Deep Dive

In the frenzy to meet rising energy demand, utilities and others often overlook the value of power system innovations, industry participants say.

Published Aug. 12, 2025

Attendees listen to lab presentations as part of a workshop on advanced distribution management systems at the National Renewable Energy Laboratory’s campus in Golden, Colorado, on Dec. 12, 2024.

Retrieved from Gregory Cooper/National Renewable Energy Laboratory.

The 20th century grid’s one-way electron flow is dead.

On today’s multidimensional, multidirectional 21st century system, new tools can ease the burden of rising demand while limiting customer costs.

But in the frenzy to meet rising energy demand, utilities and others often overlook the value of power system innovations, industry sources, regulators and technology providers say. Instead, many are calling for restarting aged power plants and touting immature energy sources, which could increase electricity prices 25% by 2030, according to Energy Innovation projections.

New generation and transmission infrastructure is needed. But a sophisticated set of power system optimizations could allow operators to reduce the need for costly new infrastructure by maximizing the flexibility of loads and resources.

“New large loads impart costs to the system,” said Kay Aikin, founder and CEO of technology provider Dynamic Grid. But “both data centers and generation can be flexible assets that increase system diversity, which increases reliability.”

Southern California Edison, for example, is investing in artificial intelligence-enhanced system management that gives operators visibility into the “complex series of inputs and outputs that shift constantly throughout the day,” said Jeff Monford, a spokesman for the utility.

It is a “forward radar,” he said, “reshaping how we plan, operate and maintain the grid.”

Former Federal Energy Regulatory Commission Chair Jon Wellinghoff, now CEO of consultant GridPolicy, echoed that sentiment.

“The electricity ‘system of systems’ is a complex weaving and interaction of many functions,” he said. “Millions of small loads and resources can be coordinated and optimized like large loads by automated AI platforms.”

Strength in flexibility

Flexibility provides transformative value to the U.S. power system, often called “the largest machine in the world,” key stakeholders agree.

Many utilities, however, face financial and technical barriers to flexibly operating large loads and customer-owned resources, a July 14 West Monroe survey of 500 utility executives reported.

Some reject the concept outright.

“Projected load growth cannot be met with existing approaches to load addition and grid management,” according to a Department of Energy July report.

Investors are showing renewed interest in large scale, inflexible generation. The White House ordered two retiring coal plants kept online. Mega-investments have been announced in natural gas, hydro, and nuclear power to address AI data center demand.

But these plans ignore the reality of supply chains, construction timelines and, in the case of advanced nuclear, the untested nature of the technology itself. New gas turbines face a minimum five-year delivery schedule.

They also contradict DOE’s own July 2024 recommendations that concluded “flexible, firm electricity supply” along with “demand-side efficiency and flexibility improvements in data centers” can have “immediate impact.”

That flexibility can be deployed through networked advanced computing intelligence in utility control rooms and at the system’s edge. This is “a journey,” because it takes utilities time to learn its value and prioritize their investments, said AspenTech Vice President of Power and Utilities Sally Jacquemin.

Grid-edge distributed energy resource management systems, or DERMS, and advanced distribution management systems, or ADMS, are key parts of the journey, Jacquemin said. An enterprise DERMS in the control room can “enable locationally surgical demand response” with customer-owned resources, she added.

Technology-enabled capabilities can avoid or defer infrastructure investments, which limits the need for the customer rate increases, Jacquemin said.

Managing challenges like large loads and distributed energy resources requires seeing the grid “as a dynamic, multi-directional system where power, data, and value flow in all directions,” said SCE’s Monford.

This change in perspective from a traditional grid with electrons flowing one way “enables smarter planning, more flexible operations, and more comprehensive solutions” to “meet the demands of the future,” Monford said.

Using AI to solve AI’s power problems

Data center flexibility may be the critical emerging opportunity from today’s AI-enabled system operations, several sources agreed. And flexibility “during stressful grid conditions” might “lower peak demand” and reduce the threat of new loads causing blackouts, the North American Electric Reliability Corporation acknowledged in July.

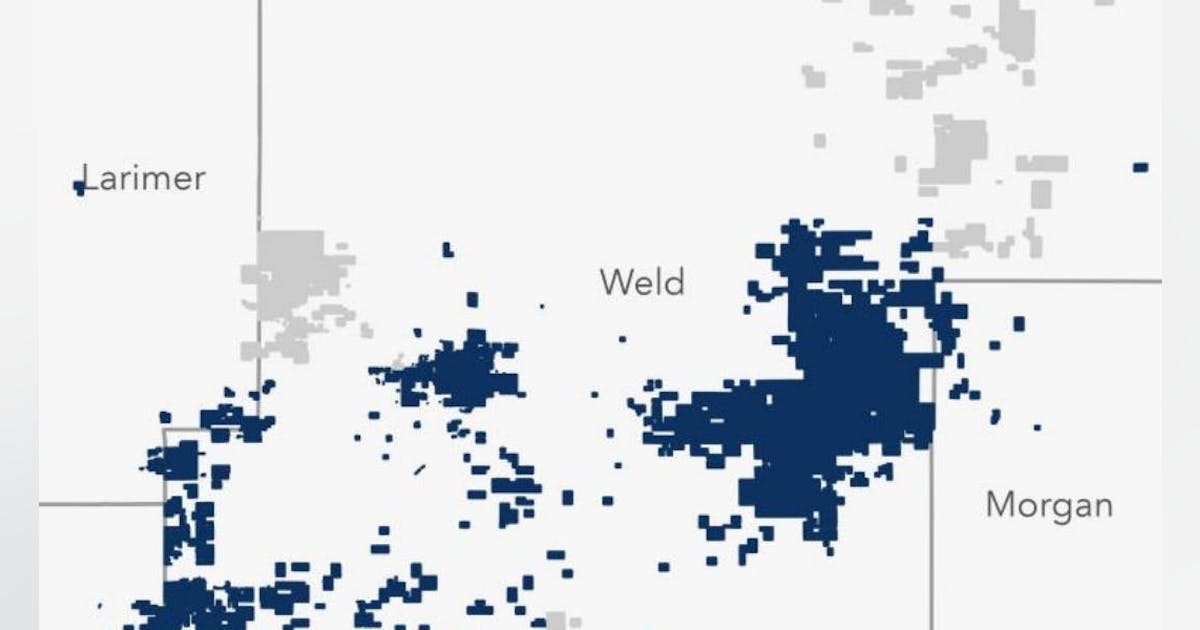

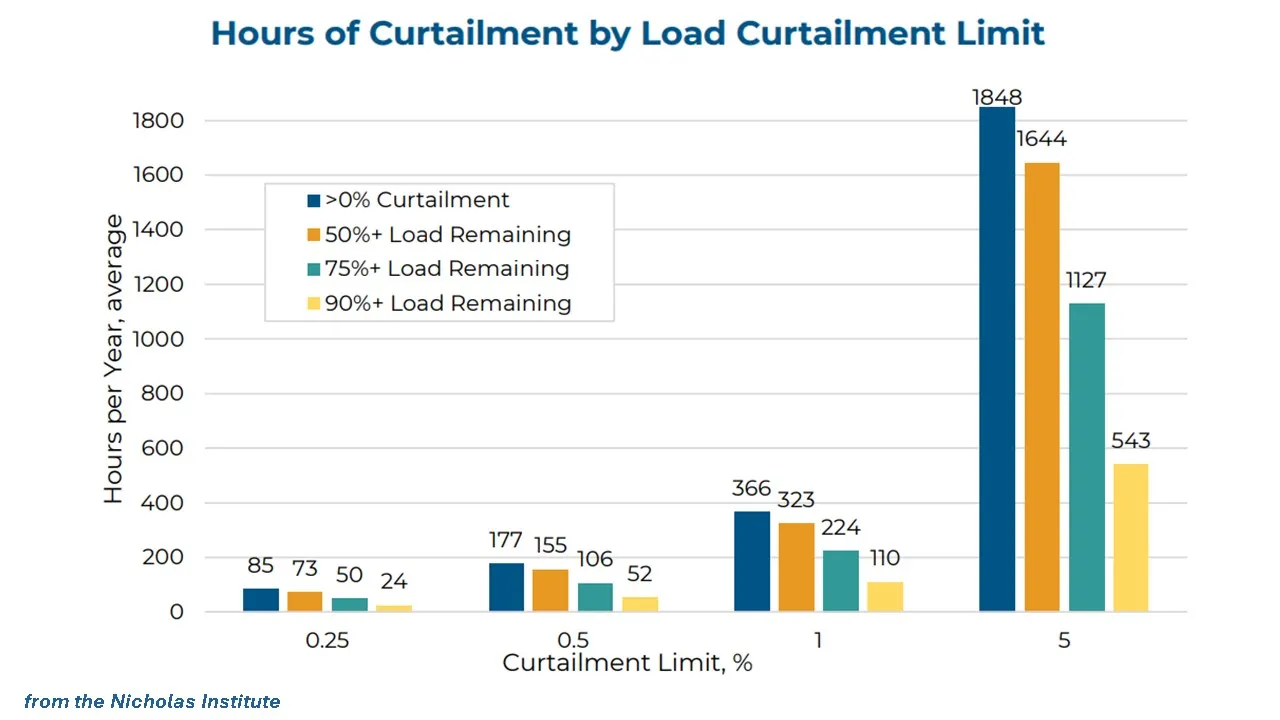

Flexible data center loads can address “10% of the nation’s current aggregate peak demand” if they are curtailed “0.25% of their maximum uptime,” according to an influential February paper, Rethinking Load Growth, published by Duke University’s Nicholas Institute.

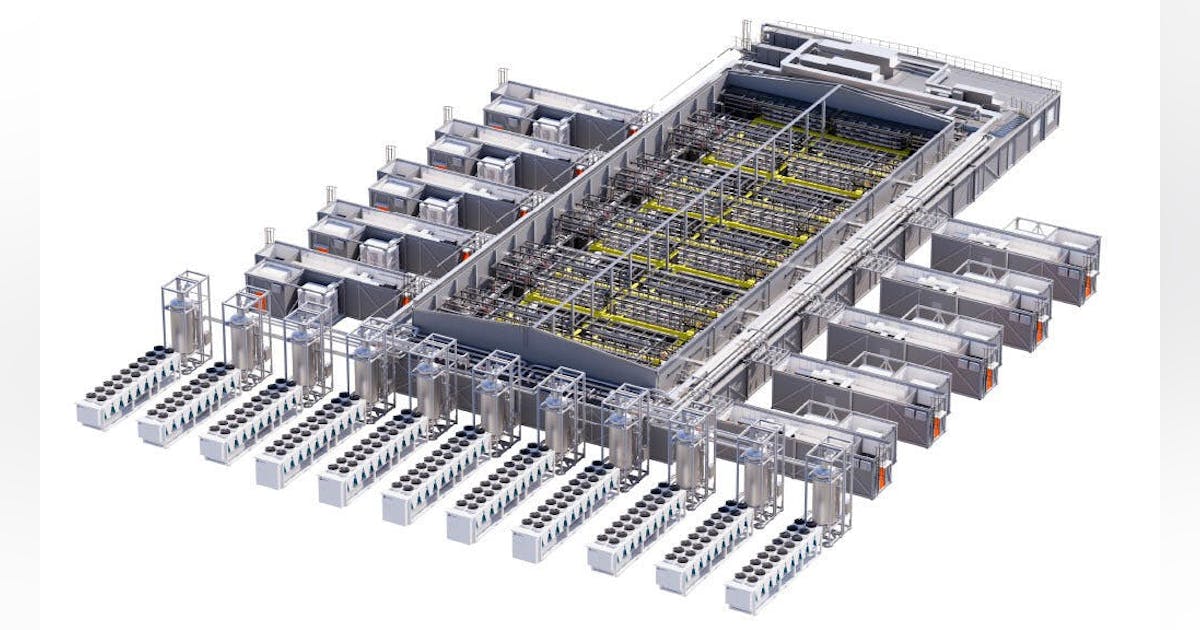

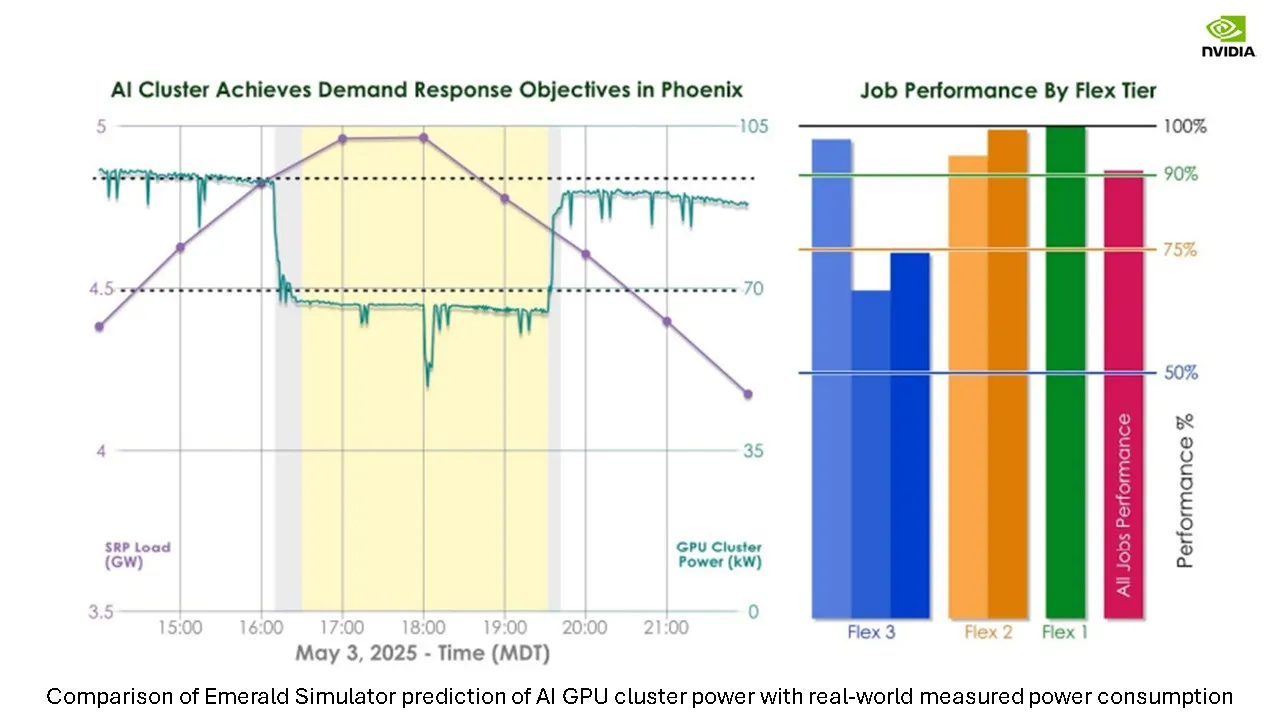

Some utilities are already testing this flexibility. Salt River Project in Arizona saw a 25% reduction in power consumption over three hours from a data center cluster of 256 Nvidia GPUs using software from Emerald AI, Nvidia said last month.

Permission granted by Emerald AI

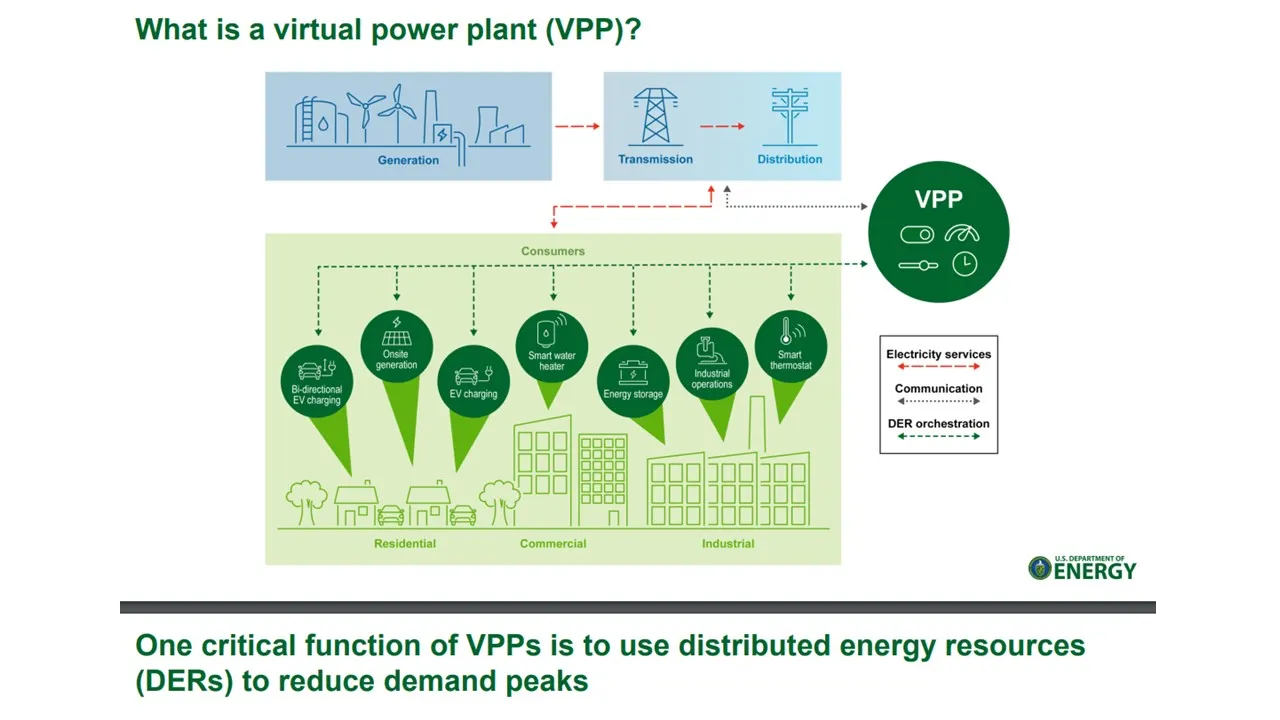

Today’s system planning and operations can be co-optimized with a network of data centers, and their electricity use can be orchestrated to meet the needs of both, said Emerald AI Founder and CEO Varun Sivaram. Flexible AI data centers can even act as a virtual power plant, protecting both system reliability and data center financial viability, he added.

If every data center built its own behind-the-meter generation, “it would be a horribly inefficient way to structure the power system” because system operators and utilities would not be able to use those resources, Sivaram said. And “it would probably be expensive for data centers” because they would not have the cost savings from relying on system resources, he added.

Tyler Norris, a PhD student at Duke and co-author of the Nicholas Institute load growth paper, said the “hard reality” is that “data centers would prefer to never flex.”

But, he added, they “do not need to draw 100% of their maximum nameplate demand at all hours.” With AI-enhanced tools and today’s system situational awareness, operators can schedule and manage the generation draw during the highest system stresses, he said.

Former FERC Chair Richard Glick, now head of consultant GQS New Energy Strategies, agreed.

Technologies now enable computational and organizational capabilities that can address today’s projected load growth faster and at a lower cost to customers, he said. They also allow deferring or avoiding new infrastructure, which “takes time and is expensive for utilities,” Glick added.

Utilities do face reduced guaranteed returns from capital expenditures, but with increasing revenues from growing loads, they can take advantage of other flexibility benefits, Glick said.

Advanced computing-enabled “regional markets, capacity markets, and energy imbalance markets now dispatch in split-seconds, which lowers costs and improves reliability on a broader scale,” he added.

Permission granted by Nicholas Institute

Bringing customers into system management

On the other side of these advanced system management tools is a growing network of customer-sited storage and generation resources that can be deployed alongside demand response programs to make the grid even more nimble and reliable.

Earlier this year, for example, demand respond and virtual power plants played a key role in keeping the power on during a heat dome that smothered the Northeast.

FERC Chair Mark Christie said at the time that demand response was “essential.”

A similar phenomenon can be seen in Puerto Rico, where the system operator relied for weeks on what advocates contend is the first operational behind-the-meter virtual power plant in Latin America and the Caribbean.

“The most important value stream of advanced demand response or any aggregated use of DER is system-wide capacity,” said Seth Frader-Thompson, president of grid-edge DERMS provider and DER aggregator EnergyHub.

It can begin with manually dispatchable DER aggregations, Frader-Thompson said. But “fairly quickly, the clear customer and system value becomes a stepping-stone to a fully-integrated automated system that can deliver far more,” he added.

“Those programs are wildly cost effective,” Frader-Thompson continued.

The Massachusetts Energy Efficiency Council found 2023 program incentives of $7 million delivered a benefit-to-cost ratio of 2.39 to utilities, he said.

Customers can also benefit

Dave Sheehan is senior director of industry solutions at Uplight, a demand response and virtual power plant provider that reports 8.5 GW of assets under management in its programs. Sheehan said those program participants earned $33 million in utility program rebates and incentives last year.

To enable that interconnected system of systems, regulators, utilities, and customers need to “value the full stack of flexible services” that customer-owned distributed energy resources offer, he said.

Puget Sound Energy is among the utilities working with Uplight to aggregate and optimize resources. The company is building on the success of an advanced distribution management system it added last year, said David Landers, PSE’s director of system planning.

“The VPP’s 86.9-MW peak load reduction this year shows the programs deliver,” Landers said. But “knowing which ones deliver, how much they are deliver, and how long they will deliver is still being evaluated.”

Other utilities are pursuing similar technologies and tools to take advantage of customer-owned resources’ value.

The New York State Energy Research and Development Authority, or NYSERDA, issued a July solicitation for new technologies to better integrate electric vehicles into the grid.

NYSERDA wants to move distribution system management “beyond pilots to deployment,” said NYSERDA Vice President of Innovation Brandon Owens. Utilities need secure, scalable infrastructure and protocols to transmit and receive data in real time, and “operationalize bidirectional data flows,” he added.

“That data flow and operational readiness can enable better use of power plants, renewable resources, and aggregated DER as VPPs,” Owens said.

It can also avoid capital investments in new infrastructure and make electricity more affordable, he added.

Pacific Gas and Electric has seen that firsthand. The company’s DERMS and communications systems allowed the streamlined interconnection of a Pepsi-owned charging station for 50 Tesla electric trucks, said Alex Portilla, PG&E’s director of grid edge innovations and clean energy technology platforms.

Infrastructure upgrades to keep the station’s peak 5-MW load from overloading the distribution system would have taken three years at significant near-term cost, Portilla said. Instead, PG&E’s DERMS allowed a flexible interconnection with Pepsi’s agreement to limit charging at automated notifications through the utility’s system, and allowed Pepsi to allocate the upgrade cost over three years, she said.

Breaking down utility ‘silos’

The historical method of using supply to balance demand is being transformed by strategies to flex demand for system balancing.

One challenge to widespread adoption of new technologies and mindsets is that the electric utility industry is siloed into different regulatory constructs for generation, transmission, distribution and customers, said Brendan Pierpont, Energy Innovations’ director of electricity modeling.

Communication and coordination across the different regulatory frameworks and different regulators is lacking, Pierpont said.

“Better methodologies and technologies that can demonstrate and assess performance will be crucial,” he added.

Breaking down barriers to those innovations is the journey’s critical next step, some stakeholders said.

“Utilities and customers are parts of a much larger system with generation, transmission, distribution, and customer components,” said Elizabeth Cook, vice president of technical strategy for the Association of Edison Illuminating Companies. Through emerging technologies, these components increasingly “include each other in a system of systems.”

But utilities are only starting to build the structures needed to take full advantage of this new technology, Cook said. Doing so will require political investments to break down “utility silos,” and replacing their incentives to build infrastructure with financial incentives for them to invest in operational technologies, she emphasized.

And “all those investments are winners,” she said.

<!– –>