TotalEnergies SE has completed the sale of its 12.5 percent stake in Oil Mining Lease (OML) 118, which contains the producing Bonga field, to partners Shell PLC and Eni SpA for $510 million.

Shell Nigeria Exploration and Production Co Ltd got 10 percent, instead of 12.5 percent as initially intended. Eni through Nigeria Agip Exploration Ltd exercised its preemption right for 2.5 percent, the parties confirmed in separate statements.

The transaction has raised operator Shell’s interest to 65 percent and Eni’s to 15 percent. Exxon Mobil Corp retains 20 percent through Esso Exploration and Production Nigeria Ltd.

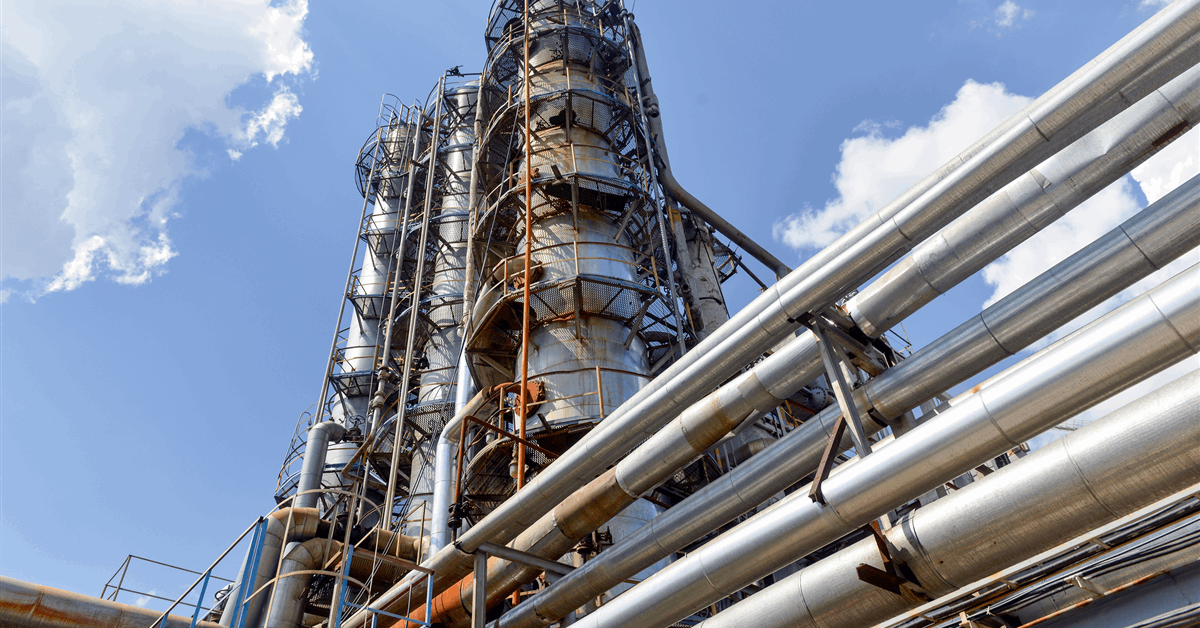

OML118 contains the Bonga field, which started production 2005 and has a capacity of 225,000 barrels of oil per day (bopd), according to Shell.

“Following our final investment decision on Bonga North last year, this acquisition represents another significant investment in Nigeria deepwater, and is part of Shell’s strategy to further invest in competitive existing assets that contribute to sustained liquids production and growth in our upstream portfolio”, Britain’s Shell said.

Expected to start production by 2030, Bonga North will have a capacity of 110,000 bopd, according to Shell’s FID announcement December 16, 2024. Bonga North holds estimated recoverable resources of over 300 million barrels of oil equivalent. It will be a tieback to the Bonga floating production storage and offloading facility, according to Shell.

“This targeted investment contributes towards growing Shell’s combined Integrated Gas and Upstream total production by one percent per year to 2030 and contributes towards sustaining our 1.4 million barrels per day of liquids production”, Shell added about the acquisition from TotalEnergies.

Italy’s state-backed Eni said separately, “This acquisition is fully aligned with Eni’s strategy to optimize its upstream portfolio and further strengthens the company’s commitment to deepwater projects in the country”.

“Eni has been present in Nigeria since 1962, with an average equity production of 50 Kboed [50,000 barrels of oil equivalent per day] in 2025”, Eni added.

TotalEnergies said May 29, announcing the transaction agreement with Shell, that its OML118 exit was part of its efforts to refocus investment in the West African country to its operated gas and offshore oil assets.

However, TotalEnergies’ deal last year to sell its 10 percent stake in the SPDC Joint Venture to Chappal Energies Mauritius Ltd had collapsed, according to an online statement by the Nigerian Upstream Petroleum Regulatory Commission on September 25, 2025.

On March 13, 2025, Shell said it had completed the sale of Shell Petroleum Development Company of Nigeria Ltd (SPDC) as it also concentrates on deepwater and integrated gas assets. In the $1.3-billion transaction, the consortium Renaissance Africa took over SPDC and consequently acquired a 30 percent operating stake in the SPDC Joint Venture.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR