In an EBW Analytics Group report sent to Rigzone by the EBW team on Thursday, Eli Rubin, an energy analyst at the company, outlined that the “$5.00 [per million British thermal units (MMBtu)] psychological threshold” is “still a relevant market driver” for natural gas.

“The January natural gas contract traded as high as $5.039 [per MMBtu] yesterday before closing at $4.995,” Rubin said in the report.

“Technicals appear supportive of further upside, physical prices strong, and very cold forecasts intact,” he added.

“DTN’s forecast for Weeks 2 and 3 added another 4 gHDDs in the past 24 hours, and the Week 4 forecast highlights enduring cold risks into Christmas. If frigid late-December forecasts roll forward, it could present further tailwinds for NYMEX upside,” he continued.

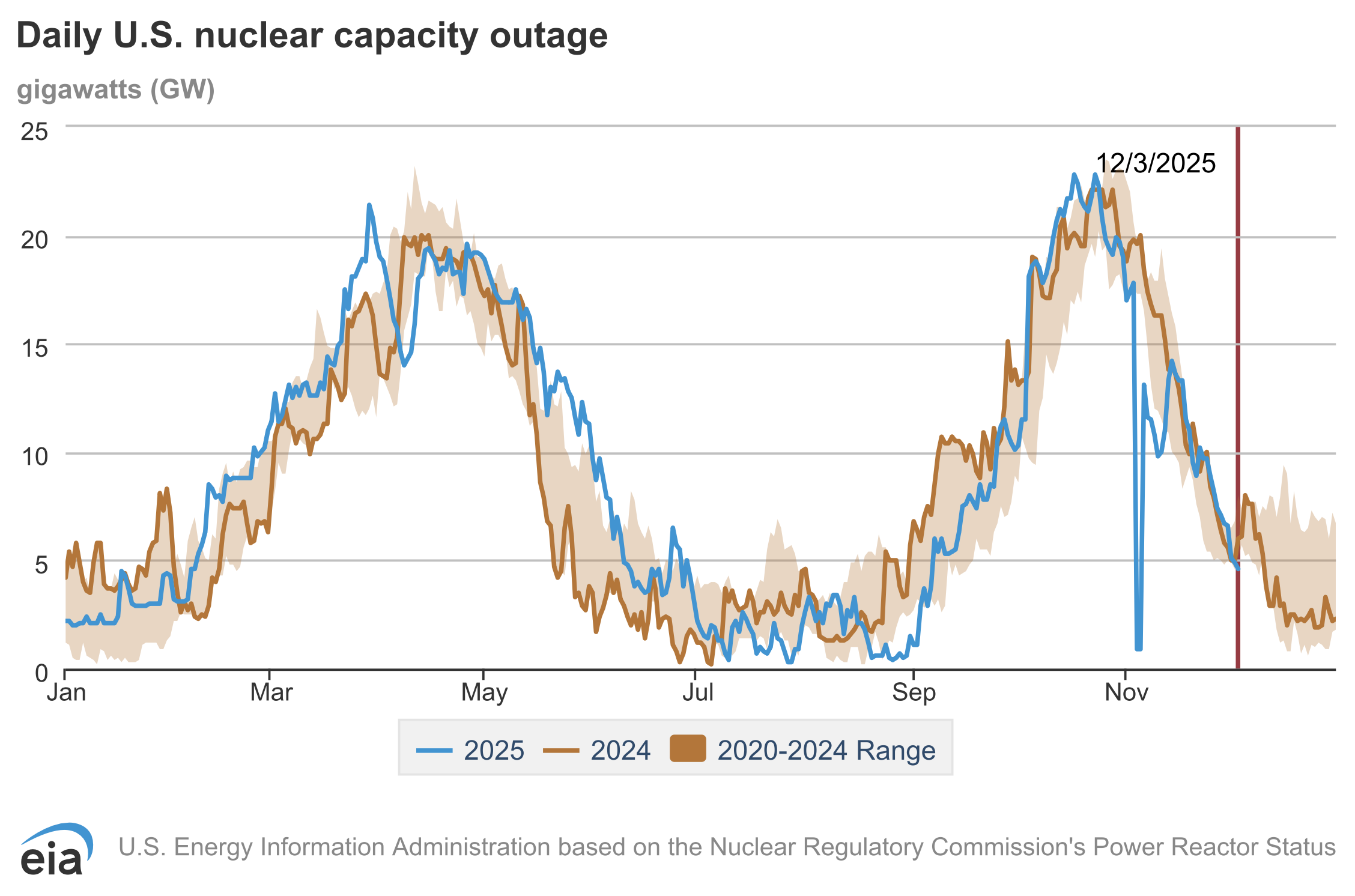

Rubin highlighted in the report that consensus projections for this morning’s U.S. Energy Information Administration (EIA) weekly natural gas storage report are for a 14 to 18 billion cubic foot draw.

“The subsequent four EIA weeks, however, may total 218 Bcf (7.8 Bcfpd) tighter than the five-year average,” he said.

“LNG remains up 5.1 Bcfpd and November production upside seems to be stalling. Our most likely storage projection for the end of March dipped below 1,600 Bcf,” he added.

“While winter 2025/26 storage appears adequate, concerns over rebuilding storage next year have led the 2026 injection season contracts to add 16.3 cents since Friday – even outpacing January contract gains (+14.5 cents) week to date,” he continued.

The EBW report outlined that the January natural gas contract’s Wednesday close of $4.995 per MMBtu marked a 15.5 cent, or 3.2 percent, increase from Tuesday’s close.

In the report, EBW predicted a “test higher and relent” trend for the NYMEX front-month natural gas contract price over the next 7-10 days and a “volatile path higher” trend over the next 30-45 days.

In a report sent to Rigzone by the EBW team on Wednesday, Rubin highlighted that the January natural gas contract “set a four-month intraday high yesterday [Tuesday] at $4.984 before stumbling on (i) weather models uncertain of the mid-December outlook and (ii) being just shy of the $5.00 per MMBtu psychological level”.

In that report, Rubin said “very cold national weather may peak tomorrow [Thursday], nearly 10 gHDDs colder than 30-year norms”.

“Thursday may be the coldest day of December – but daily figures slip to warmer than normal by mid-next week. If technical resistance at $5.00 holds, this variability highlights consolidation risks over the next 7-10 days,” he added.

“While natural gas storage may boast a 186-Bcf surplus to normal to end November, however, forecasts for the coldest December since 2010 may tip storage into a deficit by Christmas,” Rubin pointed out.

“A triple-digit deficit is probable to start 2026. Reloading cold potential into late December, if it verifies, does not yet appear fully priced-in to current NYMEX futures,” he said.

Wednesday’s EBW report highlighted that the January natural gas contract closed at $4.840 per MMBtu on Tuesday. This marked an 8.1 cent, or 1.6 percent, drop on Monday’s closing price, the report outlined.

In this report, EBW also predicted a “test higher and relent” trend for the NYMEX front-month natural gas contract price over the next 7-10 days and a “volatile path higher” trend over the next 30-45 days.

In a market analysis sent to Rigzone on Thursday, Dilin Wu, Research Strategist at Pepperstone, said “U.S. natural gas prices have climbed sharply since late October, fueled by record LNG exports, growing electricity demand from AI data centers, and seasonal heating needs”.

“Short-term upside is clear, but medium-term expansion risks warrant caution,” Wu added in the analysis.

The EIA’s next weekly natural gas storage report is scheduled to be released later today. It will include data for the week ending November 28.

To contact the author, email [email protected]