Saudi Aramco reported a decline in profit in the first quarter as lower crude prices put pressure on the finances of the world’s biggest oil exporter.

Net income slipped 4.6 percent to 97.5 billion riyals ($26 billion) in the quarter, according to a statement Sunday. Free cash flow again failed to cover the dividend despite the total payout being lower. Operating profit, which fell 5.3 percent, beat analyst estimates compiled by Bloomberg.

The numbers are another sign of the pressures on Aramco’s balance sheet. As part of a previously announced plan, the company earlier this year decided to cut its dividend for 2025 by about a third to $85 billion. While that helps ease some of the strain on Aramco, it lowers a key source of revenue for the Saudi government whose own finances are under increasing stress.

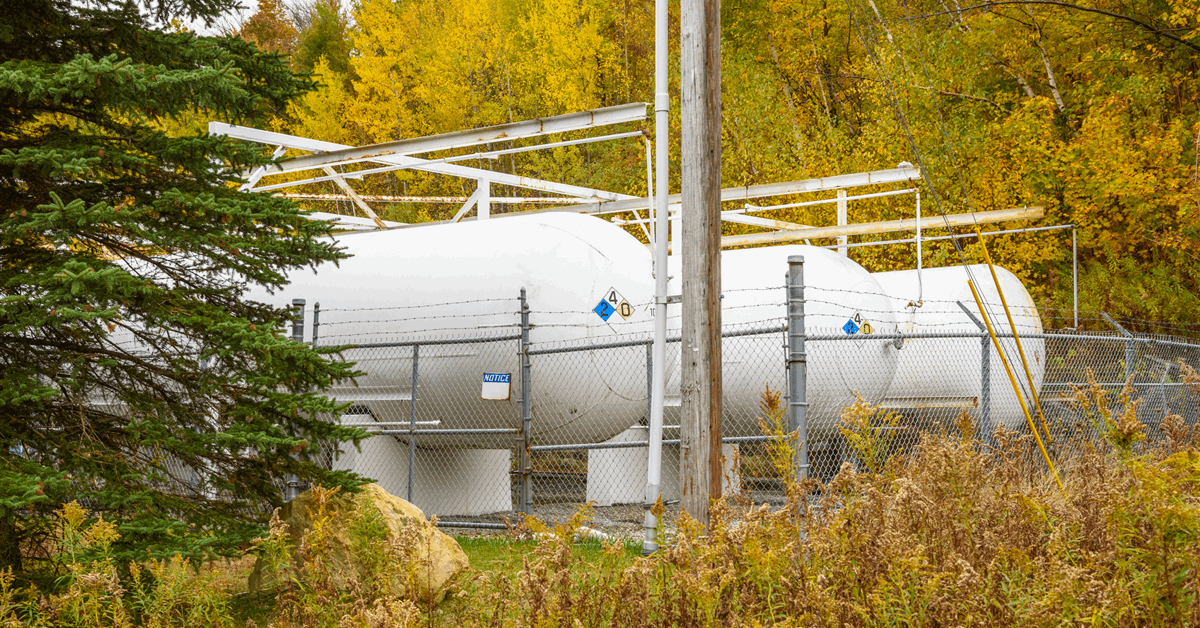

Oil’s decline since April is likely to inflict more pain both on Aramco and the Saudi government despite the higher oil production. Over the past five weeks, Riyadh led the OPEC+ coalition through two bigger-than-scheduled supply hikes, which together with US President Donald Trump ’s trade war, briefly crashed oil futures to a four-year low below $60 a barrel in London.

The company’s total dividend for the quarter fell to $21.36 billion, compared with $31 billion in the same three months of last year. That’s primarily because Aramco decided to vastly reduce the performance-linked component of the payout after completing the distribution of the bumper profits from 2022.

The lower payout will add to the strain on the Saudi budget as Crown Prince Mohammed bin Salman spends hundreds of billions of dollars to modernize the economy. That plan, which includes an entirely new city in the desert called Neom and a push into sports, has led to a widening deficit, with debt levels jumping by the most on record in the first quarter. The Saudi government and the kingdom’s main wealth fund together own over 97 percent of Aramco.

Brent contracts are trading near $64, significantly below the $92-level that the International Monetary Fund estimates the kingdom needs to balance its spending. Aramco sold its crude at an average price of $76.30 a barrel in the first quarter, compared with $83 a year earlier, according to the statement.

Trump is scheduled to tour the Middle East, arriving in Riyadh Tuesday and later visiting Qatar and the United Arab Emirates. The president has called on OPEC+ to raise output and lower oil prices to control inflation and put pressure on Russia over its war in Ukraine.

–With assistance from Kateryna Kadabashy and Omar Tamo.

©2025 Bloomberg L.P.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg