Dive Brief:

- The amount of capital invested in U.S. projects across sectors that use biogas grew by 40% year over year in 2024, according to an analysis released last week by industry group American Biogas Council.

- The number of new facilities that came online also increased by 17% year over year, the group revealed, including at landfills, farms and wastewater treatment plants. There are now nearly 2,500 facilities that capture and use biogas in the United States.

- The report also reflects how policies that are favorable to renewable natural gas have dominated the industry, as 95% of the 125 projects that came online last year produced RNG.

Dive Insight:

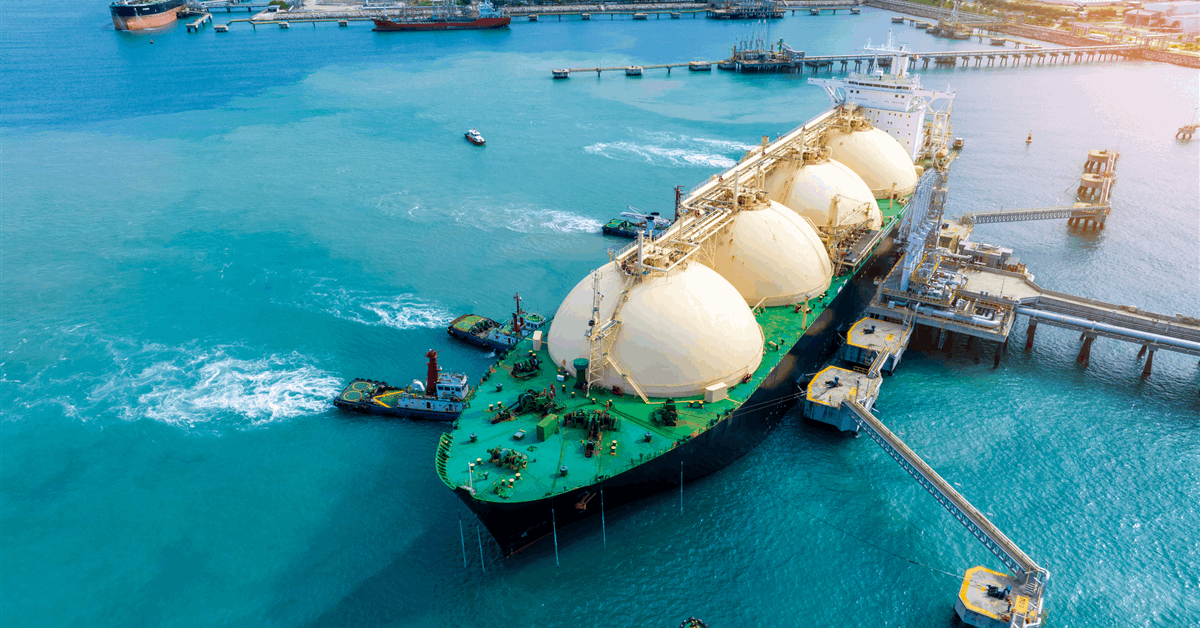

Those trends reflect growing interest in using biogas for energy or to convert into renewable natural gas, a fuel that can be used in place of petroleum-based natural gas.

The use of biogas for energy has a long history, particularly for wastewater treatment facilities and landfills. The first modern anaerobic digestion plant was built at a sewage treatment site in India in the 1800s, according to the National Renewable Energy Laboratory. Biogas capture and use has also become common for U.S. landfills above a certain size due to federal programs like the U.S. EPA’s Landfill Methane Outreach Program, which began in the 1990s.

Today, 47% of all biogas capture facilities in the country are at wastewater facilities. An additional 25% are at agricultural facilities, 23% are at landfills and 5% are built to process food waste alone. Codigestion, where multiple feedstocks like food waste, agricultural waste or sewage are processed at the same time, has also become more common.

A growing number of public incentives have made refining biogas a more profitable enterprise as demand increases for fuel not derived from petroleum. Policies like the federal Renewable Fuel Standard and state clean fuel initiatives have led to major growth in the biogas industry, specifically for RNG.

While 77% of biogas facilities today produce power, 95% of new projects last year produced RNG instead to take advantage of those incentives, per ABC. NREL has previously estimated that RNG could displace about 5% of electric power sector natural gas consumption and 56% of transportation-related natural gas consumption.

“The biogas industry is changing very quickly,” Patrick Serfass, executive director of ABC, said in a recent webinar discussing the data.

The landfill sector of the industry saw the least growth year over year, with 24 facilities coming online in 2024 compared to 26 in 2023. Large waste companies previously have complained about construction and permitting delays that slowed project starts, though they remain committed to building dozens of landfill-gas-to-RNG facilities across the country. Even so, landfills account for 72% of total U.S. biogas production capacity due to the high volume of gas they produce.

Agriculture-based digesters grew 24% year-over-year in 2024, the most of any sector in the industry. There are currently 615 such digesters nationwide, with more on the way thanks to continued investment in the space.

Standalone facilities that handle food waste remain the smallest sector in the biogas industry, with 114 operations representing 5% of all biogas facilities. Of those, 52 handled postconsumer food waste while the rest handled pre-consumer industrial food waste. Still, the sector has plenty of room for growth.

“A lot of people in our industry are pretty bullish that the food waste systems will see much more significant growth in the coming years,” Serfass said.

ABC projects that more than 15,000 new sites could be developed for biogas use in the U.S., based on capturable gas generation across industry sectors. It notes Germany has nearly 10,000 digesters nationwide, allowing some communities to almost entirely stop using petroleum-based fuels as a result.

ABC advocates for policies that would support additional industry growth, including “tailpipe rules” for medium- and heavy-duty fleets that don’t favor electric vehicles over natural gas-fueled vehicles. The group is also pushing to preserve and extend tax credits that support fuel and electricity production, which may be threatened by President Trump’s targeting of Inflation Reduction Act measures.

“Organic waste is everywhere; this is not an urban/rural or red/blue issue,” Heather Dziedzic, vice president of policy at ABC, said last week. “This is nationwide.”