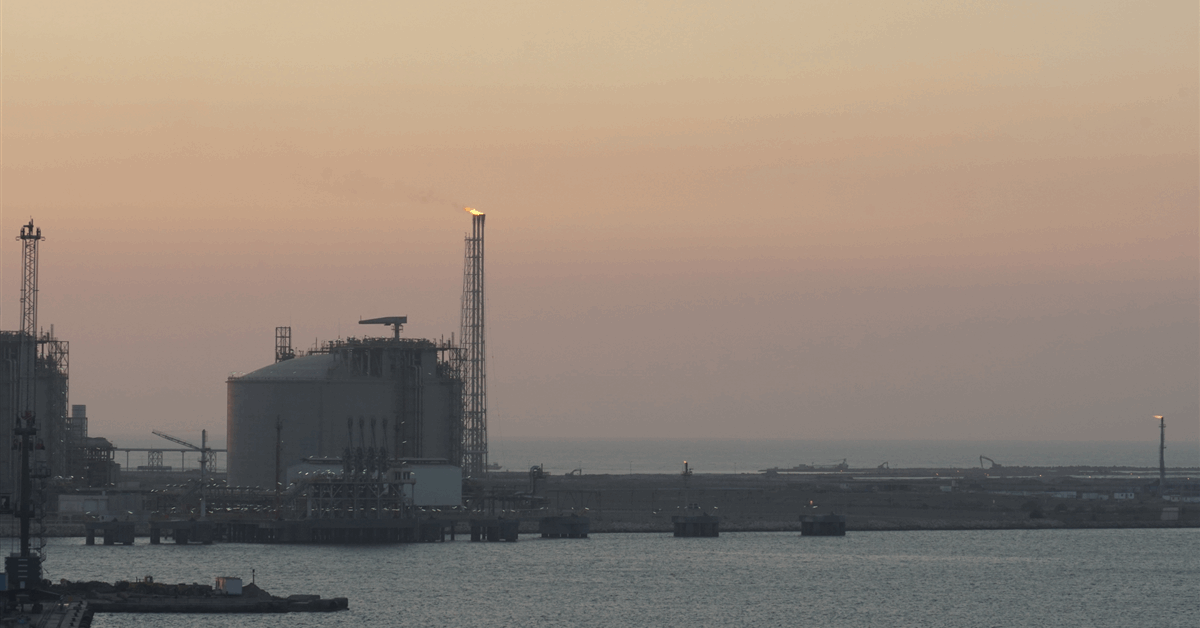

Civitas Resources Inc., an oil and gas explorer that has been weighing a sale, is considering a merger with Permian Basin rival SM Energy Co., according to people familiar with the matter.

Civitas has been discussing a deal with SM that wouldn’t include a premium and would be structured as a merger of equals as it explores strategic options, said the people, who asked to not be identified because the details aren’t public. No deal has been finalized and other parties are circling Civitas, the people added.

Representatives for Civitas and SM Energy declined to comment.

If a transaction is consummated, the combined company would be worth at least $14 billion, including debt, making it one of the year’s biggest oil and gas deals, according to data compiled by Bloomberg.

The Permian Basin of West Texas and New Mexico — the largest and most productive US oil field — has seen a blitz of merger activity in recent years as small players pair up to gain scale and major operators look for a toehold. In August, Crescent Energy Co. agreed to buy Permian Basin rival Vital Energy Inc. for $3.1 billion.

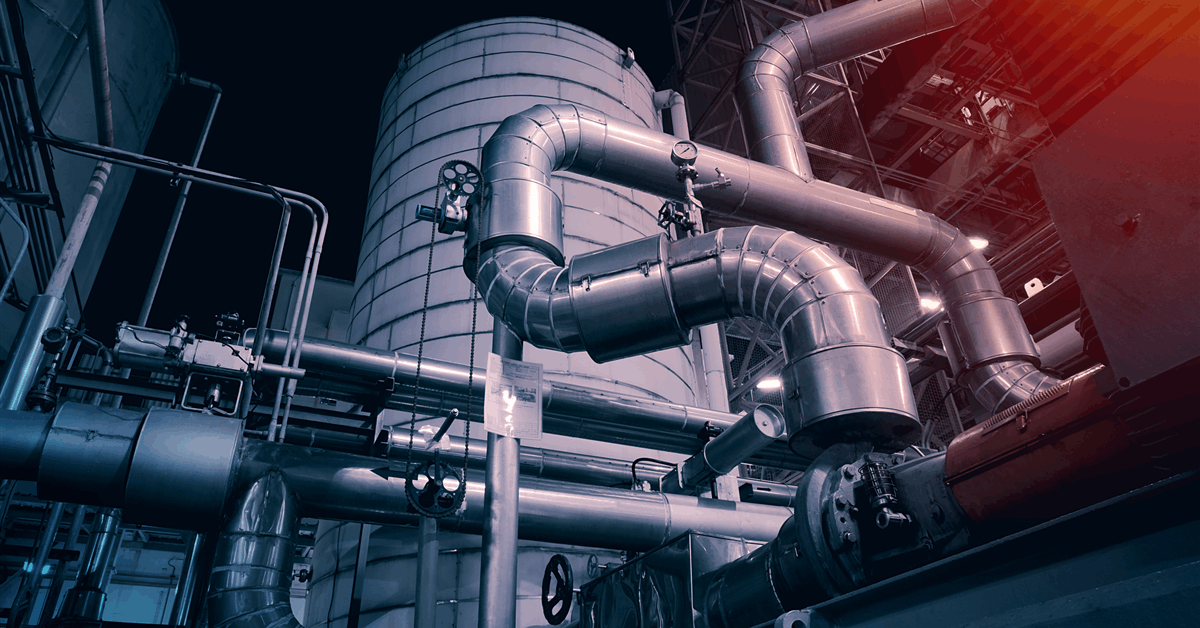

This deal would bring together two of the region’s midsize, public players. Civitas, with a market value of about $3.2 billion, produces oil across about 140,000 net acres throughout the basin, according to an investor presentation in August. SM has a market value of about $2.9 billion and about 109,000 acres in a well-developed swathe of the Permian known as the Midland Basin.

SM has an enterprise value of about $5.5 billion while Civitas is worth about $8.5 billion, including debt. EOG Resources Inc.’s $5.6 billion takeover of Encino Acquisition Partners is the largest deal announced this year in the US oil and gas exploration sector, according to data compiled by Bloomberg.

The companies’ operations extend beyond the Permian. SM has acreage in the Eagle Ford shale of South Texas and Utah’s Uinta Basin while Civitas has a position in Colorado’s Denver-Julesburg Basin.

Civitas has been selling assets to pay down debt, including a package of lower-margin assets in the Denver-Jules. In August, Interim Chief Executive Officer Wouter van Kempen took the helm of the company from Chris Doyle.

Bloomberg News reported last month that Denver-based Civitas was weighing options including a sale.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.