BP announced, in a statement posted on its website on Thursday, that it has started up its sixth “major” upstream oil and gas project of 2025.

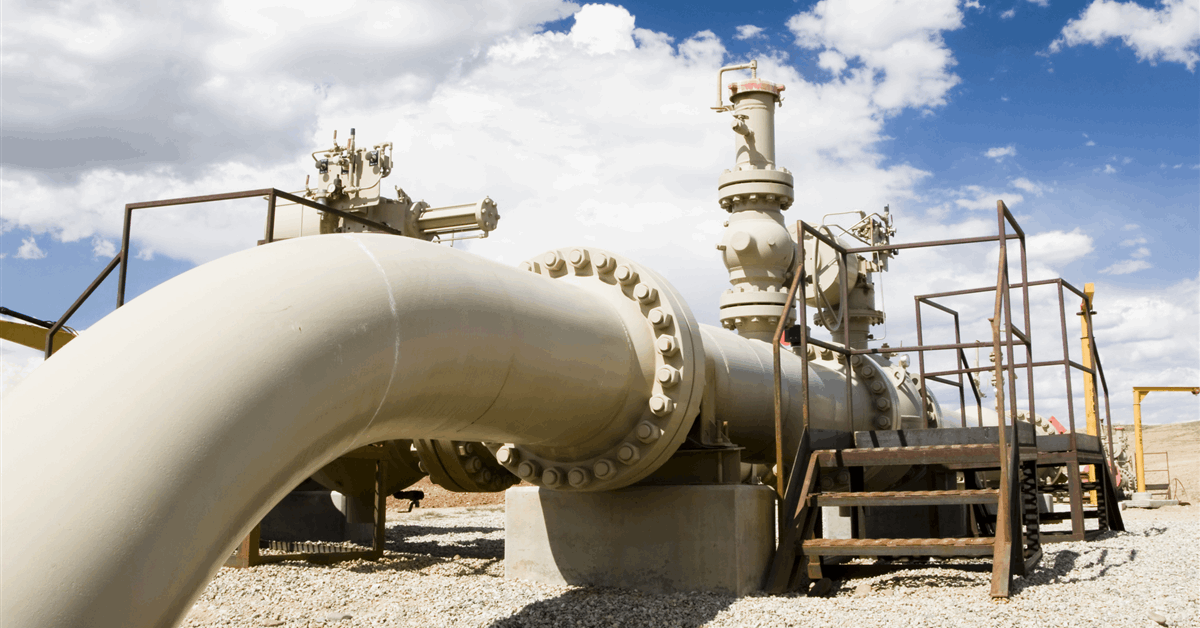

That project is the Murlach field in the UK North Sea, the statement pointed out, adding that the development adds a peak net production of around 15,000 barrels of oil equivalent per day to the BP operated Eastern Trough Area Project (ETAP) in the central North Sea.

The ETAP hub has been operating for 27 years, BP highlighted in its statement.

The Murlach project received government and regulatory approvals in 2023 and involved the redevelopment of a field originally in operation in the early 2000s, according to BP’s statement, which noted that the company acquired the field license after it was relinquished by the previous operator.

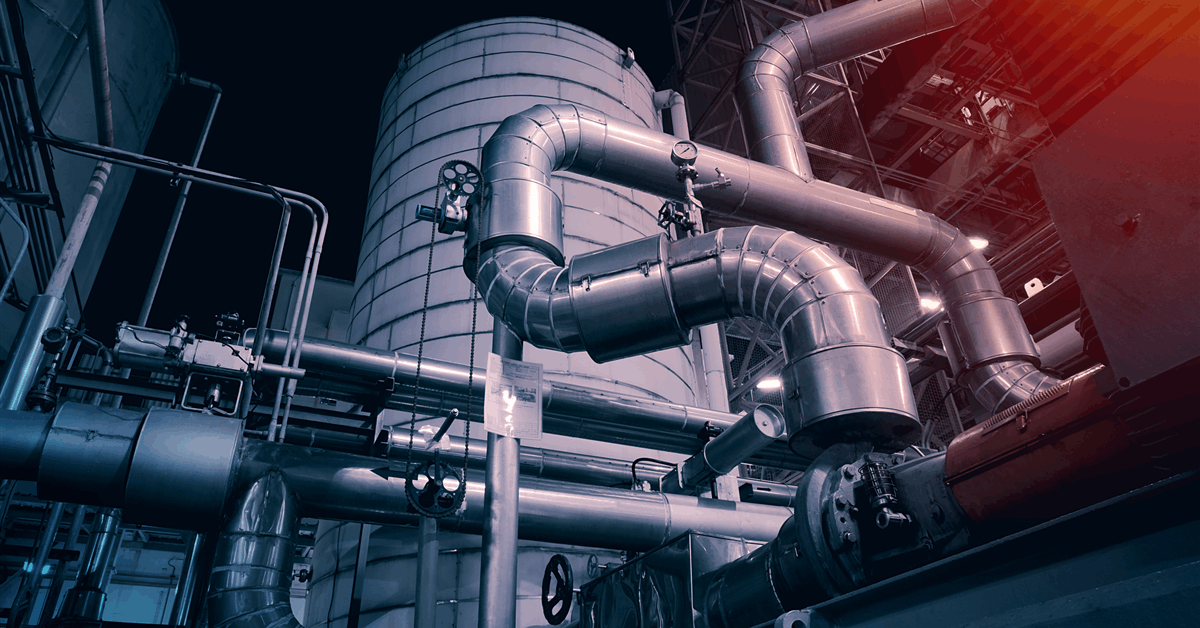

The redevelopment included drilling two new wells, adding subsea equipment, reusing some existing kit, and making topside changes to the ETAP central processing facility, BP said in the statement.

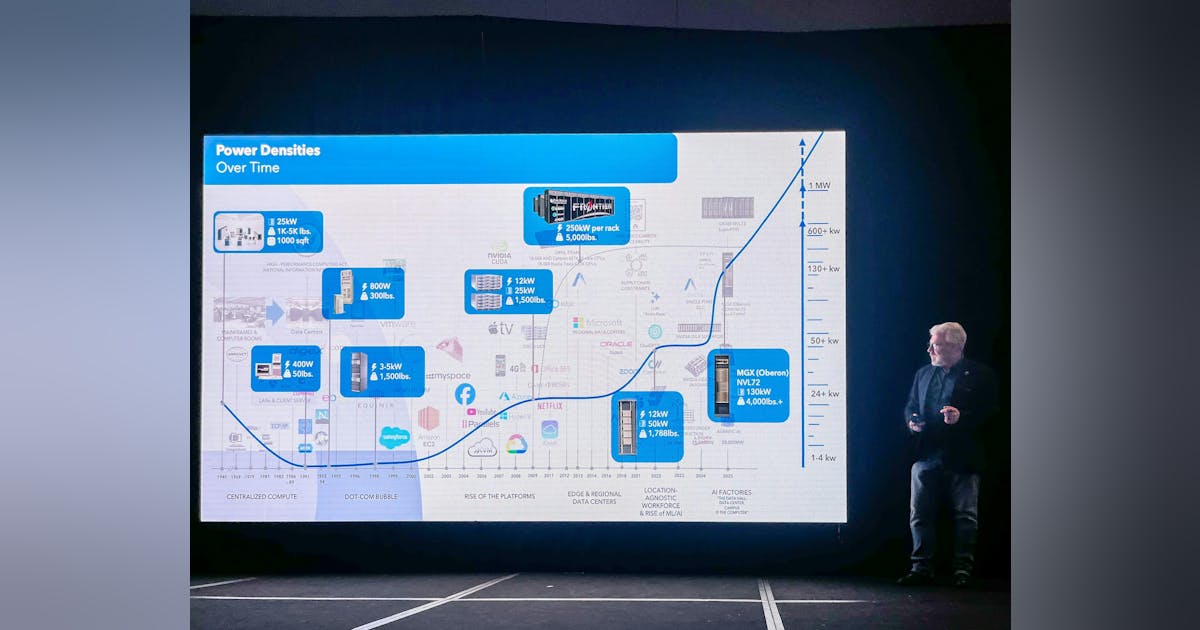

Overall, the six projects started up this year add around 150,000 barrels of oil equivalent per day of combined peak net production, according to BP’s statement, which noted that this contributes to the company’s target to deliver an additional 250,000 barrels of oil equivalent per day of combined peak net production by the end of 2027.

“Murlach is the sixth start-up for BP in 2025 and marks another important milestone in our plan to deliver 10 major upstream oil and gas projects by the end of 2027,” Ewan Drummond, BP’s senior vice president of projects, said in the statement.

“These projects reflect BP’s strength in safely increasing production to supply energy to meet global demand, while maintaining a relentless focus on shareholder returns. They also highlight our focus on efficient delivery, with four starting up ahead of schedule,” he added.

Doris Reiter, senior vice president of BP North Sea, said in the statement, “a key focus for BP in the North Sea is to identify opportunities that can be developed competitively using existing infrastructure to effectively manage established oil and gas hubs for the entirety of their lifespan – Murlach serves as another great example of this”.

“It’s also testament to the skill and dedication of the BP team, our co-venturer NEO NEXT Energy, and supply chain colleagues,” Reiter added.

Rigzone asked BP if it was planning to start up any more major upstream oil and gas projects this year, and if so, if any of those were based in the UK North Sea.

In response, a BP spokesperson told Rigzone that no more projects are planned to start up this year but highlighted that the company is expecting four more before the end of 2027, “two in Gulf of America (2026 and 2027 start-ups) and two in Trinidad (both 2027)”.

A ‘major projects’ section on BP’s website shows a list of several projects “starting up in 2026 and beyond”. These include the Atlantis Drill Center 1 Expansion and the Atlantis Major Facility Expansion, both of which are shown on the site to be deepwater oil projects located in the U.S. Gulf of America.

The site outlines that the former is projected to start up in 2026 and have a peak annual average gross production of 15 million barrels of oil equivalent per day and that the latter is projected to come online in 2027 and have a peak annual average gross production of 10 million barrels of oil equivalent per day.

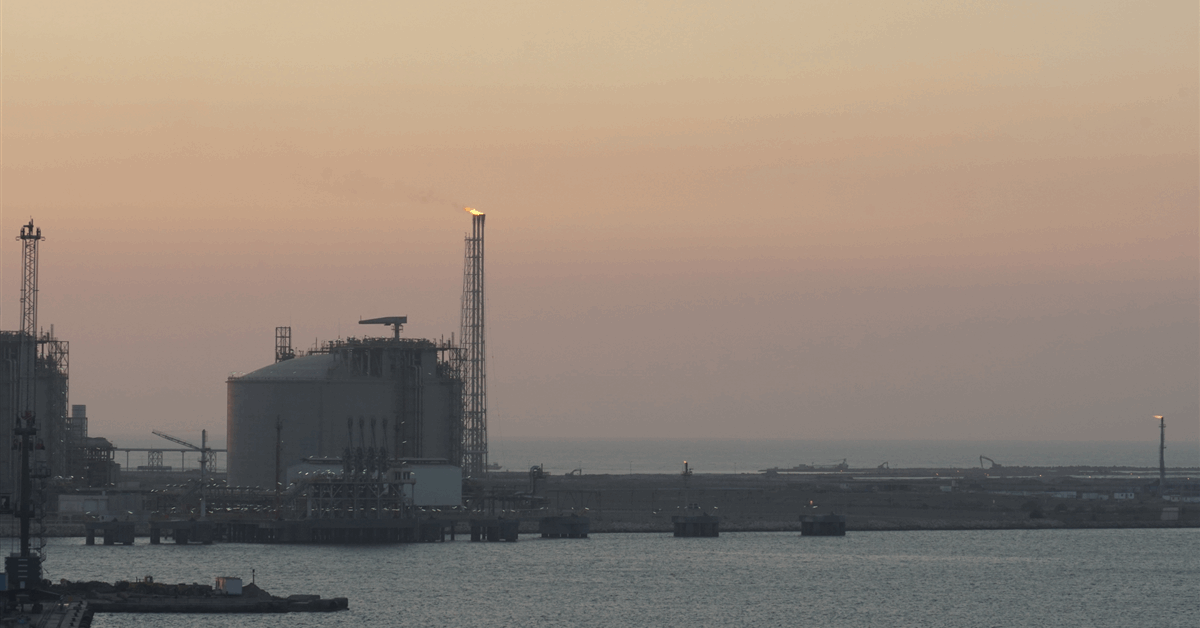

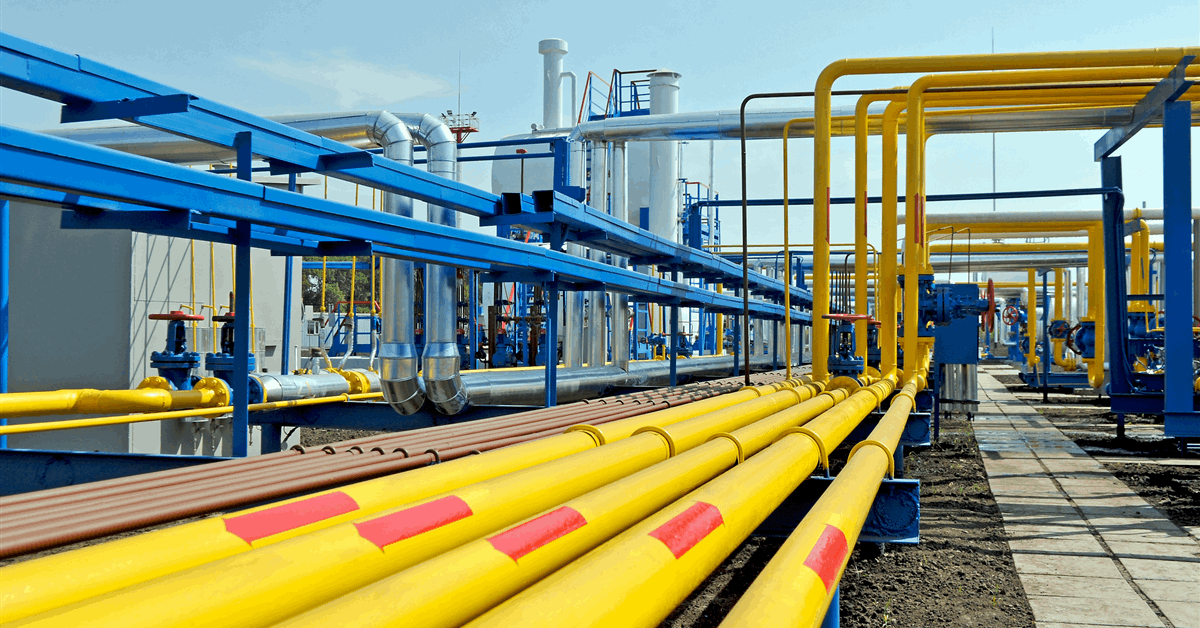

Also included in the list of projects “starting up in 2026 and beyond” is Coconut and Ginger, both of which are shown to be located in Trinidad. Both of these projects are projected to start up in 2027, the site outlined. Coconut is shown on the site to be a gas project and Ginger is shown on the site to be an LNG project with a peak annual average gross production of 50 million barrels of oil equivalent per day.

To contact the author, email [email protected]