ADNOC Gas PLC has signed a long-term deal worth $3.5-4.2 billion to supply natural gas to Emsteel.

“The 20-year agreement, effective January 1, 2027, secures a stable and reliable supply of lower-carbon natural gas to power Emsteel’s operations and future growth”, a joint statement said.

Emsteel chief executive Saeed Ghumran Al Remeithi said the contract “reinforces our shared commitment to maximizing In-Country Value and supporting national economic resilience”.

“With ADNOC Gas as a key energy partner, EMSTEEL will continue advancing green steel production, enhancing efficiency across our value chain and contributing to the sustainable growth of the nation’s industrial ecosystem”, Al Remeithi added.

Emsteel says it is the United Arab Emirates’ biggest publicly listed steel and building materials manufacturer.

Domestic Demand Growth

On the back of domestic gas demand, ADNOC Gas had reported an eight percent year-on-year increase in net profit to $1.34 billion for the third quarter, the company’s highest for the July-September period.

The increase was driven by a four percent rise in domestic gas sales volumes, according to an online statement by the company November 13. Demand is supported by growth in the United Arab Emirates’ economy, the gas processing and sales arm of Abu Dhabi National Oil Co PJSC (ADNOC) said.

ADNOC Gas said, “Year-to-date net income reached $3.99 billion, exceeding market expectations, even as oil prices averaged $71/barrel in the first nine months of 2025 compared to $83/barrel in 2024”.

“Q3 2025 saw ADNOC Gas’ domestic gas business deliver record results, with EBITDA rising to $914 million, up 26 percent year-on-year”, ADNOC Gas said.

On lower prices, revenue fell from $4.87 billion for Q3 2024 to $4.86 billion for Q3 2025. Operating profit landed at $1.74 billion, up from $1.69 billion for Q3 2024. Profit before tax was $1.72 billion, up from $1.68 billion for Q3 2024.

LNG Growth

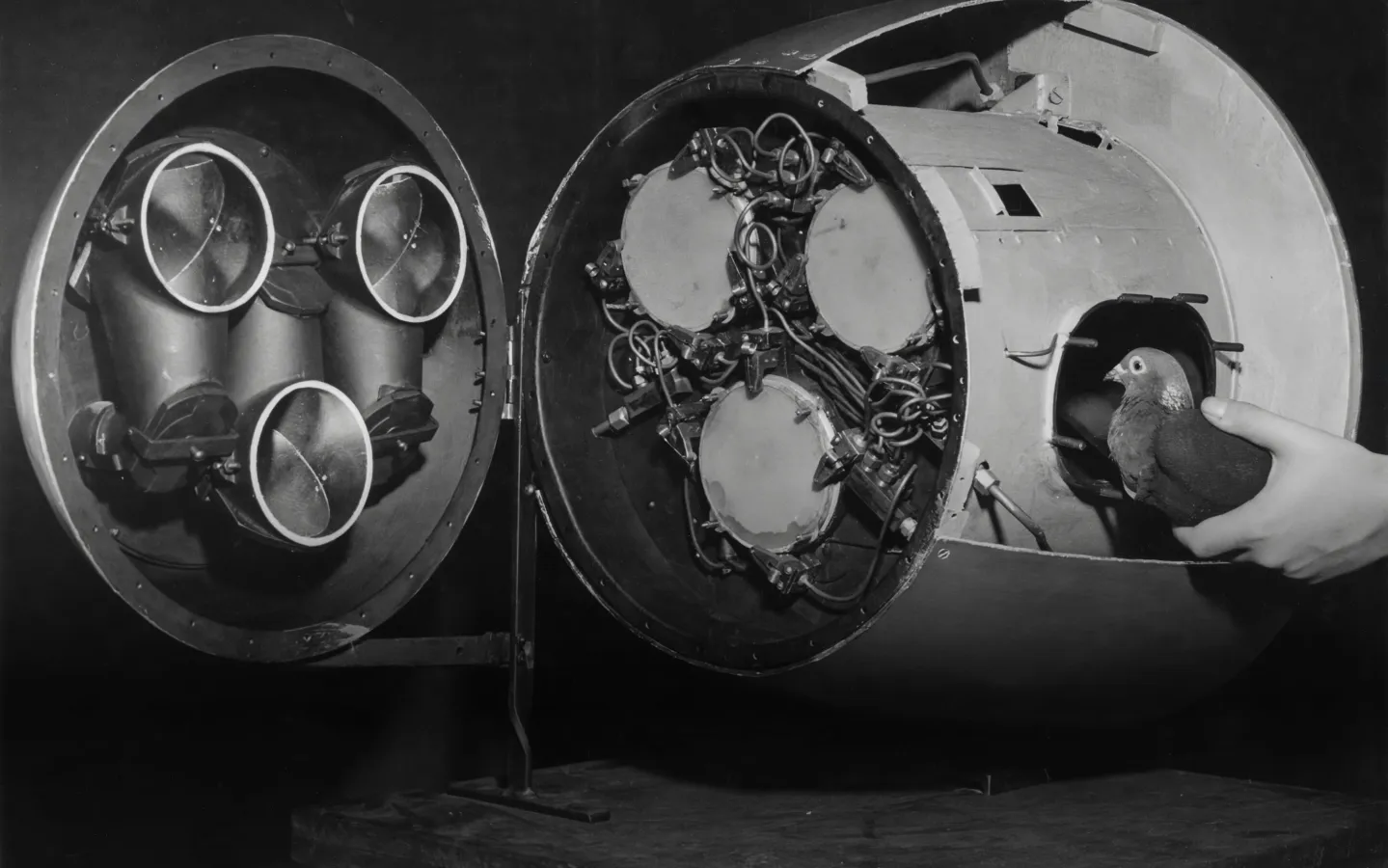

ADNOC this year has also entered long-term agreements to supply liquefied natural gas (LNG), including from the Ruwais LNG project in the UAE.

On November 4 ADNOC said offtakes from the project totaled over eight million metric tons per annum (MMtpa), as it announced a 15-year deal with Shell PLC to supply the British company up to one MMtpa. Shell already holds a 10 percent stake in the project through Shell Overseas Holdings Ltd.

“Signed during ADIPEC, the deal marks ADNOC’s first long-term LNG sales agreement with Shell and the eighth long-term offtake agreement secured for the Ruwais LNG project”, ADNOC said in a press release.

“This SPA [sale and purchase agreement] converts a previous heads of agreement into a definitive agreement and marks a significant step in ADNOC’s efforts to rapidly commercialize the Ruwais LNG project.

“With this latest agreement, more than eight MMtpa of the project’s planned 9.6 MMtpa capacity is now secured through long-term deals with customers across Asia and Europe, just 16 months after the project’s final investment decision in July 2024”.

The export plant in Al Ruwais Industrial City is planned to have two trains, each with a production capacity of 4.8 MMtpa. Targeted to be put into production 2028, the facility would more than double ADNOC’s LNG capacity.

Upstream Capacity Expansion

On November 24 ADNOC reported the UAE had grown its conventional reserves from 290 trillion standard cubic feet (Tscf) of gas to 297 Tscf and from 113 billion stock tank barrels (Bstb) of oil to 120 Bstb.

“ADNOC has also made new oil and gas discoveries totaling more than 1.2 billion barrels of oil equivalent”, the company added.

ADNOC also announced a new company, ADNOC Ghasha, for the Ghasha Concession. The area includes the Hail, Ghasha, Dalma, SARB and Nasr fields.

“The concession is set to produce 1.8 billion scf of gas and 150,000 barrels per day of oil and condensates”, ADNOC said. “Construction of the Hail and Ghasha mega project, a key development within the Ghasha concession, is now progressing at pace”.

To contact the author, email [email protected]