Dive Brief:

- Carrier Global Corp. saw 6% year-over-year sales growth in the fourth quarter of 2024, led by an 11% organic increase in HVAC sales, the company reported Tuesday.

- HVAC sales in the Americas saw growth in the high teens, driven by continued strength in commercial and North America residential, which were both up double digits and partially offset declines in its light commercial segment, Carrier said in its report.

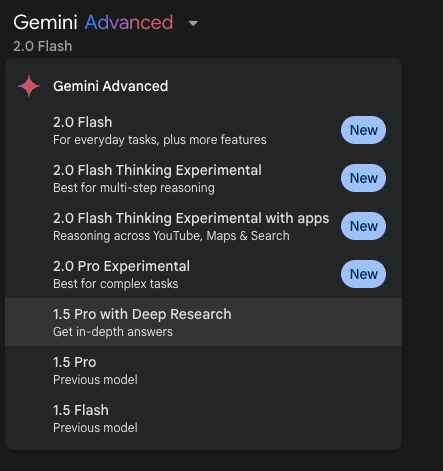

- Carrier, like many other HVAC and cooling providers, is also pushing into the data center market and is expecting $1 billion in sales during 2025, CEO David Gitlin said on its Feb. 11 earnings call. “The idea for hyperscalers and certainly the [co-locators] is to say, ‘You worry about running the data centers; let us worry about all the cooling you need by having optimized integrated cooling systems,’” Gitlin said.

Dive Insight:

Carrier’s global commercial HVAC grew in the mid-teens compared with last year, “positioning [Carrier] for another year of double-digit growth in 2025 in the business,” Gitlin said on the call. Commercial HVAC and aftermarket sales were also up by double digits year-over-year for the fourth consecutive year, according to the company’s earnings presentation.

HVAC in the Americas increased by low-teen percentages year-over-year, Gitlin said. The company has also worked to improve manufacturing capacity in the Americas, increasing output of its facility in Charlotte, North Carolina, by about 50%. In addition to a new facility the company is building, “we can more than double our output for North America and the demand has been great,” Gitlin said.

Within the U.S., Carrier is working with utilities to provide an end-to-end integrated battery heat pump solution with automated controls that can run the system using stored energy during peak hours, while recharging during the trough of energy grid usage, Gitlin said. “The interest from utilities and other customers has been very encouraging to address grid constraints and resiliency,” he said.

The company last week also introduced QuantumLeap, a suite of solutions designed to support the rapidly expanding data center industry. The move helps Carrier position itself for significant growth by expanding its portfolio of advanced, energy-efficient cooling solutions, creating customizable aftermarket programs, and scaling its manufacturing and engineering capacity.

Carrier says that with the global data center cooling market projected to reach $20 billion by 2029, QuantumLeap represents “the next evolution in data center thermal management.” The company also touted its next-generation chillers and air handling units and a new cooling distribution unit that enables direct-to-chip liquid cooling. It also referenced its advanced building management systems, infrastructure management and predictive maintenance and service.

“By combining traditional cooling, liquid cooling and our building and server management systems, we provide differentiated more efficient solutions for our customers in this important and growing vertical,” Gitlin said on the call.

Due to its positioning within the markets Carrier serves, Gitlin said, the company expects another year of double-digit growth in aftermarket and global commercial HVAC.