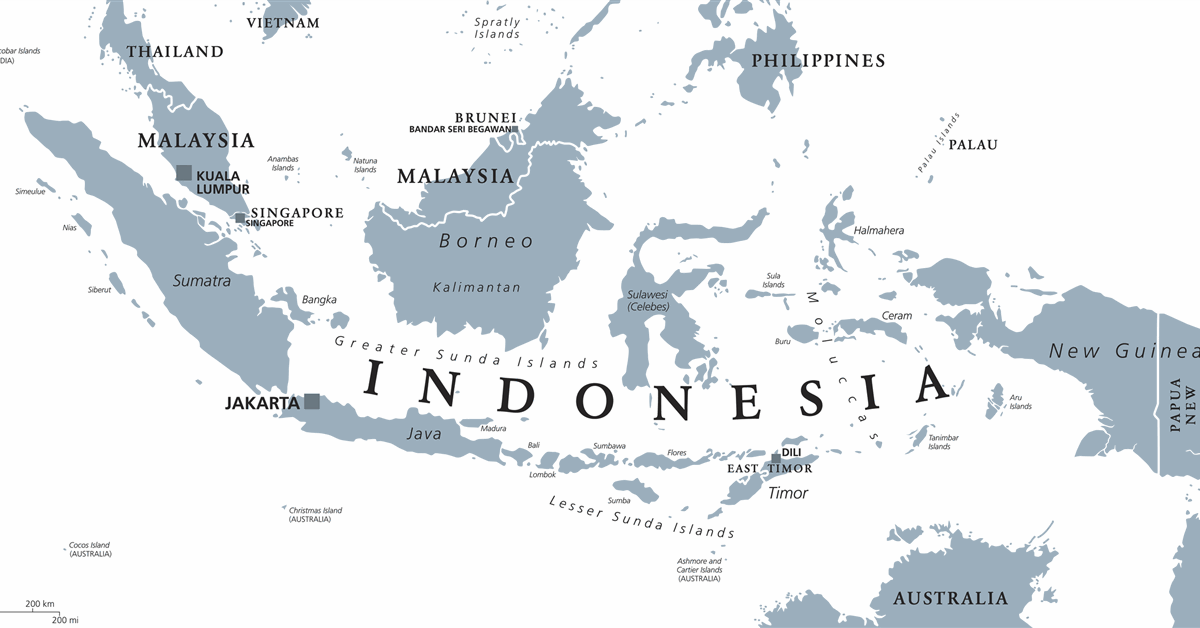

London-based EnQuest PLC said it has won the bidding for two production sharing contracts (PSCs) for the Gaea and Gaea II blocks in Papua Barat, Indonesia, along with its joint venture partners, as announced by the country’s Ministry of Energy and Minerals.

The blocks present unrisked resource potential of multi-trillion standard cubic feet for EnQuest, the company said in a news release.

EnQuest said the award marks its entry into Indonesia, “a country that offers a broad range of growth opportunities that span the full upstream lifecycle”.

The move further expands EnQuest’s Southeast Asian footprint, adding to its growing momentum in the region, after securing an extension to its gas production in Malaysia and signing of an acquisition of Harbour Energy’s Vietnam business, the company said.

Subject to the execution of the PSC, EnQuest will be designated as the PSC operator with a 40 percent working interest, working with its joint venture partners, the Tangguh Joint Venture composed of BP Exploration Indonesia Limited, MI Berau B.V., CNOOC Southeast Asia Limited, ENEOS Xplora Inc., Indonesia Natural Gas Resources Muturi, Inc., KG Wiriagar Petroleum Ltd and PT Agra Energi Indonesia.

2024 Production Report

In its most recent earnings release, Enquest reported 2024 production of 40,736 barrels of oil equivalent per day (boepd), compared to 43,812 boepd in the prior year.

EnQuest Chief Executive Amjad Bseisu said, “The Group delivered another outstanding year of operational performance in 2024, with production efficiency at 90 percent across the asset portfolio, representing a continuation of the excellence that defines our status as a top-quartile operator and expert in late-life asset management. After producing 40.7 Kboed in 2024, year-to-date production from our existing portfolio, as of the end of February 2025, was 43.0 Kboed [excluding Vietnam], tracking ahead of our guidance range of 40–45 Kboed, which includes approximately 5 Kboed of pro forma volumes for Vietnam. Demonstrating our differentiated operational capability across the transition lifecycle, we have continued to consolidate our position as a leading exponent of decommissioning activities, having been responsible for more than 35 percent of the wells plugged and abandoned in the North Sea over the past three years”.

“In recent months, the Group has executed successive material growth transactions across South East Asia, providing geographic and commodity diversification within the portfolio. Our entry into Vietnam, through the Block 12W acquisition, and our increased presence in Malaysia, with the enhancement of our Seligi gas agreement and the DEWA gas development PSC award, are all underpinned by leveraging our differentiated operating capability to create asset value. As EnQuest continues to pursue growth in the UK North Sea and further potential new country entries in South East Asia, these transactions underscore our commitment to growth, a disciplined approach to [mergers and acquisitions], and a strategy to invest capital where we identify the most favorable returns,” Bseisu continued.

“Our foundation for growth is robust and we are well-positioned to transact, with our transaction ready liquidity increasing to [approximately] $550 million at the end of February, following the latest redetermination of the Group’s reserve-based lending facility, which remains fully undrawn. Having consistently delivered against production, operational and cost targets, we have generated material free cash flows across recent years, even during periods of reduced commodity prices. This commitment to delivery, against the backdrop of a challenging fiscal environment in the UK, has seen us reduce EnQuest net debt by more than $1.6 billion since its peak,” he concluded.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR