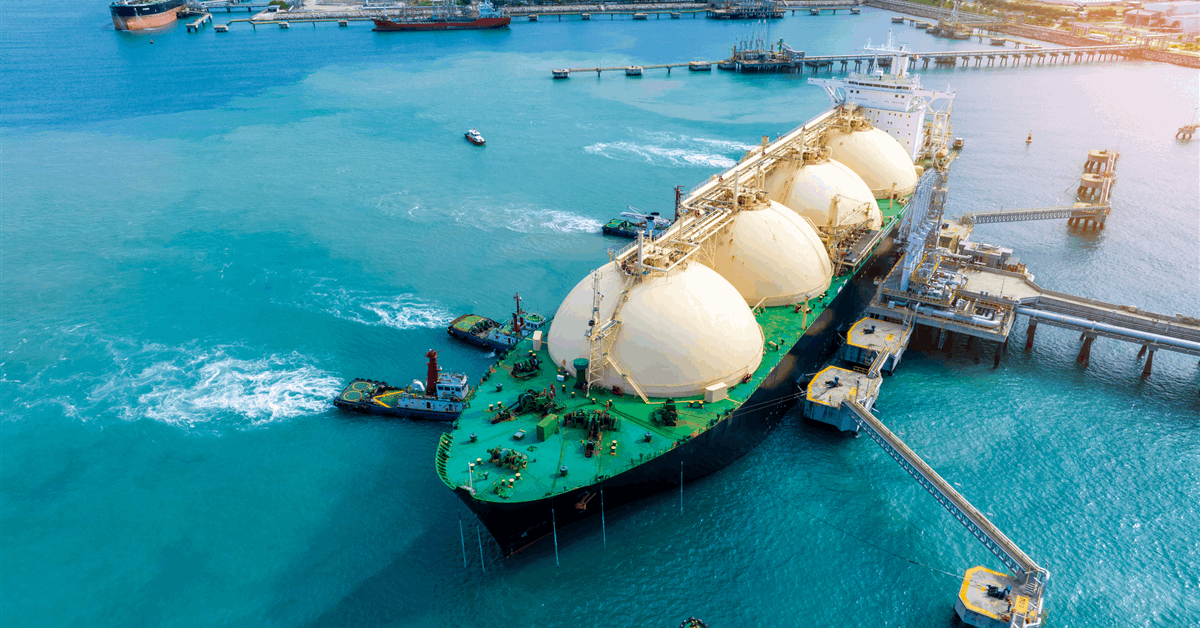

In an analysis posted on its website earlier this month, Dryad Global said maritime traffic through the Bab el-Mandeb Strait “has experienced a significant downturn following the series of Houthi attacks”.

“Before the attacks started in November 2023, the strait saw an average of approximately 459 cargo-carrying vessels over 10,000 deadweight tonnage (dwt) per week,” Dryad noted in the analysis.

“However, current data reflects a stark reduction, with only 252 transits recorded, marking a 48 percent decrease,” it added.

“Analyzing by vessel type, bulk carriers have seen the most dramatic decline, dropping from an average of 540 transits per week to just 79, an 85 percent reduction. Crude oil tankers have also decreased, from 78 transits to 45, indicating a 42 percent fall,” it continued.

“Product tankers, with specifics less detailed pre-attack, are now averaging 43 transits per week. Containerships have plummeted by 70 percent, from a ‘normal’ average of 130 transits to only 40. General cargo ships have decreased by 24 percent,” Dryad went on to state.

The company noted in the analysis that LNG and LPG carriers “have shown the most severe impact”.

“No LNG carriers have transited since mid-March 2024, with LPG carrier traffic dropping by 92 percent,” Dryad said.

Dryad also stated in the analysis that the total deadweight tonnage of vessels passing through the strait had “fallen by 67 percent by March 2024, suggesting not only fewer ships but potentially smaller vessels or reduced cargo loads”.

The traffic through this region has not recovered since March of 2024, Dryad noted in the analysis.

“This situation underscores the broader economic implications, including increased shipping times and costs due to rerouting around Africa via the Cape of Good Hope,” Dryad said.

“The ongoing instability in the region has led to a rise in insurance premiums for ships transiting the Red Sea, reflecting the heightened risk,” it added.

“Despite some reduction in attack frequency, the shipping industry remains cautious, preferring longer but safer routes. This shift has been integrated into current economic models, and without a significant improvement in regional security, the return to pre-attack transit levels seems improbable in the near future,” it continued.

“The strategic reassessment of shipping routes, coupled with the unpredictability of the situation, indicates a sustained avoidance of the Bab el-Mandeb Strait by commercial vessels until stability can be assured,” Dryad went on to state.

When Rigzone asked Dryad CEO Corey Ranslem if we could see the Red Sea open up in 2025, Ranslem told Rigzone that “there is a probability that we could see the level of attacks [in the region] remain where they are now, which could lower the threat level”.

Ranslem added, however, that “there are a number of things that could also change this current situation quickly”.

“The biggest is the ceasefire between Israel and Hamas. If the ceasefire holds, we could potentially see a return to safer operations within the Red Sea region,” he added.

Ranslem told Rigzone that another issue to consider for a return of shipping traffic to this region is the Joint War Risks Committee (JWRC) designation.

The International Underwriting Association of London, which describes itself as the representative body for companies in London providing international and wholesale insurance and reinsurance coverage, notes on its site that “the London market’s Joint War Committee publishes a list of areas of perceived enhanced risk in relation to hull war, strikes, terrorism and related perils”.

“If that designation remains in place, there is a substantial insurance cost for vessels transiting this region,” Ranslem told Rigzone.

“Even if the threat level goes down substantially, we could still see vessels take the longer route around the Horn of Africa purely for insurance reasons,” Ranslem added.

Dryad Global offers a comprehensive suite of maritime intelligence and Cyber solutions, the company’s website notes. The site highlights that Ranslem has 27 years of experience in the public and private sector working with ports, cargo lines, cruise lines, and large yachts. Ranslem is a veteran of the U.S. Coast Guard and is a recognized expert in U.S. Federal Court in maritime security, the site states.

To contact the author, email [email protected]