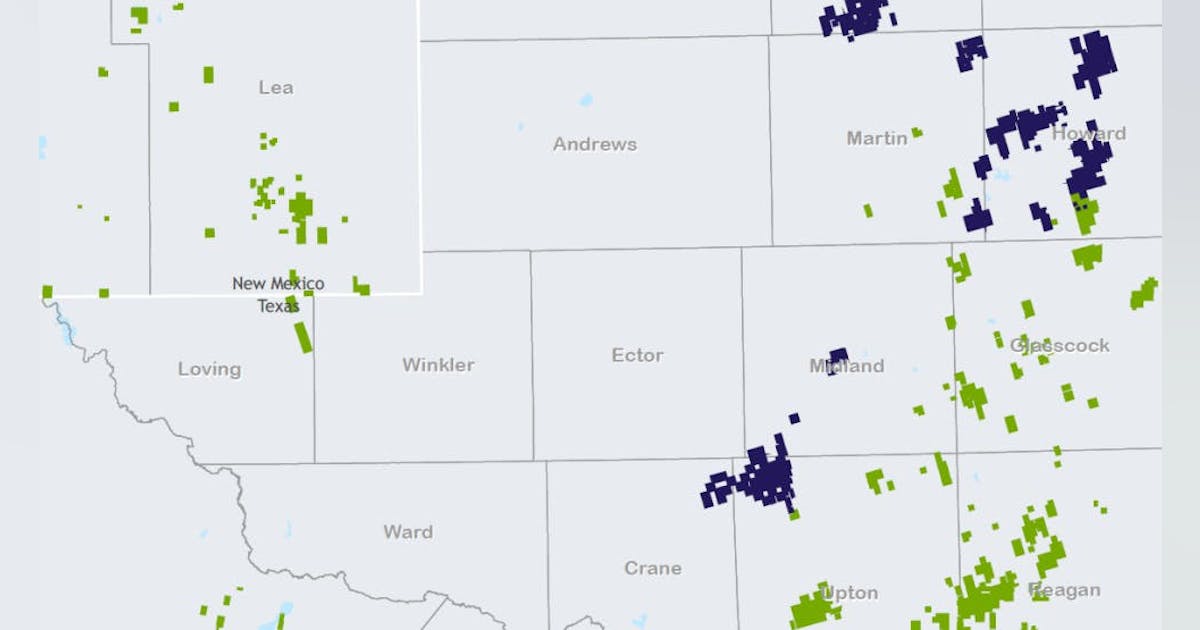

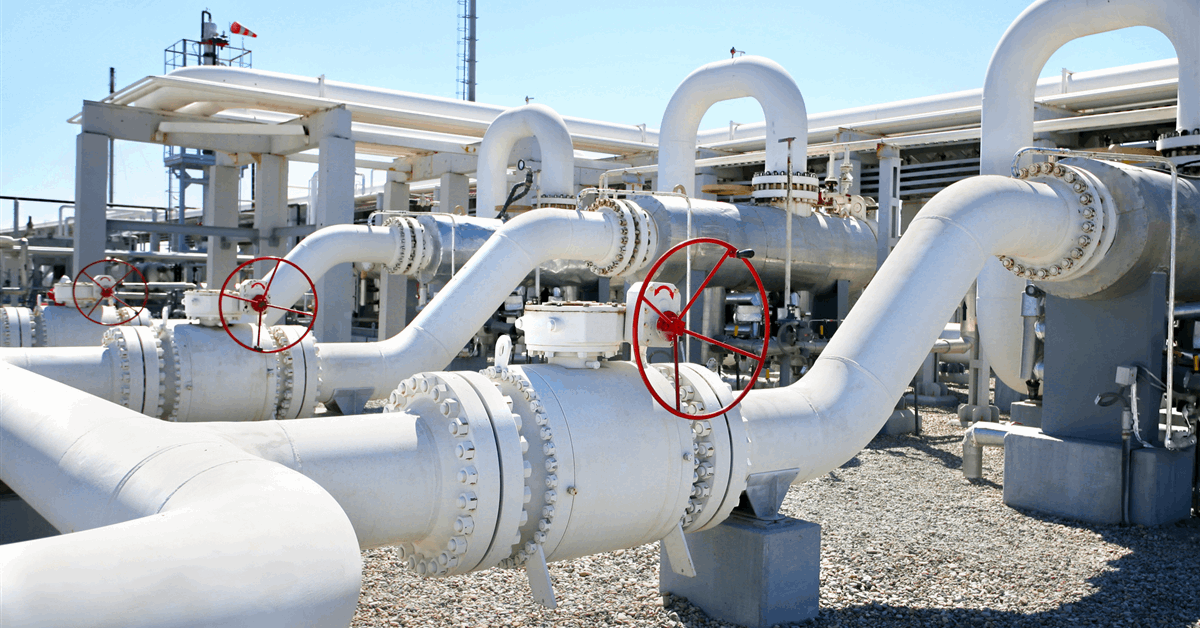

BP PLC announced Monday an agreement to farm down its stakes in midstream pipelines and facilities in the Permian basin and Eagle Ford play to Sixth Street for $1.5 billion.

The assets – under bpx energy, BP’s onshore oil and gas business in the United States – include four Permian central processing facilities. Grand Slam, Bingo, Checkmate and Crossroads, which started operations in June, connect wells to third-party pipeline networks that carry oil and gas to customers.

“Following completion of both transactions, bpx’s ownership interest in the Permian midstream assets will move to 51 percent (from 100 percent), while bpx’s ownership interest in the Eagle Ford midstream assets will move to 25 percent (from 75 percent)”, BP said in a press release.

“Sixth Street will hold the remaining, non-operating interests”, while BP will remain operator, the British company said.

Kyle Koontz, chief executive of bpx energy, said, “We recognized early on that investing in midstream would be an important ingredient to our success in these basins in terms of driving value, flow assurance and lowering emissions”.

BP said it had paid $1 billion upon signing the transaction and will settle the remaining balance by yearend.

“The effect on non-controlling interest reported in the income statement is projected to be in the range of $100-200 million per annum”, it said.

In its quarterly report on Tuesday, BP said it expects to complete over $4 billion worth of asset sales in 2025, part of a $20-billion divestment target by 2027 under a “reset” plan it announced February.

Last month BP penned an agreement to sell adjoining production and exploration assets on the United Kingdom’s side of the North Sea including the Culzean gas and condensate field to Serica Energy PLC for at least $232 million, as announced by Serica on October 13.

The transaction consists of BP’s 32 percent non-operating stake in the P111 license, which contains Culzean, and the adjacent P2544 exploration block, Serica said.

The acquisition is subject to a 30-day preemption period during which BP’s partners – operator TotalEnergies SE (49.99 percent) and NEO NEXT Energy Ltd (18.01 percent) – may exercise their option to acquire BP’s stake on the same terms as those agreed by Serica, Serica said.

BP’s share of production from Culzean was about 25,500 barrels of oil equivalent a day in the first half of 2025, Serica noted.

On July 18 BP said it has agreed to divest its onshore wind business in the U.S. to LS Power Development LLC, giving up 1.3 gigawatts of net capacity from 10 projects in operation.

Five of the projects are wholly owned by BP. In each of the other five, BP owns 50 percent.

All 10 projects, which can generate up to 1.7 GW gross, are grid-connected and signed to 15 offtakers, according to a joint statement.

The parties expect to complete the transaction by yearend, subject to regulatory approvals. The price was not disclosed. Employees will transfer to the new owner.

On July 9 BP said it had signed a deal to divest its convenience, mobility and BP Pulse businesses in the Netherlands to local fuels distributor Catom BV. BP Pulse is BP’s multinational electric vehicle charging business.

“The transaction includes around 300 bp-owned or branded retail sites – some with on-site EV charging infrastructure – as well as 15 operational BP Pulse EV charging hubs, eight under development and the associated Dutch fleet business”, a joint statement said.

The parties did not disclose the price of the transaction, expected to be completed by yearend subject to regulatory approvals.

On March 27 BP said it was initiating a marketing process to sell its retail sites, associated fleet and EV charging infrastructure in Austria, as well as its stake in the Linz fuel terminal. BP aims to complete the sale in 2025.

On February 26 BP said it was considering “all options” for its Castrol lubricants business.

On February 6 it announced a marketing process for the potential sale of Ruhr Oel GmbH-BP Gelsenkirchen, a refining, petrochemical and pipeline company in Germany and the Netherlands. Sale completion is targeted 2025.

To contact the author, email [email protected]