This is the latest installment in Utility Dive’s “Taking Charge” series, where we engage with power sector leaders on the energy transition.

Stable, scalable organic flow battery technology could replace the ubiquitous lithium-ion battery, says XL Batteries co-founder and CEO Tom Sisto – and make the U.S. less dependent on China, which dominates the lithium battery supply chain.

Sisto aims for XL Batteries’ product, a water-based organic flow battery which uses petrochemical feedstocks, to help replace lithium batteries. The petrochemical feedstocks are used to supply the organic molecules the company was founded around, which Sisto says are uniquely stable and therefore well-suited to battery use.

“Our hope is to put demos into customers’ hands fairly soon,” he said. “And we will be commercially deploying very large scale projects significantly before 2030.”

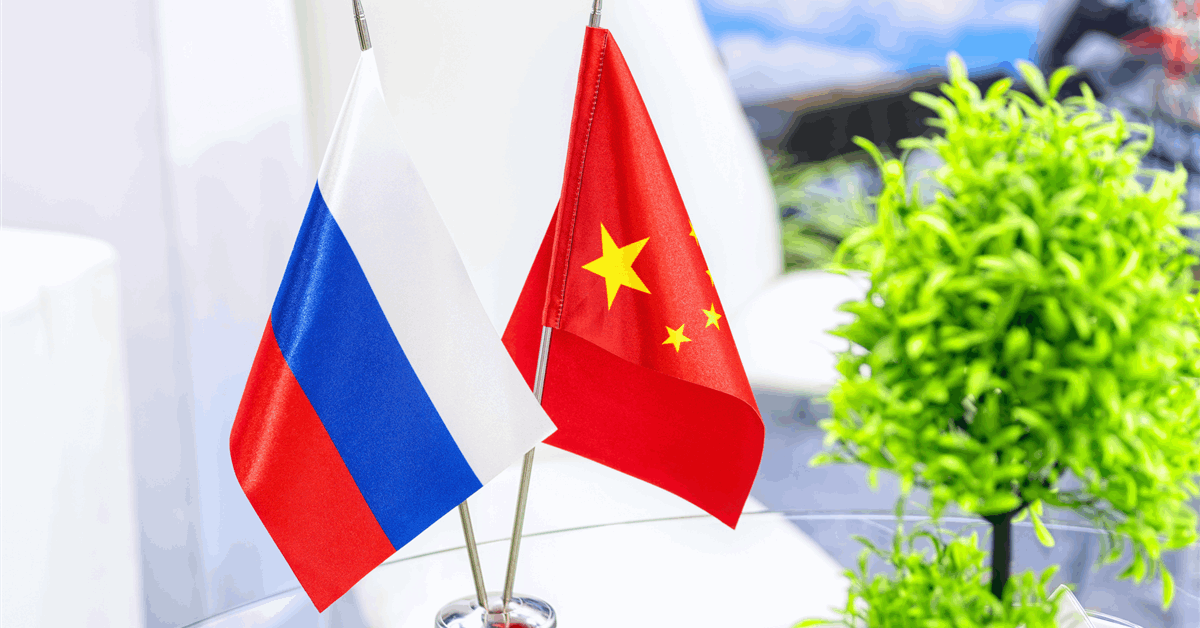

The “commodity chemicals” that XL Batteries uses as feedstocks are “global, ubiquitous, and made at the largest scales in the world,” Sisto said. In contrast, China “dominates the active materials production portion of the lithium battery supply chain,” according to a June article from the Center for Strategic and International Studies.

Behind China, Japan and South Korea, the United States “finds itself a distant fourth” in lithium battery materials production, “a position where it is likely to remain for 10 years despite significant investment,” CSIS said.

Costs across the battery supply chain are already soaring in the U.S. due to President Trump’s new tariffs on Chinese goods, causing project delays and cancellations.

“We’re seeing the disruption of these lithium-ion utility scale projects,” Sisto said. “I think what it’s done is it’s opened people’s eyes to [China’s] 90% control over the entirety of the supply chain, from the raw materials up.”

Even if developers in the U.S. “wanted to build a factory, we don’t have the equipment to go inside of it,” he said. “And then if we want to build the factory that makes the equipment that goes inside the factory, we don’t have the expertise. And if we want the minerals, we don’t have the refining capability, or the mining capability, so on and so forth.”

Sisto said that he sees the current U.S. economic uncertainty as an opportunity for organic flow battery technology to take hold in the market. He drew a comparison to 2022, when Russia cut its flow of natural gas to Europe by more than half, causing an energy crisis that led Europe to reduce its reliance on gas.

“In a single day, that [status quo] can be upended,” he said. “And I think that’s the way that a lot of our customers are sort of thinking about it. It’s less about, what can you do in the next three months, six months, nine months, and more about, how do we make ourselves resilient as project planners, to not necessarily have an entire portfolio of projects collapsing?”

Sisto said several members of XL Batteries’ team were previously founders and employees at A123 Systems, a lithium-ion phosphate battery company which was purchased by Chinese auto parts maker Wanxiang Group at auction in 2013 after going bankrupt.

“They saw what happened with the collapse of that company, and then the patents being purchased by Chinese companies and the technology being transferred overseas, and the investment by that country’s infrastructure into dominating that entire supply chain,” he said.

China’s dominance over the lithium battery supply chain has been “intentional,” Sisto said, and a “very smart, strategic move to control what is a critical technology.”

Lithium-ion batteries have an obvious advantage over nascent organic flow technology – it’s a mature technology that was commercialized decades ago and operates at a robust scale, Sisto said.

Flow batteries are already a mature technology themselves, he said, but the existing technology is too expensive to use at scale. “Vanadium is the electrolyte, vanadium dissolved in sulfuric acid,” he said. “The promise of organic flow batteries is to drive out the high cost that comes with vanadium and the corrosivity of sulfuric acid, which drives a lot of system design costs to handle that corrosivity.”