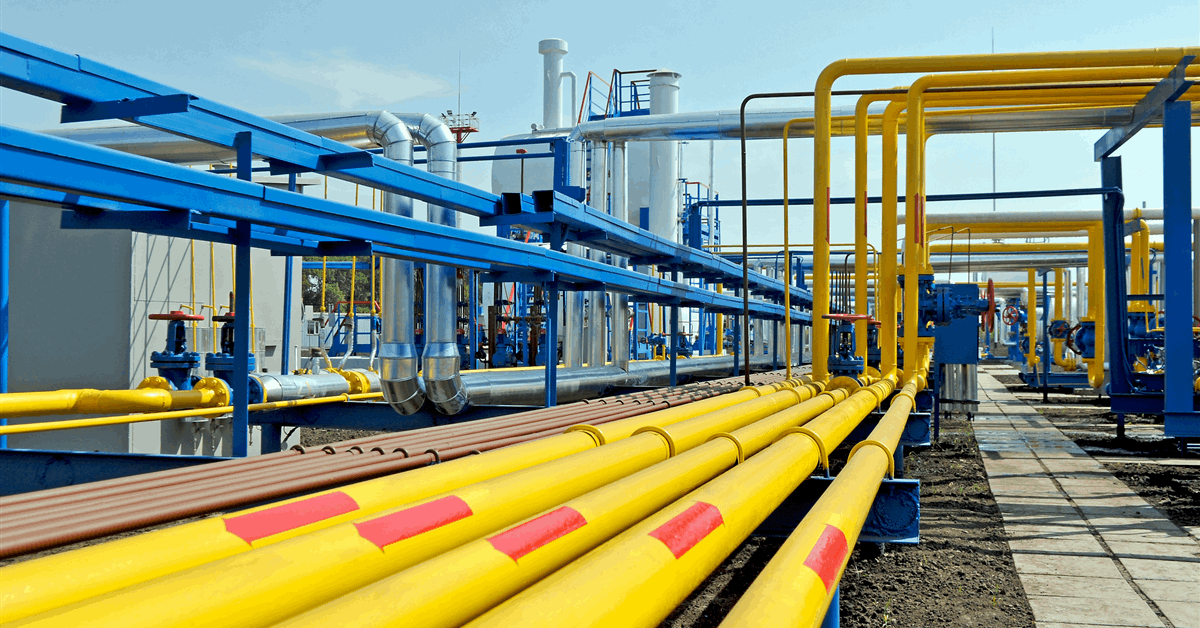

Naftogaz Group over the last week announced loans of EUR 300 million ($347.25 million) from the European Investment Bank (EIB) and UAH 3 billion ($71.97 million) from Ukraine’s state-owned Oschadbank to buy natural gas for Ukraine.

The EIB loan is part of the European Union bank’s Ukraine Energy Rescue Plan, unveiled October 2024 with up to EUR 600 million in urgent and medium-term energy financing.

“This new financing [EUR 300 million] from the EIB will help reinforce Ukraine’s energy security during the winter, providing vital support to communities and businesses”, EIB president Nadia Calviño said in a statement from the bank October 1.

“This loan combines rapid crisis response with a long-term view. It supports the country’s shift to cleaner, more sustainable energy – a cornerstone of the country’s recovery and EU integration”, said EIB vice president Teresa Czerwinska, who oversees the bank’s Ukraine operations.

Under the agreement, Ukraine’s state-owned integrated oil and gas company Naftogaz will reinvest an equivalent amount in renewable energy and other decarbonization projects. In another financing announced June 2024, the EIB committed EUR 400,000 for technical support to help Naftogaz craft its decarbonization strategy.

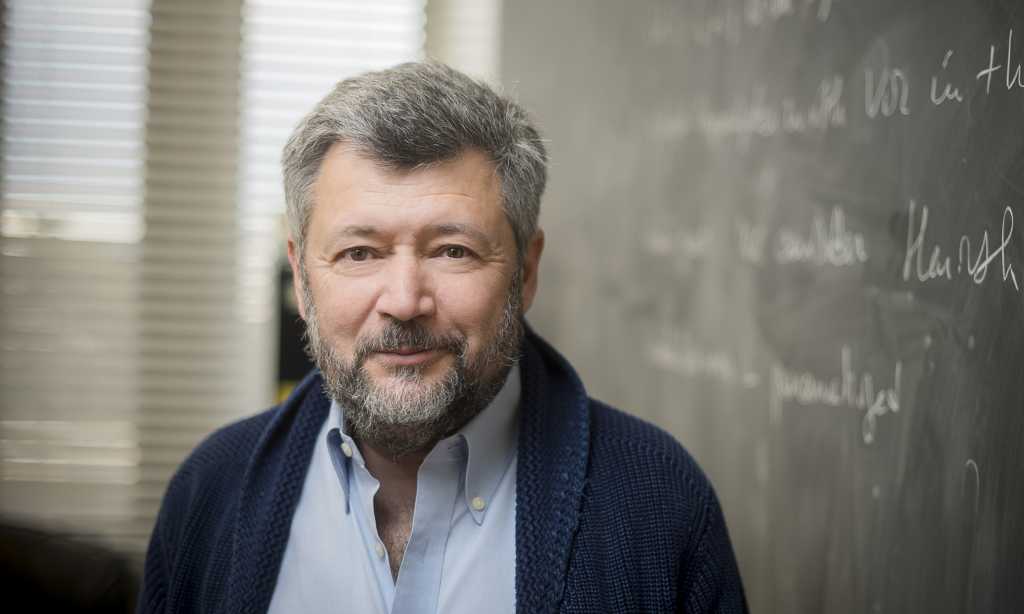

“EUR 300 million from the EIB is substantial and practical support that will help us guarantee the country’s energy resilience ahead of the winter”, Naftogaz chief executive Sergii Koretskyi said in a statement from the company.

Ukraine Prime Minister Yuliia Svyrydenko was quoted by Naftogaz as saying, “Thanks to this financing, Ukraine will be able to secure gas reserves and ensure a stable supply of heat this winter for hundreds of thousands of households, even amid ongoing enemy attacks”.

The European Commission agreed to guarantee the loan through the Ukraine Investment Framework (UIF), the EIB said.

The UIF is part of the EU’s Ukraine Facility, a platform to mobilize up to EUR 50 billion – EUR 33 billion in loans and EUR 17 billion in grants – from 2024 to 2027, according to the European Council, which gave the final greenlight for the facility February 2024. The UIF aims to mobilize EUR 40 billion of investments for recovery, reconstruction and modernization, according to its implementer the European Commission.

The EIB loan announced last week was signed in Kyiv as part of European Commissioner for Enlargement Marta Kos’ visit, the loan parties said.

On Thursday Naftogaz announced an Oschadbank loan of UAH 3 billion for gas importation.

Earlier the European Bank for Reconstruction and Development (EBRD) committed a two-year revolving loan of EUR 500 million, 90 percent of which is guaranteed by the European Commission through the UIF, to help Naftogaz procure gas.

The London-based EBRD has now provided four funding packages for Naftogaz since Russia invaded Ukraine in 2022, the EBRD said in a statement August 12. The latest “brings the total bank financing to Naftogaz to EUR 1.6 billion, including EUR 1.27 billion in EBRD loans and EUR 330 million (NOK 3.63 billion) in grants provided by Norway via EBRD”, the bank said.

“The transaction will also support the reform objectives of previous EBRD engagement, with Naftogaz working towards the integration of the Ukrainian gas market with that of the EU”.

Ukraine had 88.13 terawatt hours of stored gas, a filling level of 27.49 percent, as of Wednesday, according to the latest update on the online monitoring dashboard of the European Network of Transmission System Operators for Gas.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR