Malaysia’s Petroliam Nasional Bhd (Petronas) and Italy’s Eni SpA on Monday announced a binding agreement to combine their assets in Indonesia and Malaysia into a company equally owned by the state-controlled oil and gas producers.

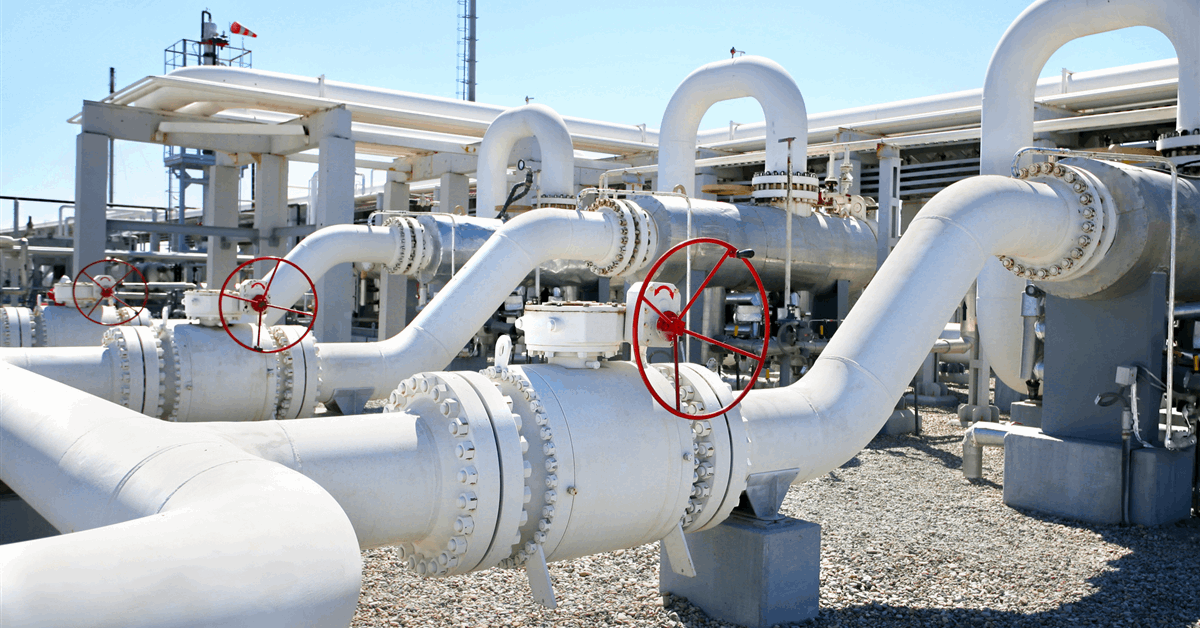

The independent company, to be called NewCo, will focus on natural gas-producing and development assets including in Indonesia’s Kutei Basin, Eni said in an online statement Monday. Announcing the prior memorandum of understanding February 27, Eni and Petronas said the combination would create a “major” liquefied natural gas player in the Asian market.

Last year Indonesian authorities approved Eni’s development plan for the offshore Gehem and Geng North fields, which includes the construction of a new production hub with an output capacity of about two billion cubic feet a day of gas and 80,000 barrels of oil per day of condensates. Geng North was discovered 2023 under the North Ganal production sharing contract (PSC). Gehem meanwhile came under Eni when it acquired Chevron Corp’s operating stake in the Rapak PSC, as well as the Ganal and Makassar Straits PSCs, in 2023.

The government also approved at the time Eni’s development plan for the Gendalo and Gandang fields, which would be tied back to existing infrastructure. Gendalo and Gandang are under the Ganal block, which is separate from the North Ganal block.

Eni at the time also secured a 20-year extension to the Indonesia Deepwater Development gas project, which consists of the Ganal and Rapak blocks, as announced by the company August 23, 2024.

The Ganal, North Ganal, Makassar Straits and Rapak blocks sit in the Kutei Basin off the coast of East Kalimantan province. The province is on the Indonesian side of Borneo, an island shared with Brunei and Malaysia.

NewCo will have an initial production capacity of over 300,000 barrels of oil equivalent a day (boed). It will grow its output capacity to more than 500,000 boed “in the medium term”, Eni said Monday.

“NewCo will operate as a financially self-sufficient entity, with plans to invest in excess of $15 billion over the next five years”, Eni said. “This investment will support the development of at least eight new projects and the drilling of 15 exploration wells, with the aim of developing approximately three billion boe of discovered reserves. NewCo also aims to unlock an estimated 10 billion boe of unrisked exploration potential”.

“Under NewCo, Eni and PETRONAS will combine complementary portfolios, technical strengths and regional expertise to deliver long-term value creation, operational excellence and leadership in the energy transition”, Eni said.

“The creation of NewCo will enable Eni to accelerate project development cycles and optimize capital allocation, and also achieve operational synergies in exploration, production and asset management, while capturing growth from both mature producing fields and high-opportunity exploration areas”, it added.

“The new business will form part of Eni’s satellite model strategy, following similar successful ventures such as Var Energy in Norway, Azule in Angola and Ithaca in the UK”, Eni said. The model involves, in Eni’s words, “creating focused and lean companies able to attract new capital to create value through operating and financial synergies and the acceleration of growth”.

Petronas said separately on Monday, “The joint venture supports both companies’ broader gas aspirations and complements Petronas’ other established businesses in Indonesia outside of the joint venture scope, enabling new opportunities for growth and innovation in the sector”.

The parties expect to complete the transaction next year, subject to regulatory approvals. Petronas said the transaction also needs the waiver of pre-emption rights.

To contact the author, email [email protected]