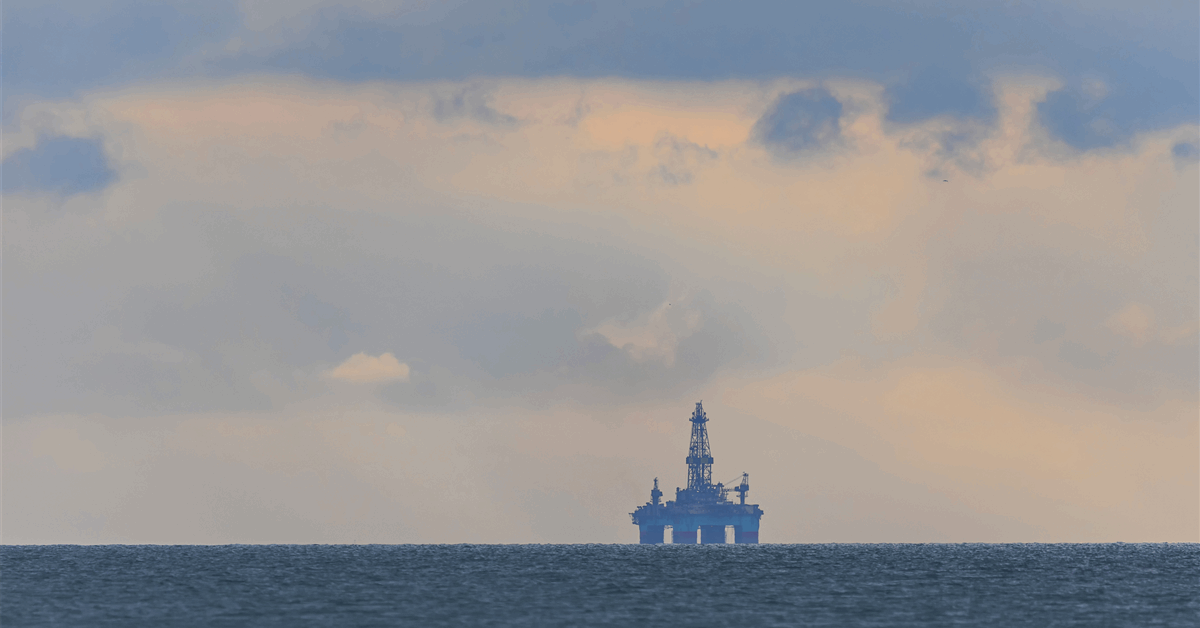

According to the U.S. Energy Information Administration’s (EIA) latest short term energy outlook (STEO) which was published on January 13, the West Texas Intermediate (WTI) spot price average will drop in 2026 and 2027.

The EIA projected in this STEO that the WTI spot price will come in at $52.21 per barrel this year and $50.36 per barrel next year. The commodity averaged $65.40 per barrel in 2025, the EIA’s January STEO showed.

A quarterly breakdown included in the outlook forecast that the WTI spot price will come in at $54.93 per barrel in the first quarter of 2026, $52.67 per barrel in the second quarter, $52.03 per barrel in the third quarter, $49.34 per barrel in the fourth quarter, $49.00 per barrel in the first quarter of 2027, $50.66 per barrel in the second quarter, $50.68 per barrel in the third quarter, and $51.00 per barrel in the fourth quarter of next year.

In its previous STEO, which was released in December, the EIA projected that the WTI spot price would average $65.32 per barrel in 2025 and $51.42 per barrel in 2026. That STEO did not offer an average WTI spot price forecast for 2027.

The EIA’s November STEO saw the WTI spot price averaging $65.15 per barrel in 2025 and $51.26 per barrel in 2026.

A chart hosted on the EIA’s website, which was last updated on January 14 and displayed the annual average Cushing, OK, WTI spot price, on a free on board basis, from 1986 to 2025, showed that this commodity hit a peak in 2008, at $99.67 per barrel. The commodity saw its lowest price, between 1986 and 2025, in 1986, at $15.05 per barrel, the chart highlighted. The highest price the commodity has seen this decade came in 2022, at $94.90 per barrel, the chart showed.

In a BMI report sent to Rigzone by the Fitch Group on Friday, analysts at BMI, a unit of Fitch Solutions, projected that the front month WTI crude price will average $64 per barrel in 2026 and $68 per barrel in 2027.

In a J.P. Morgan research note sent to Rigzone by the company’s head of global commodities strategy, Natasha Kaneva, on Wednesday, J.P. Morgan forecast that the WTI crude oil price will average $54 per barrel in 2026 and $53 per barrel in 2027.

J.P. Morgan projected in that report that the commodity will come in at $56 per barrel in the first quarter of 2026, $55 per barrel in the second quarter, $52 per barrel in the third quarter, $51 per barrel across the fourth quarter of 2026 and the first quarter of 2027, $53 per barrel across the second and third quarters of next year, and $55 per barrel in the fourth quarter of 2027.

In a Stratas Advisors report sent to Rigzone by the Stratas team on January 12, the company highlighted that the price of WTI ended the week at $58.78 per barrel after closing the previous week at $57.33 per barrel.

Ole S. Hansen, the head of commodity strategy at Saxo Bank A/S, highlighted in a commodities note sent to Rigzone by the Saxo Bank team on January 9 that, “technically, resistance sits just below $59 in WTI and $63 in Brent, with a clear break above these levels potentially triggering momentum- and short‑covering‑led extensions”.

In the fourth quarter Dallas Fed Energy Survey, which was released recently, executives from oil and gas firms revealed where they expect the WTI crude oil price to be at various points in the future.

The survey asked participants what they expect WTI prices to be in six months, one year, two years, and five years. Executives from 116 oil and gas firms answered this question and gave a mean response of $59 per barrel for the six month mark, $63 per barrel for the year mark, $69 per barrel for the two year mark, and $75 per barrel for the five year mark, the survey showed.

This survey also asked participants what they expect the WTI crude oil price to be at the end of 2026. Executives from 128 oil and gas firms answered this question and gave an average response of $62.41 per barrel, the survey highlighted. The low forecast was $50 per barrel, the high forecast was $82.30 per barrel, and the average daily spot price during the survey was $59.00 per barrel, the survey pointed out.

To contact the author, email [email protected]