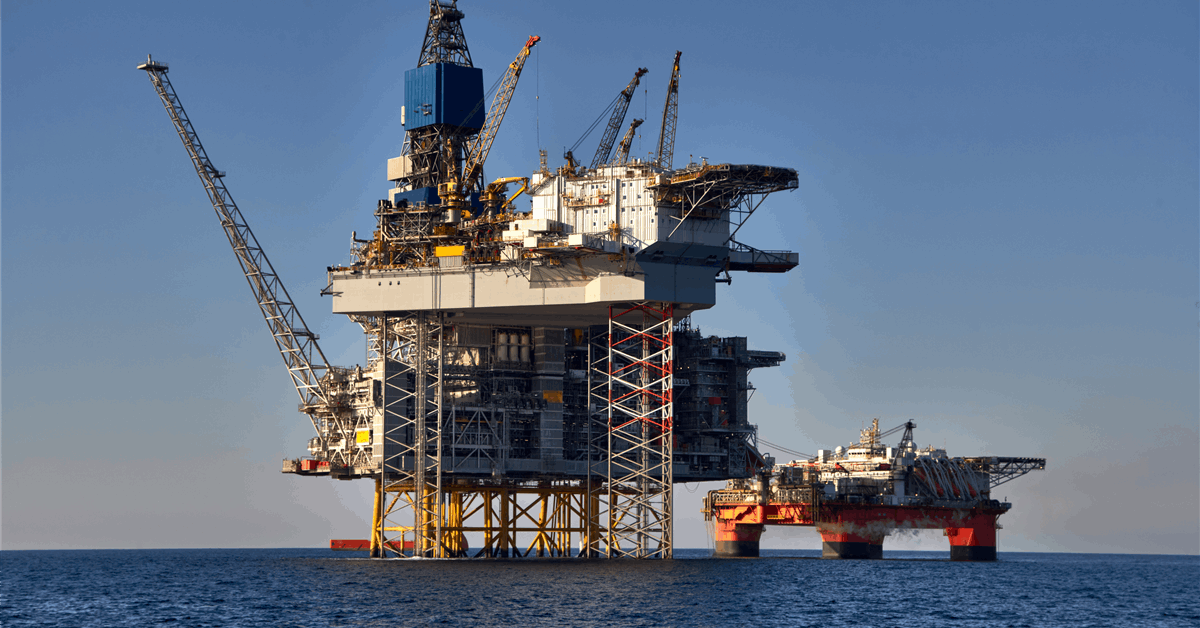

Equinor ASA and its partners have agreed to proceed with the first project to be connected to the Johan Castberg field.

Johan Castberg started production in March as only the third development on Norway’s side of the Barents Sea, according to information on government website Norskpetroleum.no. The other two, Snøhvit and Goliat, came online 2007 and 2016 respectively.

“Recoverable oil in the new subsea development [the Isflak discovery] is estimated at 46 million barrels, and start-up is planned as early as the fourth quarter of 2028”, the Norwegian primarily state-owned company said in an online statement.

Isflak, the first of several discoveries planned to be tied back to Johan Castberg, was discovered 2021. Its development is estimated to cost over NOK 4 billion, according to the statement.

“A rapid development is possible because we can copy standardized solutions from Johan Castberg. The reservoir is in the same license and is similar to the discoveries we have developed previously, which means that we can copy equipment and well solutions. Johan Castberg has been developed as a future hub in the area”, said Equinor senior vice president for project development Trond Bokn.

Equinor said, “The development solution for the Isflak discovery consists of two wells in a new subsea template tied back to existing subsea facilities via pipelines and umbilicals, and all new infrastructure is located within the current Johan Castberg license”.

“Equinor has therefore applied to the Ministry of Energy for confirmation that Equinor has fulfilled the impact assessment obligation and exemption from the requirement for a plan for development and operation”, it said. “Global combustion emissions have been assessed in line with new practice”.

Johan Castberg has raised Norway’s production capacity by up to 220,000 barrels per day, with estimated recoverable volumes of 450-650 million barrels, according to Equinor.

The approved development plan consists of the Skrugard, Havis and Drivis discoveries, proven between 2011 and 2013, according to Norskpetroleum.no.

On June 30, 2025, Equinor announced a new discovery in Johan Castberg. It put preliminary estimates for Drivis Tubåen, or well 7720/7-DD-1H, at 9-15 million barrels of oil. Equinor said then it would evaluate a potential tieback to existing infrastructure at Johan Castberg.

Drivis Tubåen is the 14th exploration well drilled in production license 532, awarded 2009, according to the Norwegian Offshore Directorate. Equinor operates the license with a 46.3 percent stake. Eni SpA-backed Var Energi ASA owns 30 percent. Norway’s state-owned Petoro AS has 23.7 percent.

“We see opportunities to add 250-550 million new recoverable barrels that can be developed and produced over Johan Castberg. The partnership is already planning six new wells for improved oil recovery, and we will explore more in the area”, Grete Birgitte Haaland, Equinor senior vice president for exploration and production North, said in the statement announcing the final investment decision for Isflak.

“Equinor’s ambition is to maintain the production level on the NCS [Norwegian continental shelf] from 2020 until 2035, although production from the current fields will decline”, Haaland noted. “A significant part will come from new wells and projects.

“We are planning about 75 subsea developments in the next few years, and this project is a good example of how this can be done efficiently working closely with license partners and authorities”.

Equinor said in the statement, “The Norwegian continental shelf is changing. Many of the developments in the future are smaller discoveries that can quickly be tied back to existing infrastructure and larger fields”.

“Costs and environmental footprints can thus be reduced, value creation and jobs can be extended and Norway’s role as a reliable and long-term energy supplier can be maintained”, Equinor added.

To contact the author, email [email protected]