Enterprise Products Partners LP said some of its affiliates have executed agreements to acquire a natural gas gathering affiliate of Occidental in a debt-free transaction for $580 million in cash.

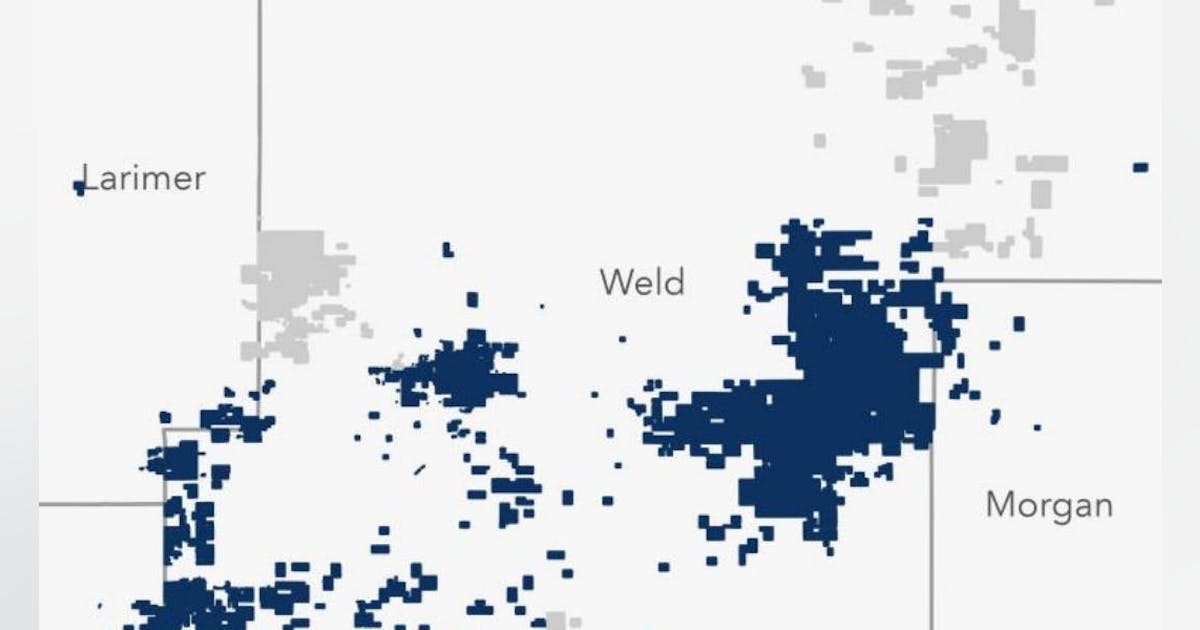

Occidental’s affiliate owns certain natural gas gathering systems in the Midland Basin that include about 200 miles of natural gas gathering pipelines that support Occidental’s production activities, Enterprise said in a news release.

The agreements include a long-term dedication of approximately 73,000 acres across four counties in the Midland Basin, according to the release. Closing of the acquisition is expected in the third quarter, subject to customary regulatory approvals.

With access to more than 1,000 drillable locations, these systems will expand Enterprise’s natural gas gathering footprint in the Midland Basin and “provide long-term development visibility,” the partnership said.

Enterprise said it also plans to build a new Athena natural gas processing plant with the capacity to process 300 million cubic feet per day of natural gas and extract up to 40,000 barrels per day (bpd) of natural gas liquids (NGLs). Athena is expected to begin service during the fourth quarter of 2026, at which time Enterprise’s Midland Basin assets will have the capability to process 2.2 billion cubic feet per day of natural gas and extract 310,000 bpd of NGLs.

The investments in the Athena plant and expansions of Enterprise’s Midland Basin gathering system are included in the company’s estimate of growth capital expenditures of $4.0 billion to $4.5 billion for 2025 and $2.2 billion to $2.5 billion for 2026.

“These agreements with Occidental are consistent with Enterprise’s focus on expanding our Midland Basin franchise through organic investments in our midstream network and through targeted acquisitions that bolt-on to our existing infrastructure,” A.J. Teague, co-CEO of Enterprise’s general partner, said. “To accommodate production growth in this area of the basin, Enterprise will build its ninth Midland Basin natural gas processing plant and expand its natural gas gathering system. The Permian Basin is responsible for approximately 90 percent of domestic liquid hydrocarbons growth and our continued investment in natural gas processing infrastructure supports Enterprise’s producer customers and brings additional volume into the company’s integrated natural gas liquids value chain”.

In a separate statement, Occidental said it signed four agreements to divest select Permian Basin assets, generating approximately $950 million in proceeds to be used for debt reduction.

Between April and July, Occidental said it completed multiple transactions with undisclosed parties totaling approximately $370 million, divesting non-core and select non-operated Permian Basin upstream assets that are not in the company’s near-term development plans.

Along with the Midland Basin divestment to Enterprise, the transactions bring the total divestitures since the December 2023 announcement of the company’s CrownRock acquisition to approximately $4 billion.

Since July 2024, Occidental said it has repaid $7.5 billion of debt, including proceeds from non-core Delaware Basin transactions that closed in April and July, and expects to apply an additional $580 million to debt reduction upon closing of the Midland Basin gas gathering divestiture.

“We are pleased with how we continue to strategically strengthen our portfolio, and it’s rewarding to see those efforts drive debt reduction and create value for shareholders,” Occidental President and CEO Vicki Hollub said. “We believe Occidental has the best assets in our history and we will continue to find opportunities to high-grade our portfolio and generate long-term value”.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR