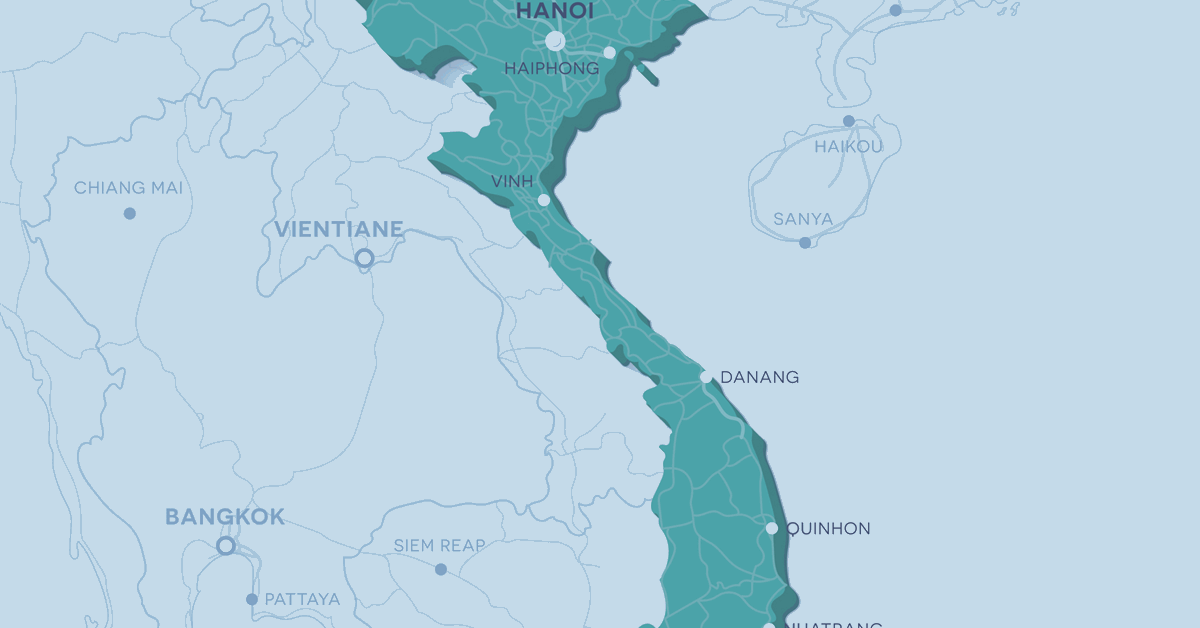

London-based EnQuest PLC is acquiring Harbour Energy’s business in Vietnam, which includes a 53.125 percent equity interest in the Chim Sáo and Dua production fields.

The transaction has an effective date of January 1, 2024, and is expected to close in the second quarter of 2025, EnQuest said in a news release. The headline value of the transaction is $84 million and the company expects to pay consideration of approximately $35 million upon completion, net of interim period cash flows.

Upon closing of the acquisition, EnQuest will operate the Chim Sáo and Dua fields (Block 12W), “deploying its proven late life and FPSO asset management expertise to maximise value and progress discovered resources into reserves,” according to the release.

Block 12W is made up of three producing oil and gas fields: Chim Sáo, Chim Sáo North West (CSNW) and Dua, located in the Nam Con Son Basin, approximately 248.5 miles (400 kilometers) south west of Vung Tau, Vietnam.

As of 1 January, net 2P reserves and 2C resources across the fields totaled 7.5 million barrels of oil equivalent (boe) and 4.9 million boe, respectively. Block 12W production has responded positively to the drilling of three infill wells during 2023 and a series of well interventions undertaken in 2023-2024, according to the release. The combined impact of these activities contributed around 3.0 million boe to 2P reserves. Net production in 2025 is projected to average around 5,300 boe per day, “with further significant upside potential relating to well intervention performance”.

EnQuest said the acquisition aligns with its “strategic aim to grow its international operating footprint by investing in fast-payback assets, with low capex and reduced carbon intensity”.

The Block 12W Production Sharing Contract (PSC) runs until November 2030, with an opportunity to extend the contract. Additional Block 12W prospectivity is spread across three gas discoveries and several additional targets, EnQuest noted, adding that it plans to explore the potential upside of the assets.

The transaction involves EnQuest’s acquisition of the 28.125 percent equity share held by Premier Oil Vietnam Offshore BV (POVO) and the 25 percent share held by Premier Oil Vietnam Limited (POVL). EnQuest will be the field operator, with non-operator joint venture partners Bitexco, with a working interest of 31.875 percent, and PetroVietnam Exploration Production Corporation Ltd, with 15 percent.

EnQuest CEO Amjad Bseisu said, “Our entry into Vietnam is highly complementary to EnQuest’s well-established and high-performing Malaysia business and significantly enhances the scale of our operations and opportunity in South East Asia. The region is key to EnQuest’s growth and diversification strategy and we are excited by the potential to deploy our proven expertise and operating capability to optimise and enhance the Block 12W assets”.

“We look forward to welcoming our new employees from the existing Harbour Energy team to the Group and are committed to working with our partners, Bitexco and PetroVietnam Exploration Production Corporation Ltd, to explore future opportunities in the assets. As EnQuest continues to work towards a transformational transaction in the UK North Sea, this agreement underlines our commitment to growth, a disciplined approach to M&A, and deploying capital where we see the most favorable returns,” he added.

According to the release, the Chim Sáo oil field was discovered in 2006 and first oil was achieved in October 2011. Having been developed via a single wellhead platform, Chim Sáo and CSNW oil production is exported through the Lewek Emas floating production storage and offloading (FPSO) vessel, and gas is exported by pipeline to Vung Tau near Ho Chi Minh City. Chim Sáo currently has 14 active oil producers and seven water injectors.

The Dua oil and gas field was subsequently developed as a subsea tie-back to Chim Sáo, with first production achieved in July 2014, through three subsea oil producers.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR