The UK’s carbon capture and storage (CCS) industry has taken a major step forward with the announcement of government agreement for ENI’s Liverpool Bay project.

This welcome development comes in a critical period of ongoing government consultations that will shape the future of the North Sea.

The UK has world-leading potential for carbon capture and storage, but achieving our ambitions in this area is directly linked to the future of the domestic oil and gas sector.

Supportive government policy that prioritises domestic oil and gas production over imports is vital not just to UK energy security, but also to maintain the skilled workforce and supply chain companies needed for carbon capture and storage in the future.

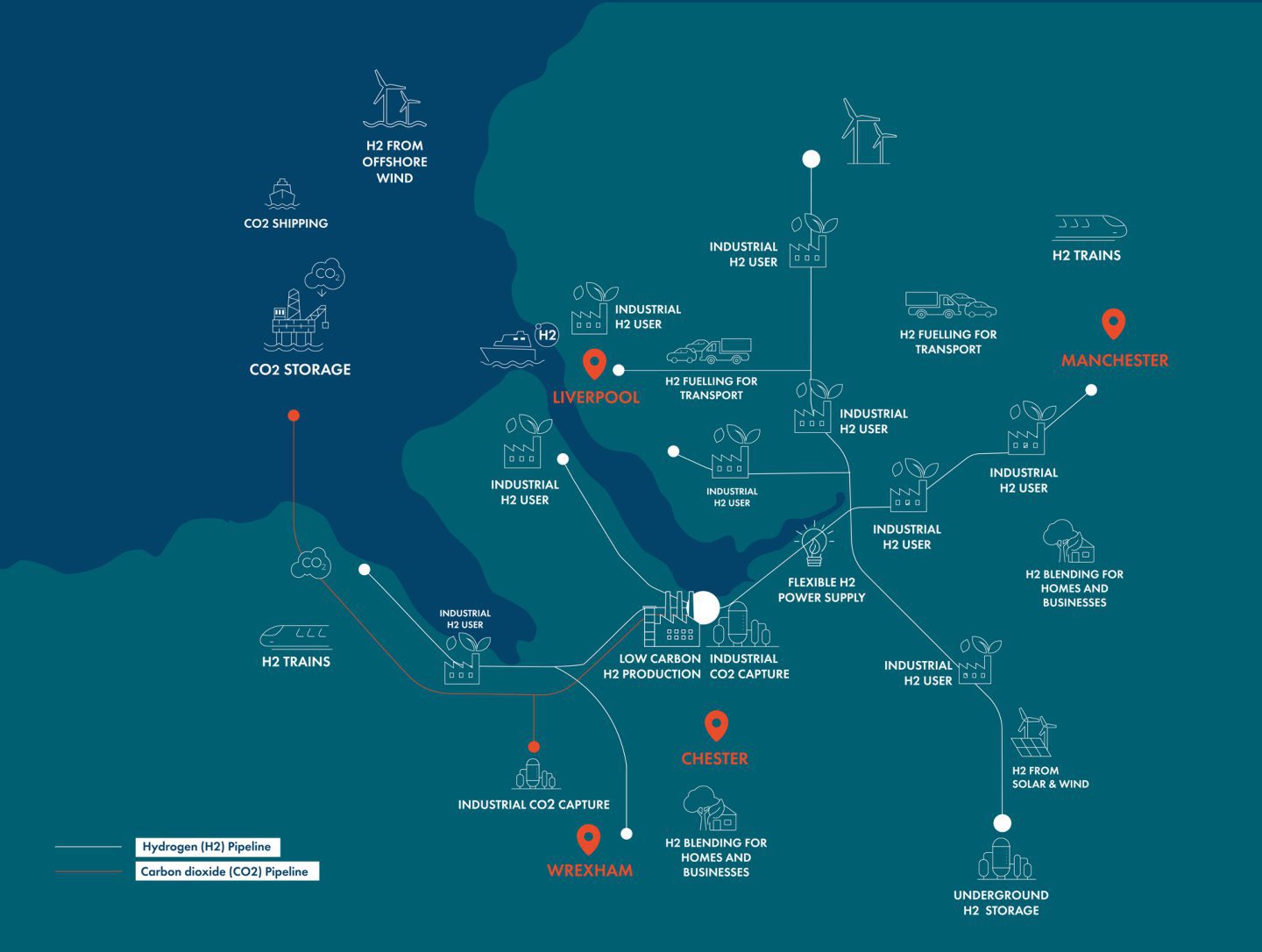

The Liverpool Bay milestone involves the carbon transportation and storage system of the Track-1 HyNet industrial cluster, designed to remove emissions from industries across the north-east of England and North Wales.

It also includes three carbon storage permits granted by the North Sea Transition Authority and will bring an estimated 2,000 new jobs.

Carbon will be stored in depleted oil and gas reservoirs, with existing infrastructure, including 150km of onshore and offshore pipelines being repurposed.

HyNet brings the UK closer to the exciting prospect of developing a world-leading CCS industry.

© Supplied by HyNet

© Supplied by HyNetThe government has pledged £21.7 billion to be spent over the next 25 years across Track-1 clusters, which include HyNet and the East Coast Cluster on Teesside.

Reducing emissions from these industrial heartlands will kickstart new growth in manufacturing communities.

More than £6bn in contracts will flow to the supply chain across both projects.

These clusters will capture carbon from hard-to-abate sectors such as cement manufacture, lime for industrial processes, and energy from waste.

The full pipeline of CCS projects must be delivered if we are to stay on course for UK net zero targets.

Track-2 clusters Acorn and Viking, which cover north-east Scotland and Humberside, are essential for building long-term confidence in the sector.

Firm government backing in the forthcoming spending review is essential.

It is equally important that transportation and storage infrastructure, along with emitters outside the current cluster sequencing process, are given clear and viable pathways to market.

Without decisive action, the UK risks falling behind, with a CCS sector that remains small-scale, high cost, misaligned with international progress, and vulnerable to public opposition.

The ENI announcement coincided with the release of a new report, “Carbon Capture & Storage in the UK: Accelerating Towards the Merchant Model”, commissioned by OEUK and developed by engineering consultancy Arup.

This independent report sets out a clear and credible pathway to building a commercially viable, self-sustaining CCS industry in the UK, with a model of how this can be achieved within the next decade – but only if the right conditions are in place.

Success depends on cost reductions through innovation, competition, and collaboration, plus a stable and transparent policy framework that creates investor confidence and unlocks revenue streams to make the UK a key player in the developing European CO₂ market.

Just as importantly, the sector needs a responsive planning system and the backing of an informed, supportive public.

At a time of immense international and technological change, these projects can help to futureproof both the UK’s industrial and climate ambitions.

Industry is already delivering. OEUK members are investing at pace across the CCS value chain, committing billions to design and engineering, undertaking carbon store appraisals, as well as successfully completing the UK’s first CO₂ test injection into a depleted gas field and maximising engagement of UK supply chain companies.

Rachel Reeves will announce the outcome of the government’s comprehensive spending review in June, presenting multi-year departmental spending plans to the House of Commons.

Mapping out a funding pathway for future carbon capture and storage projects as we move to a self-sustaining model for the sector will be critical to building the momentum.

The path forward is clear, and industry is ready to lead.