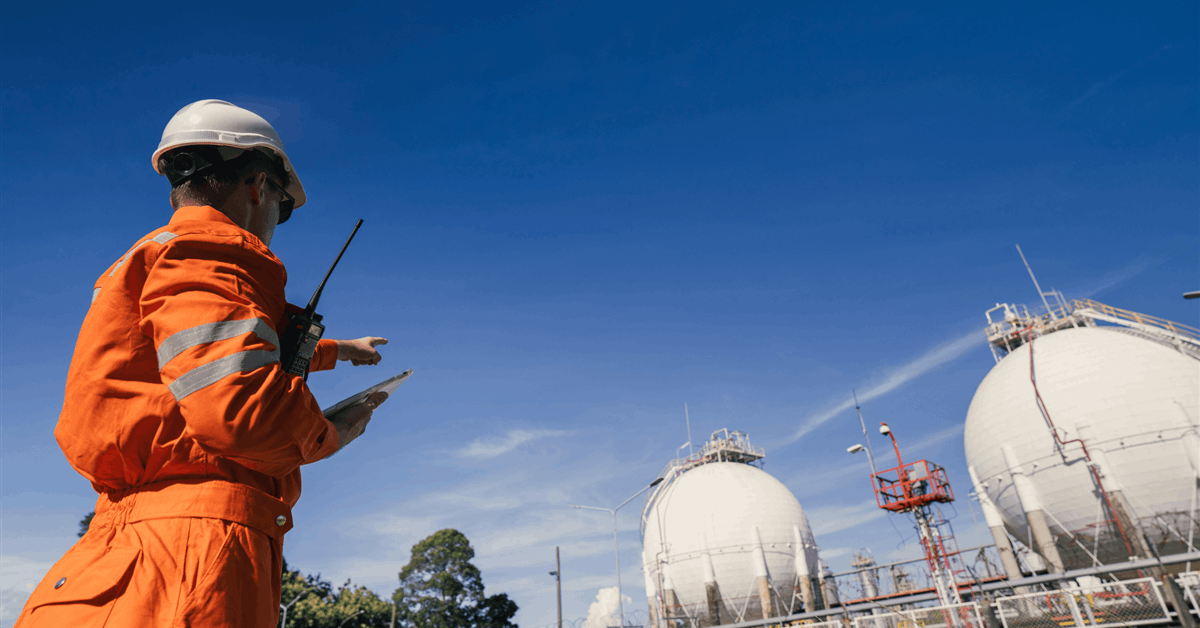

Technip Energies has been awarded a detailed engineering and design contract by Larsen & Toubro Limited’s Hydrocarbon business for a QatarEnergy LNG project in the North Field concession offshore Qatar.

The project is named the North Field Production Sustainability Offshore Compression Project, of which Technip has completed the front-end engineering and design (FEED) phase, the company said in a news release.

Technip defined the contract as “significant,” which it defined as representing revenue between $56.5 million and 282.5 million (EUR 50 million and 250 million).

Under the contract, Technip Energies will provide detailed engineering design for two offshore compression complexes. Each complex will consist of large offshore platforms, flare platforms, interconnected bridges, and other associated structures, according to the release.

Marco Villa, Chief Business Officer of Technip Energies, said, “We are pleased to be entrusted by L&T and QatarEnergy LNG for the detailed engineering design of the NFPS COMP 4 project. This selection highlights the confidence and trust in our engineering expertise and Technip Energies’ established capability to support Qatar’s energy security, ambitious projects and objectives”.

SAF Project in Australia

Further Technip Energies also won a FEED contract from Jet Zero Australia Pty Ltd for Project Ulysses, a bioethanol to sustainable aviation fuel (SAF) project located in Townsville, Australia.

The FEED contract covers an extensive package of engineering activities, documentation and planning to refine the cost estimate for the project and develop detailed timelines, the company said in an earlier statement.

The project aims to produce 102 million liters of SAF and 11 million liters of renewable diesel annually by 2028 using Australian bioethanol and technologies from Technip Energies and LanzaJet. Technip’s Hummingbird technology converts the bioethanol to sustainable ethylene and LanzaJet’s alcohol-to-jet technology transforms the ethylene to SAF, according to the statement.

Sylvain Cabalery, SVP for Sustainable Fuels, Chemicals and Circularity at Technip Energies, said, “We are very pleased to see Project Ulysses moving forward to provide the first alcohol-to-jet SAF plant in Australia. With the global aviation industry looking for ways to further secure their supply and lower emissions, Technip Energies and LanzaJet integrated technology is a smart solution, bringing energy security while at the same time eliminating up to 70 percent of greenhouse gas emissions.”

First Quarter Results

In its most recent earnings release, Technip Energies reported first-quarter adjusted earnings of EUR 0.56 per diluted share, up compared to EUR 0.50 in the previous year.

First-quarter revenue was EUR 1.85 billion, up from EUR 1.52 billion in the same period last year.

“Technip Energies has made a solid start to 2025 with year-over-year growth of 22 percent in revenues and 19 percent in EBITDA. This performance is reflective of the quality of our order intake over the last two years, and our teams’ relentless focus on execution,” Technip Energies CEO Arnaud Pieton said.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR