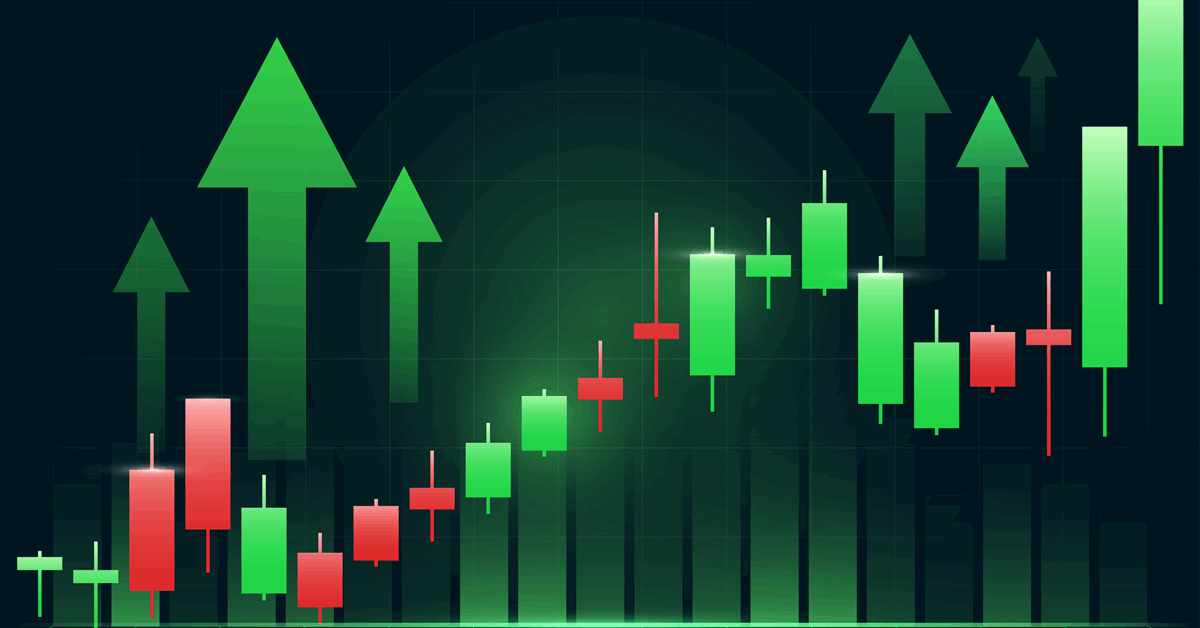

Oil rose as the potential for the US to curtail Iranian flows added to a rebound driven by broader markets.

West Texas Intermediate advanced about 2% to settle near $64 a barrel, recouping most of the previous day’s losses, which were driven by President Donald Trump’s public rebuke of the Federal Reserve.

Also supporting prices, Trump said he and Israeli Prime Minister Benjamin Netanyahu spoke on Tuesday and are aligned on trade and their approach to Iran. That came after the US announced sanctions against Iranian national and liquefied petroleum gas magnate Seyed Asadoollah Emamjomeh and his corporate network.

Crude has slumped this month on concern that mounting tensions between the US and its top trading partners will hurt economic growth and curtail oil consumption, adding to pre-existing expectations of a surplus.

Crude eased off of intraday highs later in the session after the Financial Times reported that Russian President Vladimir Putin has offered to halt his country’s invasion of Ukraine across the current front line. At the same time, White House Press Secretary Karoline Leavitt reiterated Trump’s criticism of the Fed and said the president will travel to Saudi Arabia, Qatar and the United Arab Emirates in May.

Despite the widespread expectations for an oversupply of crude, market gauges have been pointing to a stronger near-term market. The closest WTI futures contract is trading at its biggest premium to the next month since February, signaling tighter supply and demand balances.

“Near-term, I would expect that the biggest wave of selling is behind us,” Martijn Rats, global oil strategist at Morgan Stanley, said in a Bloomberg Television interview. “As we go through the summer, seasonal demand does support things a little bit, but then in the second half we will probably have another period of downward pressure.”

Elsewhere, Vice President JD Vance pushed for stronger ties between New Delhi and Washington across a range of areas from energy to defense. India is the second-biggest importer of crude in the world, after China, where tariff talks remain stalled.

Oil Prices:

- West Texas Intermediate for June, the most active contract, gained 2% to settle at $63.67 in New York.

- WTI for May, which expires Tuesday, settled at $64.31.

- Brent advanced 1.8% to $67.44 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR

Bloomberg