Saudi Arabian Oil Co (Aramco) said Thursday it had completed the acquisition of a 22.5 percent stake in Rabigh Refining and Petrochemical Co (Petro Rabigh) from Sumitomo Chemical Corp for $702 million or SAR 7 ($1.9) per share.

The transaction has increased the state-owned oil giant’s ownership in Petro Rabigh to 60 percent. Tokyo-based Sumitomo retains 15 percent.

“The transaction reflects Aramco’s commitment to its partners and, as it forges ahead with a downstream strategy that promotes value creation, business integration and portfolio diversification”, Aramco said in a statement on its website.

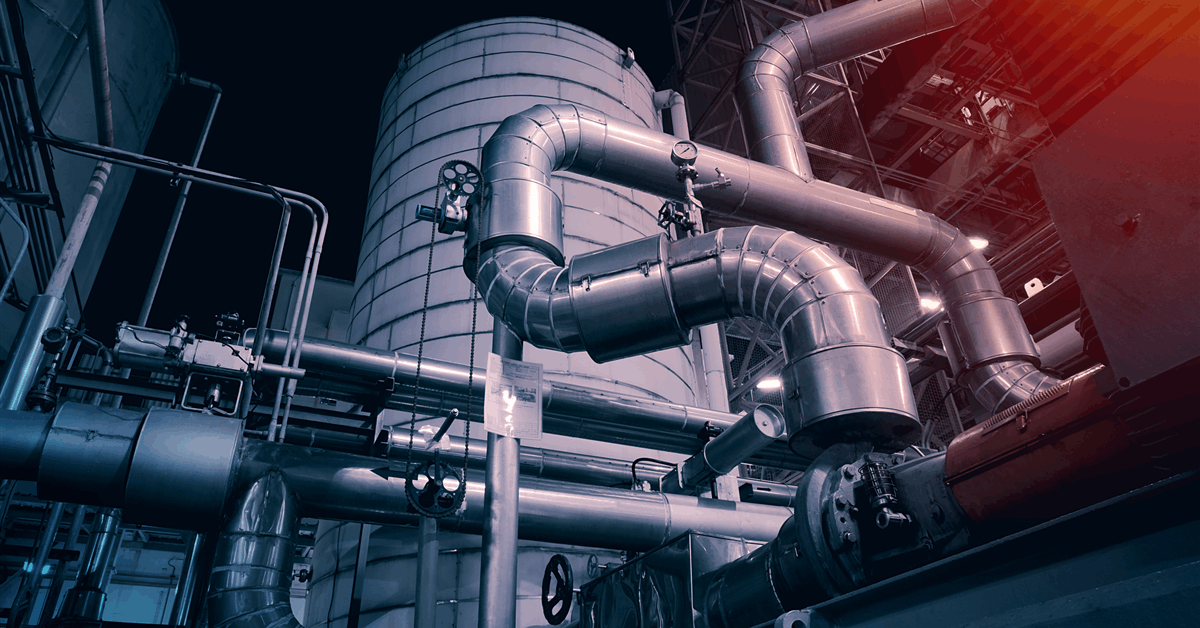

“The transaction also enhances Aramco’s ability to support the transformation program underway at Petro Rabigh, which includes targeted asset upgrades to improve the yield of high-margin products and enhance plant reliability”.

Petro Rabigh produces 14.9 million metric tons per annum (MMtpa) of refined products and 4.9 MMtpa of petrochemical products, Petro Rabigh says on its website.

As part of the transaction, Aramco and Sumitomo agreed to inject $1.4 billion to prepay part of Petro Rabigh’s debt. The capital will come from Petro Rabigh’s issuance of Class B shares to be fully subscribed to by Aramco and Sumitomo.

“Through the Class B share issuance, Aramco and Sumitomo will be able to inject fresh capital without altering Petro Rabigh’s existing governance structure or diluting the voting power of Petro Rabigh’s other shareholders”, Aramco said.

Also under the transaction, Aramco and Sumitomo had waived $1.5 billion in shareholder loans to Petro Rabigh, completed in two phases in August 2024 and January 2025, Aramco said.

Aramco senior vice president for fuels Hussain A. Al Qahtani said, “Petro Rabigh is a key player in the kingdom’s downstream sector and this additional investment by Aramco reflects strong belief in its long-term prospects”.

“We look forward to exploring closer integration with Petro Rabigh, with the aim of unlocking new opportunities and complementing Petro Rabigh’s broader transformation objectives, which include upgrading its product mix, enhancing asset reliability and optimizing operations”, Al Qahtani added.

Earlier this year Aramco completed the purchase of a 50 percent stake in Blue Hydrogen Industrial Gases Co (BHIG), with Air Products Qudra retaining the remaining half.

BHIG will help establish a hydrogen network in the Eastern Province and support a carbon capture and storage (CCS) hub Aramco is building in the city of Jubail, Aramco said in a statement March 24 announcing the completion of the deal. BHIG’s production will include natural gas-derived hydrogen with emissions captured and stored, Aramco said.

“BHIG is expected to commence commercial operations to produce blue hydrogen in coordination with Aramco’s carbon capture and storage activities in Jubail”, Aramco said.

Elsewhere in its downstream expansion, Aramco early in 2025 agreed to buy 25 percent in retail network operator Unioil Petroleum Philippines Inc. Aramco plans to use the Filipino company to market its brand and retail offerings including Valvoline lubricants in the Southeast Asian country.

The purchase “aims to capitalize on anticipated growth of the high-value fuels market in the Philippines”, Aramco said in a press release February 19.

Unioil has over 175 retail stations across the archipelago, Unioil says on its website.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR