Eni S.p.A.’s corporate venture capital company, Eni Next, has signed a collaboration agreement with Azimut Group. Under the agreement, Azimut will launch a new European Long Term Investment Fund (ELTIF) of venture capital, leveraging Eni Next’s consulting and expertise on technological developments in the energy sector.

Eni said in a media release the ELTIF’s launch is expected in September 2025, and the fund will support investments in the energy tech sector.

With a EUR 100 million ($118 million) fundraising target, the Luxembourg-based fund, which is currently awaiting authorization from the relevant authorities, will be open to a broad range of investors, both institutional and private, in line with the new ELTIF 2.0 Regulation’s criteria.

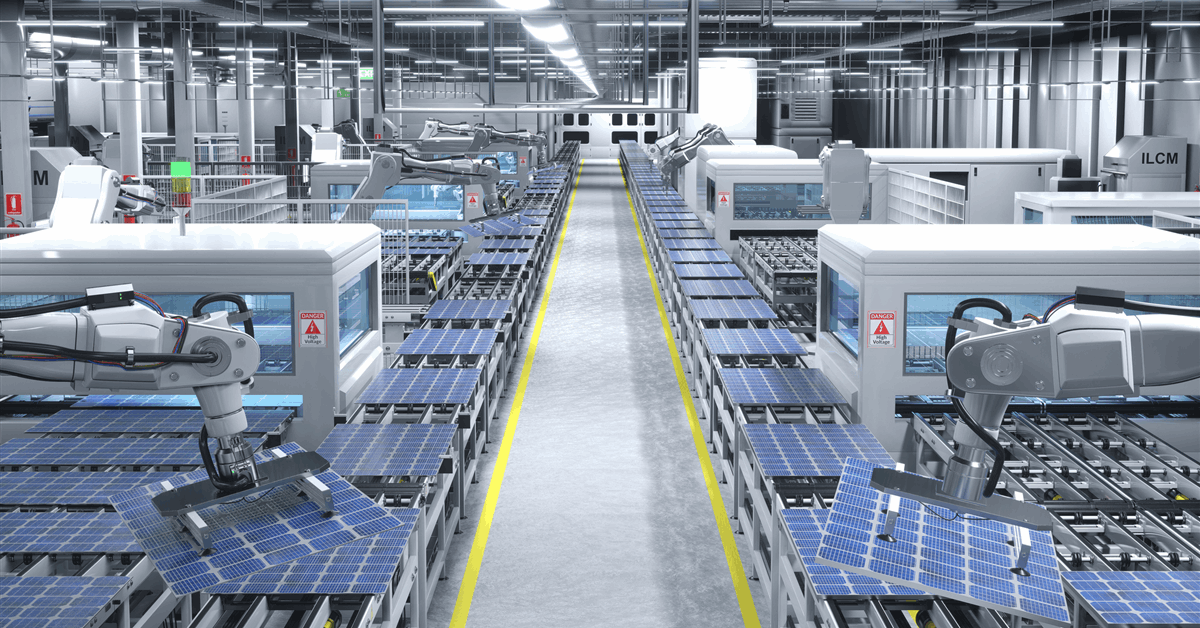

The portfolio will comprise U.S.-based startups and scale-ups in the clean tech sector, focusing on decarbonization, energy efficiency, sustainable mobility, and the circular economy. The fund may also invest in European and international companies, Eni said.

“This strategic collaboration initiated with Azimut provides Eni Next with an additional lever to support innovative companies in the energy sector. By combining our specialized expertise with Azimut’s fundraising capabilities, the partnership will further accelerate and enhance the growth of the Eni Next portfolio”, Clara Andreoletti, CEO of Eni Next, said. “The energy sector, like many other industrial sectors, is undergoing a profound transformation driven by technological innovation. To support this transition and ensure its economic sustainability, private capital plays a crucial role in enabling new technological solutions to emerge and scale rapidly”.

“As new technologies reshape the energy sector, driving a generational shift toward increasingly efficient solutions, this fund aims to give investors access to the most promising and high-potential opportunities”, Giorgio Medda, CEO of Azimut Holding, commented. “This will help bring the Group’s total investments since 2022, dedicated to global energy transition and environmental sustainability, to at least EUR 470 million ($554.5 million). Following the agreement signed with our Automobile Heritage Enhancement fund and Ferrari, this new alliance with another Italian champion marks a further step in our growth journey as a global investment partner to the country’s leading innovators”.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR