Uniper SE said it has adjusted down its personnel plan by 400 positions, citing “current challenging market developments and regulatory delays”.

“A significant portion of this reduction will be achieved by not filling positions that are currently vacant or become vacant”, the German multinational power and gas utility said in its financial statement for the first half of 2025.

“In addition, in consultation with employee representatives in Germany, Uniper will design mechanisms and a framework for a voluntary leave initiative. Country-specific measures are being developed for Uniper companies outside Germany.

“In a second step, Uniper will examine further measures to enhance efficiency”.

Uniper reported 7,440 employees as of June 2025, compared to about 11,500 at the end of 2021, the immediate year before its bailout by the German government. At the end of 2022, when it was taken over by Berlin amid the energy crisis, Uniper had around 7,000 workers, according to the statement.

Uniper also updated its strategic plan due to the current challenges.

“Uniper intends to maintain its leading role in providing a reliable energy supply to power and gas customers in Germany and other European markets”, the statement said. “It has so far made investment decisions totaling around EUR 900 million under this strategy.

“The company intends to invest about EUR 8 billion in its transformation by the early 2030s and, according to its current estimate of market developments, to invest about EUR 5 billion through 2030”.

Most of the EUR 5 billion planned until 2030 would go to Uniper’s green and flexible generation segments. The remainder would be for the Greener Commodities segment.

Uniper aims to have a power generation capacity of 15-20 gigawatts by 2030, of which 50 percent would be “renewable, low-carbon or decarbonizable”.

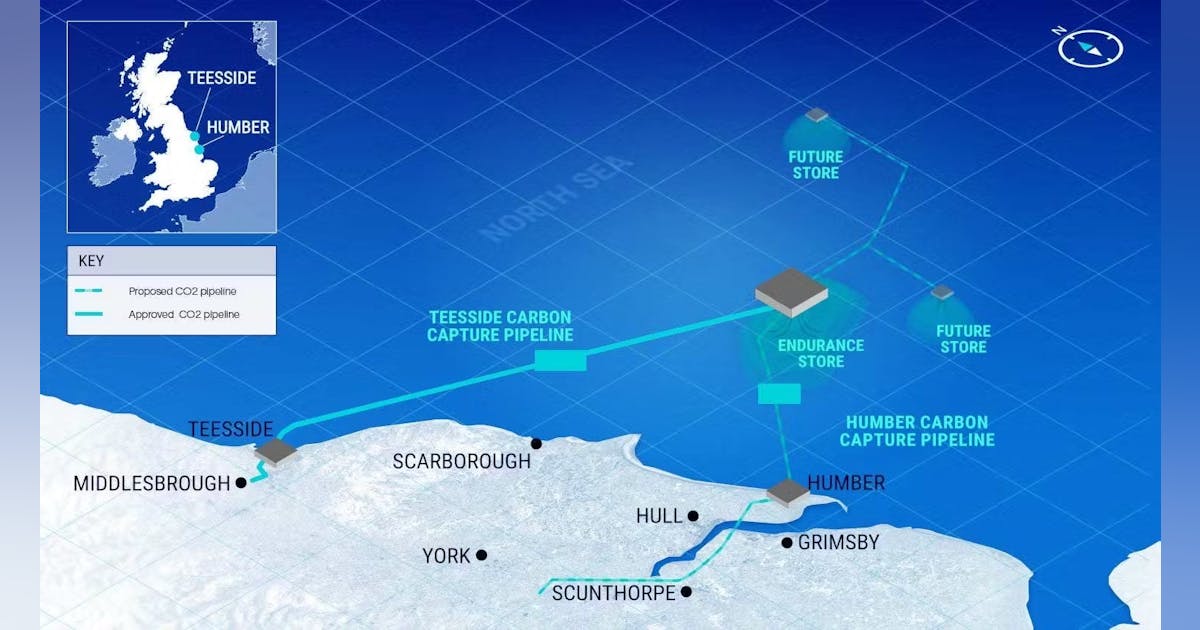

It said it intends to participate in Germany’s planned auction for new gas-fired power plants. In the United Kingdom it plans to build two gas-run plants with carbon capture and storage components in Connah’s Quay and Killingholme.

“Connah’s Quay Low Carbon Power project was, earlier this week, confirmed by the UK government as a priority project in the HyNet cluster and Uniper is now entering into negotiations to develop a gas-fired power plant with carbon capture”, said the statement last week.

The statement added, “Uniper plans to expand its gas and LNG portfolio over the medium term, primarily by means of long-term contracts, to 250 to 300 terawatt-hours (TWh) per year in line with its sales portfolio”.

“Uniper aims to consolidate its strong sales position of 180 to 200 TWh per year in Germany, Austria, and Switzerland and to selectively expand its LNG sales activities in Asia. This will enable it to manage and effectively limit price and volume risks globally”.

Last month it signed a deal with Canada’s Tourmaline Oil Corp. for an eight-year supply of gas totaling 234 billion cubic feet. In April, Uniper committed to one million metric tons per annum for 13 years from Woodside Energy Group Ltd., to be sourced from the Australian company’s under-construction Louisiana LNG project in the United States.

“We welcome the German government’s plans to build new gas-fired power plants. However, the delay in the auction process and thus in the construction of new power plants will postpone potential revenues from these projects until later years”, Uniper chief executive Michael Lewis said. “The ramp-up of the hydrogen economy will also be slower than expected.

“Consequently, we have decided to sharpen the strategic focus of our portfolio through 2030 even more on activities and projects that generate reliable earnings streams”.

Meanwhile, Uniper continued to make divestments to satisfy fair-competition guardrails imposed by the European Commission in approving its bailout. In the latest sale, Steag Iqony Group’s Iqony Fernwaerme GmbH agreed to acquire Uniper Waerme GmbH, a district heating network serving over 14,000 customers in the Ruhr region.

“We are pleased to have found a buyer in the Steag Iqony Group that will continue on the path we have taken and be a reliable employer for our around 130 colleagues”, Uniper Waerme Managing Director Nikola Feldmann said in a statement from Uniper on August 4.

For the first six months of 2025, Uniper logged EUR 135 million in adjusted net profit, down from EUR 1.14 billion for January-June 2024. Before adjustment for nonrecurring items, net income was EUR 267 million, compared to EUR 903 million for the first half of 2024.

Sales rose from EUR 31.73 billion for 1H 2024 to EUR 33.06 billion for 1H 2025, despite lower power and gas volumes. Power purchases and owned generation totaled 66.1 billion kilowatt hours (kWh), down from 75.8 billion kWh for H1 2024. Electricity sales fell from 75.1 billion kWh to 65.1 billion kWh. Gas sales dropped from 685.6 billion kWh to 533.3 billion kWh.

Adjusted EBIT declined from EUR 1.44 billion to EUR 108 million, as did adjusted EBITDA from EUR 1.74 billion to EUR 379 million.

Green Generation’s adjusted EBITDA came at EUR 420 million. “The price level in northern Sweden remains lower than in prior-year period, mainly due to high water inflow, which continues to lead to high reservoir levels”, Uniper explained. “Despite a year-on-year increase in power output, this resulted in lower earnings at Uniper’s hydropower business in Sweden.

“An unplanned extended outage at Oskarshamn 3 nuclear power station in Sweden adversely affected earnings as well.

“The earnings decline in Sweden was slightly offset by Uniper’s hydropower portfolio in Germany, which delivered higher earnings relative to the first half of the prior year thanks to more favorable market developments”.

Flexible Generation’s adjusted EBITDA landed at EUR 333 million. “Earnings were adversely affected by a decline in earnings on hedging transactions on the fossil trading margin and by a smaller generation portfolio, in particular due to the decommissioning of Ratcliffe power plant in the United Kingdom and Heyden 4 in Germany, the sale of Gonyu gas-fired power plant in Hungary, as well as the end of commercial operations of Staudinger 5 and Scholven B and C power plants in Germany and their transfer to grid reserve”, Uniper said.

Greener Commodities registered a negative EUR 296 million in adjusted EBITDA. “Past optimization activities in the gas portfolio had a negative impact on the current financial year”, Uniper said. “In addition, Uniper generated no additional income from lower costs on replacement procurement for undelivered Russian gas”.

Despite the environment, Uniper revised up the lower end of its guidance range for 2025 adjusted EBITDA from EUR 0.9-1.3 billion to EUR1-1.3 billion and 2025 adjusted net earnings from EUR 250-550 million to EUR 350-550 million.

Operating cash flow for H1 2025 was negative EUR 374 million, compared to EUR 2.95 billion for 1H 2024.

Uniper ended H1 2025 with an economic net cash position of negative EUR 3.26 billion.

To contact the author, email [email protected]