Real progress is being made on the report which charts a future for Grangemouth, the deputy first minister has said after oil refining finally ended at the industrial site earlier this week.

Kate Forbes said the end of oil processing at Scotland’s last refinery was a “dark moment” in the country’s industrial history.

However she said Scottish Enterprise has received 66 inquiries related to Project Willow – which plots a future for Grangemouth in low-carbon energy – as well as other activities at the site.

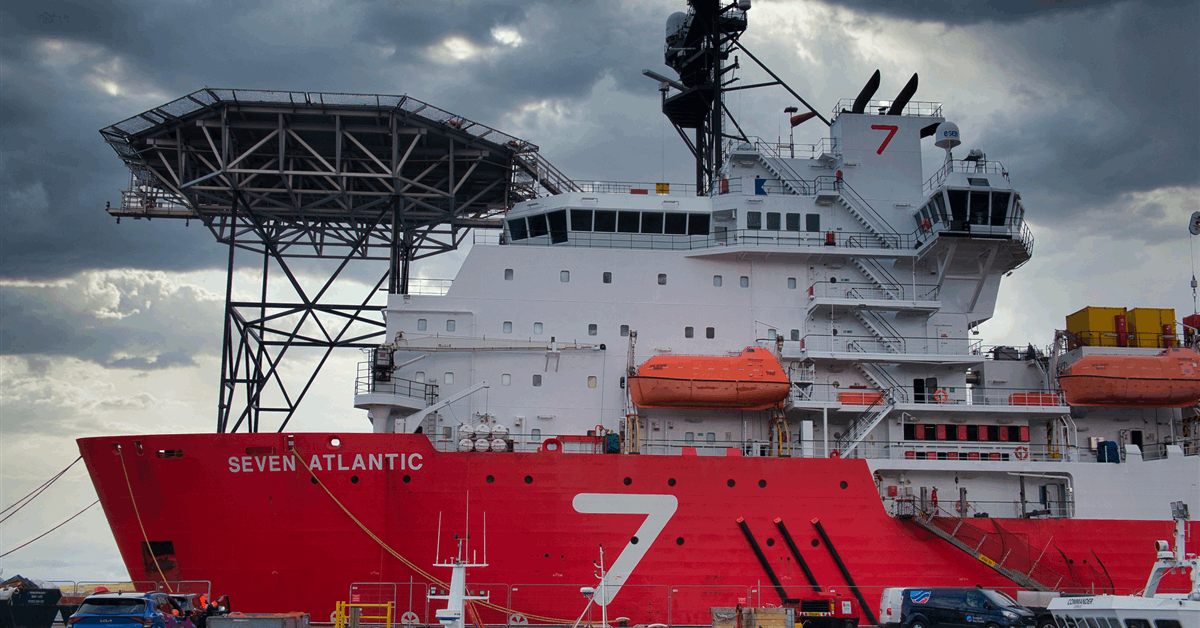

Owners Petroineos confirmed on Tuesday that Grangemouth has now transitioned to become an import terminal for finished fuels rather than an oil refinery.

The company says the refinery, which opened in 1924, is loss-making.

In recent months, hundreds of workers have taken voluntary redundancy while a number of compulsory redundancies have also been made.

Forbes delivered an update on the situation to MSPs on Wednesday.

Both the Scottish and UK governments had commissioned Project Willow to try and preserve jobs at the site.

She said: “Yesterday’s news that Petroineos has now ceased refining at Grangemouth is a devastating blow to Scotland’s economy, the workforce and the local community.

“My thoughts are with all of the workers impacted as they navigate these difficult times.

“Whilst we have anticipated this moment since Petroineos made their decision last September, it is none the less a dark moment in Scotland’s industrial history.

“It is clear that real progress is being made on both the outputs from Project Willow and other associated manufacturing opportunities.

“Scottish Enterprise are dealing with 66 inquiries aligned to both the full range of technologies set out in the report as well as to manufacturing activities carried out across the wider cluster.”

She said the situation is “nothing short of an economic crisis” as she called on the UK government to do more to support investment.

Conservative MSP Stephen Kerr accused Forbes of playing a “constitutional game”, saying the SNP have been hostile to the oil and gas industry.

The deputy first minister said many proposals present “incredible opportunities” for the site.

Labour’s Daniel Johnson said the UK government had pledged £200 million for the future of Grangemouth, saying the SNP had been made aware the refinery was under threat five years ago.

Forbes said the Scottish government had been engaging with Petroineos and has been “actively at work to secure the future of this key industrial asset”.