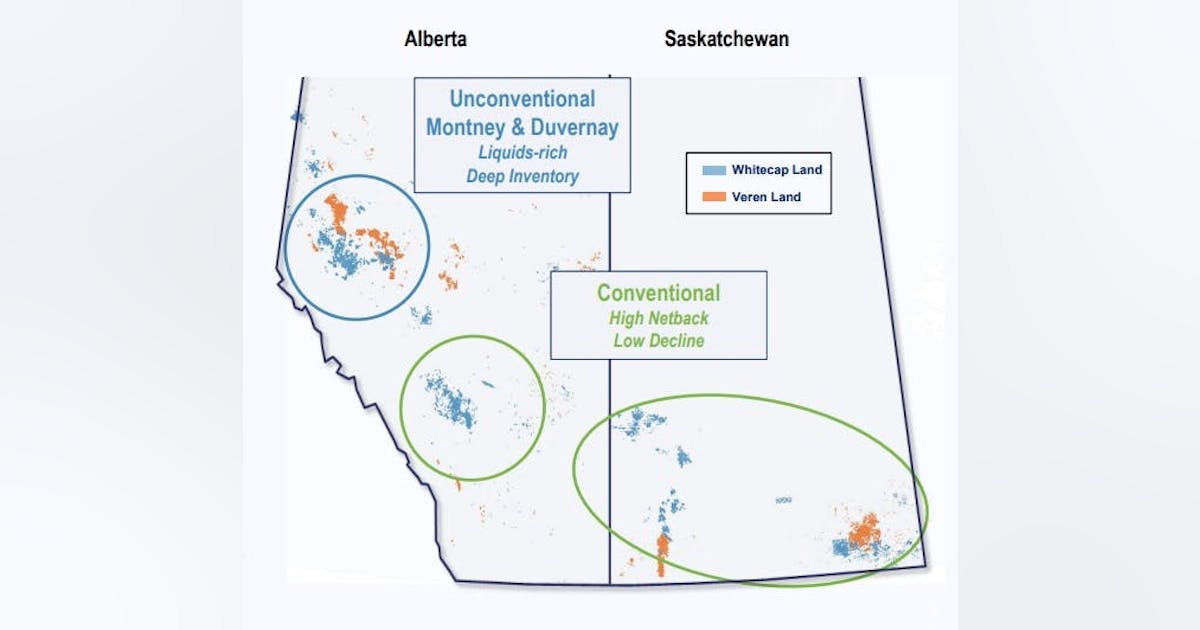

Whitecap Resources Inc., Calgary, and Veren Inc. have agreed to merge in an all-stock deal valued at $15 billion (Can.), inclusive of net debt, to form a large Western Canadian light oil and condensate producer.

The deal brings the Whitecap and Veren together to create “one world-class energy producer with one of the deepest inventory growth sets of both liquids-rich Montney and Duvernay opportunities, along with conventional light oil opportunities in some of the most profitable plays in the Western Canadian basin,” said Grant Fagerheim, Whitecap president and chief executive officer, in a joint release Mar 10.

The combine will hold 370,000 boe/d (63% liquids) of corporate production with overlap across both unconventional and conventional assets, “becomes the largest Canadian light oil focused producer and the seventh largest producer in the Western Canadian Sedimentary basin, with significant natural gas growth potential, the companies said.

Alberta Montney, Duvernay

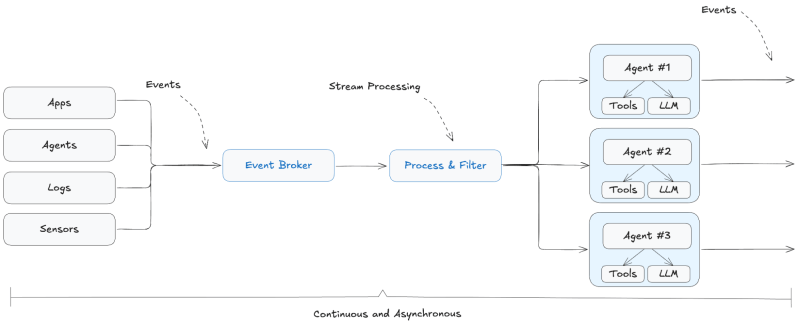

In the Kaybob Duvernay and Alberta Montney, the company expects about 220,000 boe/d of unconventional production with 1.5 million acres in Alberta with and over 4,800 total development locations in the Montney and Duvernay to drive decades of future production growth.

Of the 4,800 (4,336 net) drilling locations identified, 766 (713 net) are proved locations, 270 (254 net) are probable locations, and 3,764 (3,369 net) are unbooked locations.

Opportunities for inventory enhancement include well and completion design, real-time frac optimization, and reservoir-tailored production practices, Whitecap said in a deal presentation.

Saskatchewan

The combine is expected to become the second largest producer in Saskatchewan with consolidated assets in west and southeast Saskatchewan, according to the companies. The combined business will have 40% of its conventional production under waterflood recovery supporting a decline rate of less than 20% on 150,000 boe/d of production. The foundational assets have about 7,000 development locations.

Of the 7,000 (6,201 net) conventional drilling locations identified, 1,968 (1,722 net) are proved locations, 554 (513 net) are probable locations, and 4,478 (3,966 net) are unbooked locations.

Inventory enhancement opportunities include open hole multi-laterals and extended reach horizontals.

Annual synergies of over $200 million are expected, independent of commodity prices, the companies said.

Upon closing, expected before May 30, 2025, the merged company will be led by Whitecap’s existing management team under the Whitecap name with four Veren directors to join the Whitecap board of directors, including the current president and chief executive officer of Veren, Craig Bryksa.