Canada’s Cenovus Energy Inc. increased its takeover bid for rival MEG Energy Corp. one day before investors were due to vote on it, signaling the companies’ original deal didn’t have enough shareholder support.

The new cash-and-stock offer from Cenovus values MEG at C$29.80 per share, or C$7.6 billion ($5.4 billion), based on Tuesday’s closing price. That’s a bump of about 5% from the previous offer, which the MEG board agreed to in August. Including debt, the offer values MEG at about C$8.6 billion.

MEG shares were up 5.5% Wednesday at noon in Toronto and Cenovus shares were up 1%.

Cenovus is also offering more stock this time: the new proposed transaction is half shares, half cash. The previous bid would have paid shareholders three-quarters cash, and was criticized by some investors for limiting the potential upside for MEG investors.

“While the market will likely express some disappointment from the raised bid, we think the improved offer should support approval from MEG holders and we do believe in the strategic merits of the transaction,” JPMorgan analyst Arun Jayaram said in a note to investors.

MEG’s largest shareholder is Strathcona Resources Ltd., which owns 14% of the company and has put forward its own competing all-stock takeover proposal, which MEG’s board turned down. Strathcona didn’t immediately respond to a request for comment.

The MEG shareholder vote has been delayed until Oct. 22. Cenovus needs two-thirds support for the takeover to succeed.

“We received support from the majority of MEG’s shareholders for our transaction, Cenovus Chief Executive Officer Jon McKenzie said in a statement. “However, many MEG shareholders indicated that they would prefer to receive greater Cenovus share consideration, so that they can more fully participate in the upside of the combined company.”

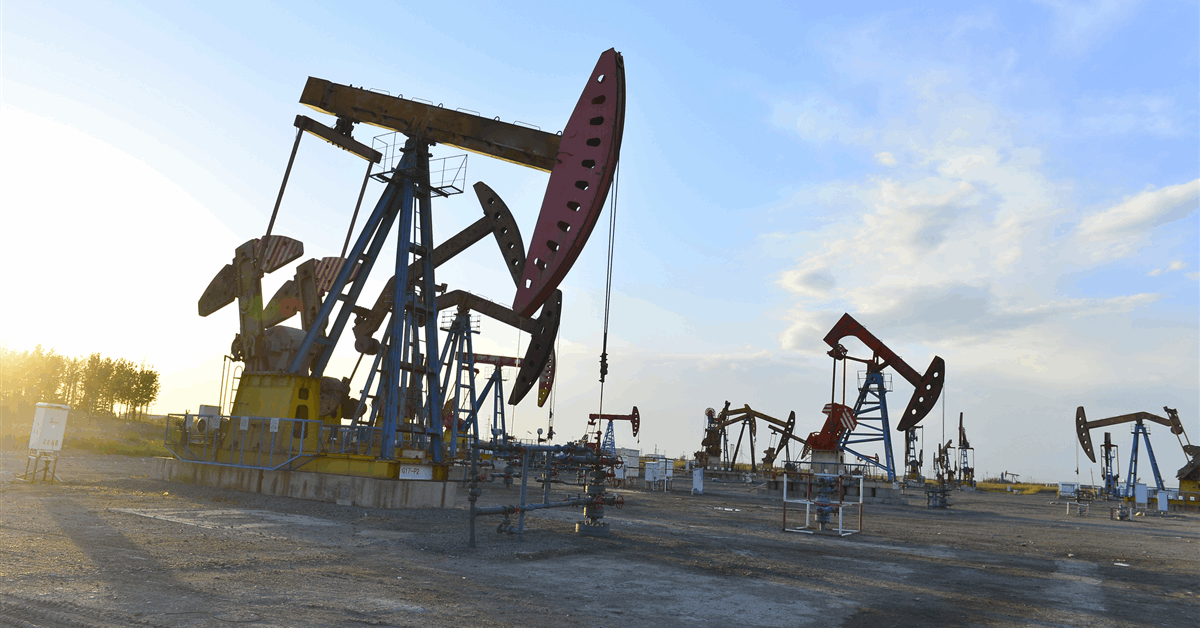

A takeover of MEG, which operates a single oil-sands site that produces about 100,000 barrels a day of crude, would position Cenovus as a dominant player in the Christina Lake region of Alberta. Cenovus’s upstream production was about 832,000 barrels of oil equivalent per day in the third quarter.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.