Millions of barrels of oil that would normally be preserve of oil refineries in Europe are instead heading to Asia as US sanctions on Russia revive one of the market’s great arbitrage trades.

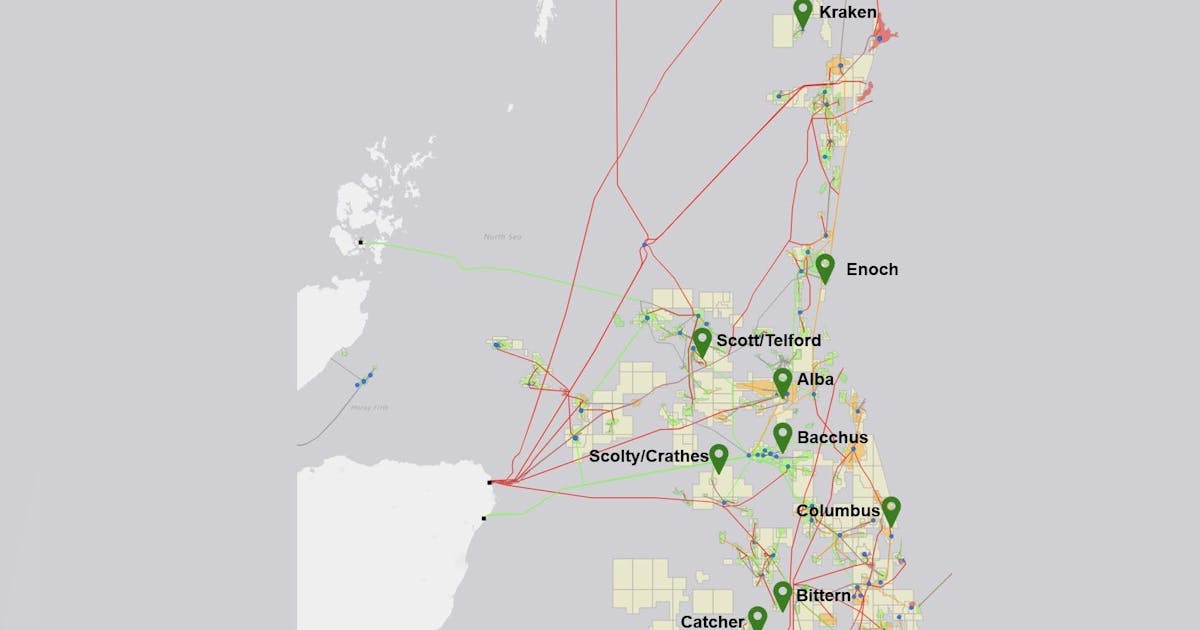

Asian companies are already on course to collect almost 400,000 barrels a day of oil from the North Sea and Kazakhstan next month, vessel tracking and trading data compiled by Bloomberg show. That puts shipments on course for a 10-month high and revives a trade that had been largely dormant for months. A major Indian refiner has also been buying large amounts of oil from West Africa and the US.

The increased shipments show the after-effects on the global oil market of Jan. 10 measures imposed by the outgoing Biden administration, which sanctioned 161 tankers connected to Russia’s oil exports, as well as insurers, traders and two big producers. Premiums for Middle East crude subsequently jumped, increasing a trading incentive to move barrels east.

While the elevated flows should have no impact on the overall availability of crude, they will nevertheless help to tighten European markets while easing any supply pressures confronting Asia.

The US measures saw a widespread increase in inquiries for supply from countries including Saudi Arabia, Iraq, Kuwait and the United Arab Emirates. Those nations, though, have pledged to honor production limits set by the Organization of Petroleum Exporting Countries and its allies, limiting their scope to respond.

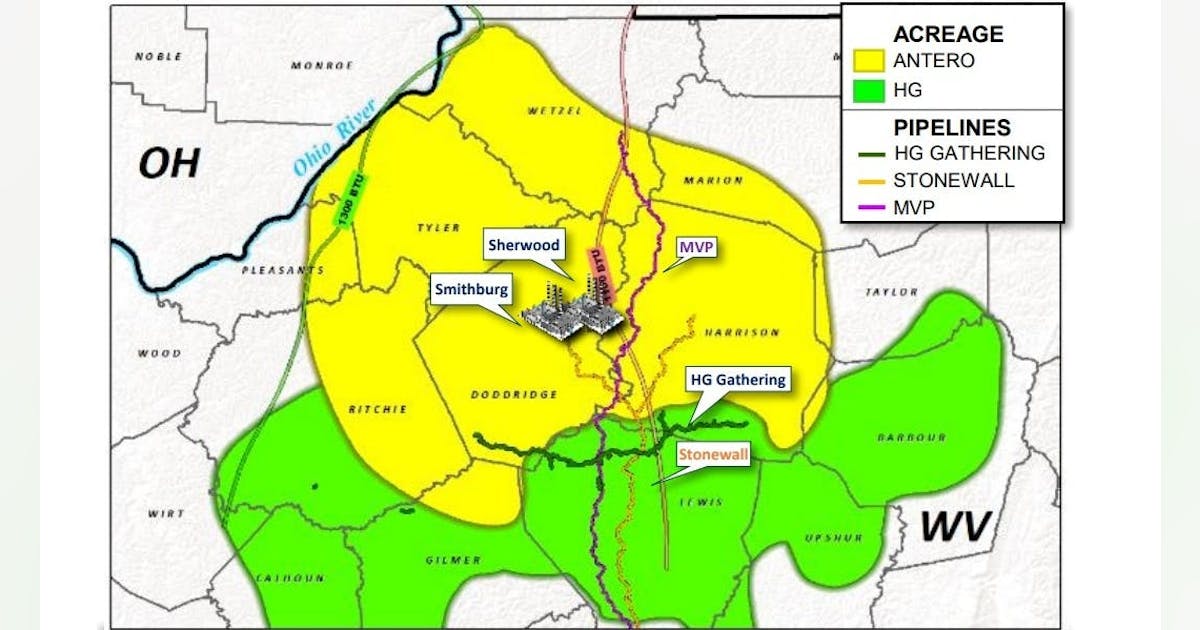

That’s meant extra buying of barrels from further afield. About 11 million to 12 million barrels of the North Sea grades Johan Sverdrup and Forties, as well as 8 million barrels of Kazakh CPC blend crude, will head to Asia in the next two months, according to traders involved in the market. That’s the highest since April 2024. Those are key grades that typically divert to Asian refineries instead of European ones during so-called arbitrage windows.

In a similar vein, Indian Oil Corp. bought at least six million barrels of US and African crude via a tender, on top of purchases of another 10 million barrels in prior tenders earlier this month.

Traders are watching what happens to Russian exports closely, given previous measures targeting Moscow’s fleet of oil tankers have proved very disruptive of those ships.

The heightened flows should go some way to closing the arbitrage. The premium has become “far too expensive” and should correct lower, Neil Crosby, an analyst at Sparta Commodities, said in a note on Monday.

Tightness in physical oil markets has been a boost for crude desks at trading houses that endured a tough 2024 when range-bound prices and sufficient supply led to lackluster opportunities for profits.

One teapot refinery, a regular importer of Russian ESPO Blend, is among the buyers of CPC Blend, the first time in many years, traders said.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg