U.S. energy consumption will grow this year, the U.S. Energy Information Administration (EIA) projected in its latest short term energy outlook (STEO), which was released on May 6.

In that STEO, the EIA forecast that total U.S. energy consumption will come in at 95.42 quadrillion British thermal units in 2025. Total U.S. energy consumption was 94.21 quadrillion British thermal units last year, the EIA’s latest STEO highlighted.

In its previous STEO, which was released in April, the EIA projected that total U.S. energy consumption would hit 95.28 quadrillion British thermal units this year. That STEO pointed out that total U.S. energy consumption was 94.20 quadrillion British thermal units in 2024.

The EIA’s May STEO forecast that total U.S. energy demand will come in at 22.16 quadrillion British thermal units in the second quarter of this year, 23.95 quadrillion British thermal units in the third quarter, and 24.01 quadrillion British thermal units in the fourth quarter. This STEO highlighted that total U.S. energy consumption was 25.30 quadrillion British thermal units in the first quarter of 2025.

In its previous April STEO, the EIA saw total U.S. energy consumption hitting 22.17 quadrillion British thermal units in the second quarter of 2025, 23.86 quadrillion British thermal units in the third quarter, and 23.95 quadrillion British thermal units in the fourth quarter. That STEO pointed out that total U.S. energy demand was 25.29 quadrillion British thermal units in the first quarter of this year.

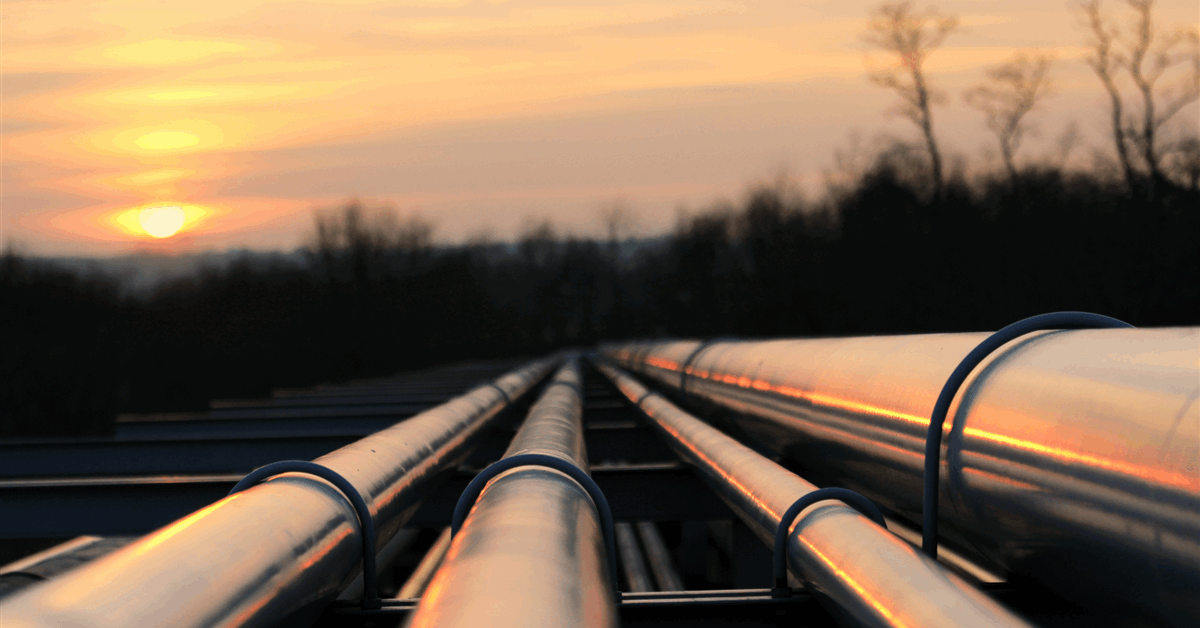

USA Liquid Fuels and Gas Demand

The EIA’s May STEO projects that U.S. liquid fuels demand and U.S. natural gas demand will both rise in 2025.

In this STEO, the EIA revealed that it sees U.S. liquid fuels demand averaging 20.50 million barrels per day this year. The STEO highlighted that U.S. liquid fuels demand averaged 20.31 million barrels per day in 2024.

The EIA’s latest STEO projected that U.S. liquid fuels consumption will average 20.49 million barrels per day in the second quarter of this year, 20.67 million barrels per day in the third quarter, and 20.48 million barrels per day in the fourth quarter. The May STEO pointed out that this demand averaged 20.36 million barrels per day in the first quarter.

U.S. natural gas demand is expected to average 91.3 billion cubic feet per day this year, the EIA’s May STEO outlined. It came in at 90.5 billion cubic feet per day last year, the STEO highlighted.

The EIA sees U.S. natural gas consumption averaging 76.4 billion cubic feet per day in the second quarter, 84.7 billion cubic feet per day in the third quarter, and 93.9 billion cubic feet in the fourth quarter. In the first quarter, this demand averaged 110.4 billion cubic feet per day, the STEO showed.

Previous Projections

In its April STEO, the EIA projected that U.S. liquid fuels demand would average 20.38 million barrels per day in 2025. This STEO also highlighted that U.S. liquid fuels demand averaged 20.31 million barrels per day in 2024.

The EIA’s April STEO forecast that U.S. liquid fuels consumption would average 20.36 million barrels per day in the second quarter of this year, 20.48 million barrels per day in the third quarter, and 20.31 million barrels per day in the fourth quarter. The April STEO pointed out that this demand averaged 20.38 million barrels per day in the first quarter.

U.S. natural gas demand was expected to come in at 91.2 billion cubic feet per day this year in the EIA’s previous STEO, which also highlighted that this consumption came in at 90.5 billion cubic feet per day in 2024.

In its April STEO, the EIA saw U.S. natural gas consumption averaging 77.2 billion cubic feet per day in the second quarter, 84.8 billion cubic feet per day in the third quarter, and 93.2 billion cubic feet in the fourth quarter. In the first quarter, this demand averaged 109.9 billion cubic feet per day, that STEO showed.

To contact the author, email [email protected]