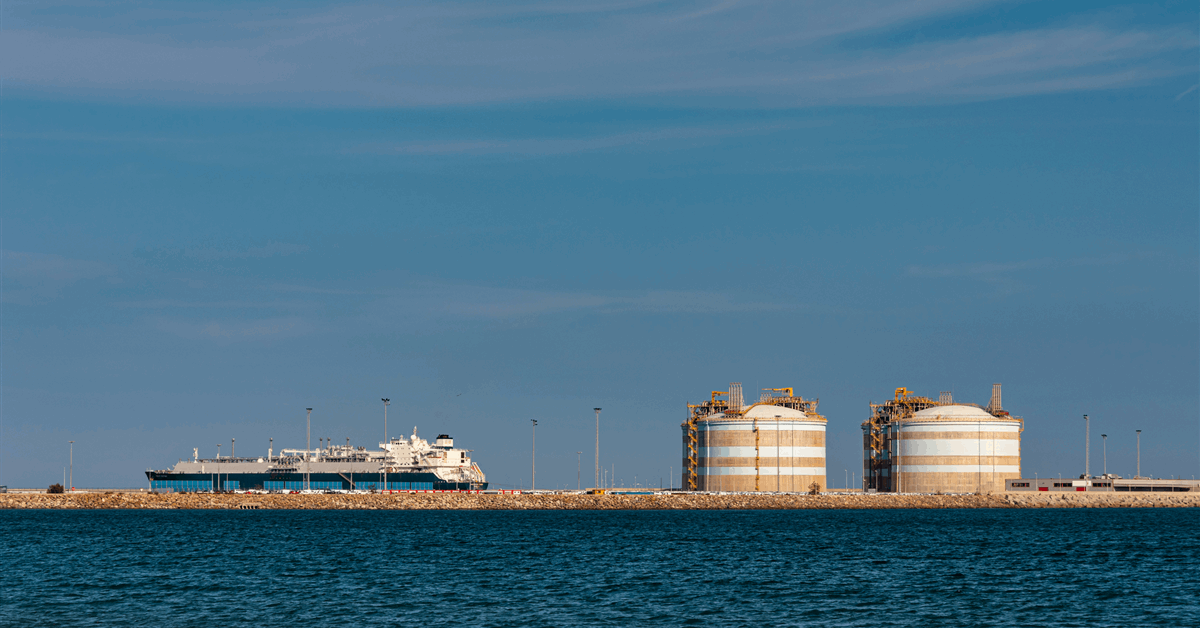

Woodside Energy Group Ltd. has tapped BP PLC for the supply of up to 640 billion cubic feet of natural gas for the Louisiana LNG project on the United States Gulf Coast.

The British energy giant will deliver the volumes starting 2029, a joint statement said Wednesday.

“This agreement represents the first tranche of a diversified portfolio of feedgas that will support the Louisiana LNG project, enabled by the project’s extensive interconnectivity to multiple producing basins and interconnecting pipelines”, the companies said.

Woodside chief executive Meg O’Neill commented, “Woodside has a long history of successful collaboration with bp. By drawing upon bp’s experience with MiQ certificates, we can access verifiably low methane intensity molecules for the Louisiana LNG project. This supports Woodside’s goals as a member in the UN Environment Program’s OGMP [Oil and Gas Methane Partnership] 2.0 initiative”.

A day prior Woodside announced a positive final investment decision (FID) on the project, which it acquired as Driftwood LNG as part of its $1.2 billion takeover of Tellurian Inc. last year.

“The forecast total capital expenditure for the LNG project, pipeline and management reserve is US$17.5 billion (100 percent)”, the Australian oil and gas explorer and producer said. New York City-based Stonepeak Partners LP will provide a staggered contribution of $5.7 billion in exchange for a 40 percent stake, under an agreement announced earlier this month.

Louisiana LNG has an Energy Department permit to export a cumulative 1.42 trillion cubic feet a year of natural gas equivalent, or 27.6 million metric tons per annum (MMtpa) of liquefied natural gas (LNG) according to Woodside, to both FTA and non-FTA countries.

The FID announced Tuesday is for phase 1, which will build 3 liquefaction trains with a collective capacity of 16.5 MMtpa,

Louisiana has already been under construction by Reston, Virginia-based Bechtel Corp.

“Development of Louisiana LNG will position Woodside as a global LNG powerhouse, enabling the company to deliver approximately 24 Mtpa [million metric tons per annum] from its global LNG portfolio in the 2030s, and operating over 5 percent of global LNG supply”, Woodside said. “The development has expansion capacity for two additional LNG trains and is fully permitted for a total capacity of 27.6 Mtpa.

“Louisiana LNG represents a compelling investment that will deliver significant cash flow and create long-term value for Woodside shareholders. It exceeds Woodside’s capital allocation targets, delivering an internal rate of return above 13 percent and a payback period of seven years.

“At full capacity, the foundation project is expected to generate approximately $2 billion of annual net operating cash in the 2030s. It will drive Woodside’s next chapter of value creation, giving the company’s global portfolio the potential to generate over $8 billion of annual net operating cash in the 2030s”.

Woodside said it would not revise its emission reduction plan to account for Louisiana LNG.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR