The aim, said Gogia, “is continuity, not cost efficiency. These deals are forward leaning, relying on revenue forecasts that remain speculative. In that context, OpenAI must continue to draw heavily on outside capital, whether through venture rounds, debt, or a future public offering.”

He pointed out, “the company’s recent legal and corporate restructuring was designed to open the doors to that capital. Removing Microsoft’s exclusivity makes room for more vendors but also signals that no one provider can meet OpenAI’s demands. In several cases, suppliers are stepping in with financing arrangements that link product sales to future performance. While these strategies help close funding gaps, they introduce fragility. What looks like revenue is often pre-paid consumption, not realized margin.”

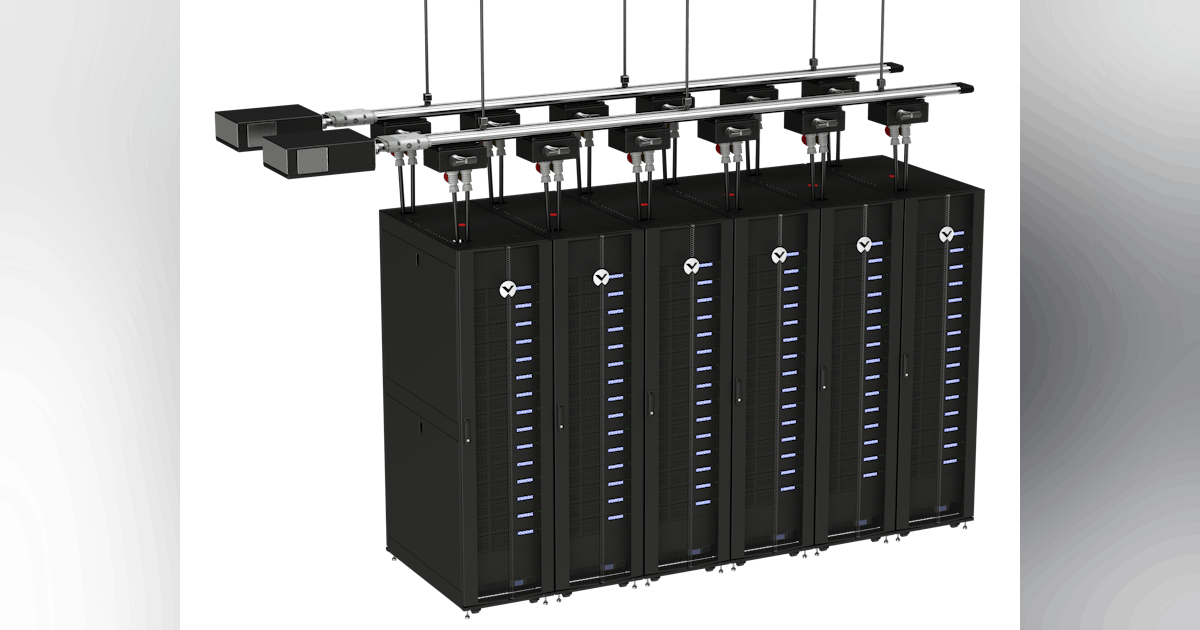

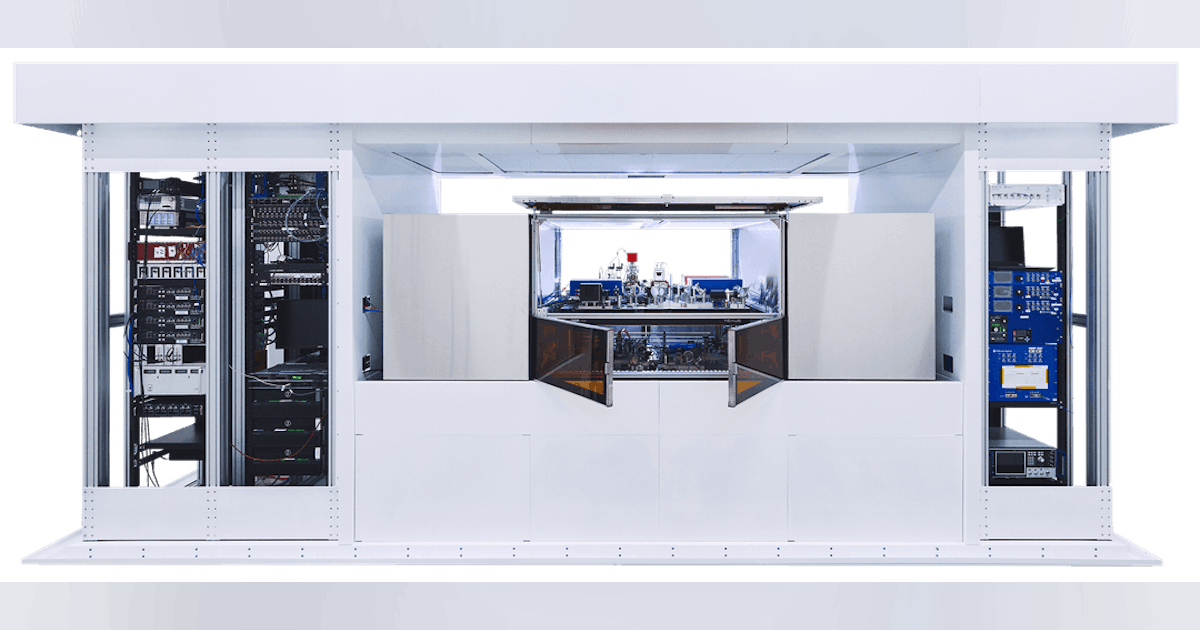

Execution risks, he said, add to the concern. “Building and energizing enough data centers to meet OpenAI’s projected needs is not a function of ambition alone. It requires grid access, cooling capacity, and regional stability. Microsoft has acknowledged that it lacks the power infrastructure to fully deploy the GPUs it owns. Without physical readiness, all of these agreements sit on shaky ground.”

Lots of equity swapping going on

Scott Bickley, advisory fellow at Info-Tech Research Group, said he has not only been astounded by the funding announcements over the last few months, but is also appalled, primarily, he said, “because of the disconnect to what this does to the underlying technology stocks and their market prices versus where the technology is at from a development and ROI perspective … and from a boots on the ground perspective.”

He added that while the financial pledges involve “huge, staggering numbers, most of them are tied up in ways that are not necessarily going to require all the cash to come from OpenAI. In a lot of cases, there is equity swapping. You have these highly discounted exchanges going on with the hyperscalers, with capacity and this whole circular financing loop taking place.”

The organization’s vision, said Bickley, “is huge, and to me, it’s either they go big or they go bust, because they are not going to make this money back off ChatGPT.”