GB Energy interim chief executive Dan McGrail has said troubled wind farm developer Ørsted has undertaken “one of the most radical corporate transformations” of recent years, but offered no assurances that GB Energy will invest in offshore wind.

“I draw great inspiration from some of the examples in the market,” McGrail said during a fireside chat at the Innovation Zero conference in London last week.

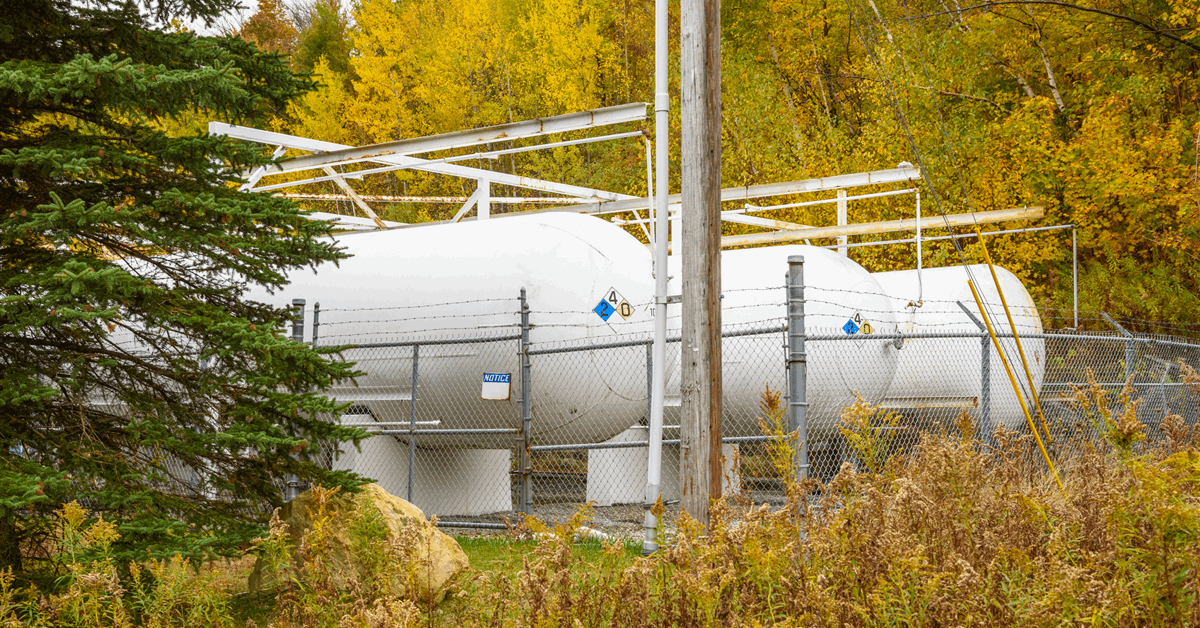

“You look at Ørsted. I know they’ve had perhaps a difficult couple of years, but 15 years ago it was an oil and gas company, and they did one of the most radical corporate transformations in a relatively short period of time.

“It shows what is possible when you have clarity of strategy, that you have alignment of vision and that you build deep capability that helps you unlock markets around the world.”

Fortunes turned around for the Danish wind developer this year after it was forced to make write-downs on its US business, ousted and replaced former CEO Mads Nipper at a critical juncture and cancelled Hornsea 4.

The developer’s shock decision to discontinue the Hornsea 4 wind farm off the coast of East Yorkshire on Wednesday, the largest such project to secure a long-term incentive in the government’s latest allocation round, will test the mettle of the recently formed national energy champion.

Acknowledging some of the wider challenges that Ørsted faces, McGrail gave a nod to the transformative potential of renewable energy.

But the question remains whether, despite McGrail and chair Juergen Maier’s stated intentions, the UK’s new state energy company could invest in the ailing offshore wind farm. The organisation remains small with just a skeleton crew of staff and was granted an £8.3 billion budget by parliament, but that is under review.

And while Maier and McGrail have indicated that GB Energy aims to replicate the successes of European state-backed energy companies such as Vattenfall and Ørsted, which have made the transformation from oil and gas to renewables, its fundamental modus operandi remains distinctly different. This could be problematic in McGrail’s view.

McGrail reiterated what Maier told a parliamentary committee hearing in November – that the fledgling state company GB Energy will seek to take minority stakes in renewable energy projects.

“We’re looking at a number of investment opportunities; the priority is to look at taking equity stakes in projects at the development stage,” he said. “To develop our own projects, but also to come in to work alongside the private sector.”

Swedish developer Vattenfall and Danish energy company Ørsted, which formerly traded under the moniker Danish Oil and Natural Gas (DONG) Energy until 2017, both specialise in large-scale offshore wind projects.

Offshore wind begs the question

Both Maier and McGrail have explicitly said that GB Energy will eschew the now relatively mature offshore wind sector. Instead, GB Energy is likely to favour innovative technologies, such as energy storage or floating offshore wind. The future of how it will operate is, critically, in McGrail’s hands.

“The Vattenfalls and Ørsteds, I think those are particularly the models we’re interested in,” Maier said at a parliamentary hearing in November. “It’s the national champion of the new technology areas.”

He was also clear in differentiating GB Energy’s priorities from that of Ørsted “because Ørsted’s assets are largely in fixed offshore wind”.

“Why would we look to move into that sector when it’s already quite occupied?” Maier said. “So, we are more likely to occupy a space in some of the newer technologies, like floating offshore wind. I’ve already mentioned tidal, large-scale storage etc. But it’s that sort of model that we will approach.”

Maier also said at the November parliamentary hearing that he saw a role for GB Energy to “coalesce” the private sector. He wants to build the company into a “national champion” for energy in the next decade.

He said that any strategic investments it makes must be “in line with us wanting to build that company”. GB Energy will both generate returns on investment, and seek “revenue streams” while investing at arms’ length, he added.

“The investments also have to be in line with the strategic plan that we’re setting out for 2030 and beyond,” Maier said of the nascent state energy company.

He said the company was “interested in taking equity stakes” in key energy projects. This is something McGrail further clarified at Innovation Zero, confirming that these would be minority stakes.

He identified a “massive opportunity” to invest in the UK supply chain in innovative areas, such as digital, drone technology and robotics.

‘In the fullness of time’

McGrail laid out his vision for GB Energy for the next decade, through to the 2030s. He echoed energy secretary Ed Miliband’s aspirations of running a publicly owned and independently operational energy company.

“In order for that to be true, in the fullness of time – and this will come down to strategy and business planning – we need to generate revenue streams and have a portfolio of activity that ultimately mean that we can be a self-sustaining entity and make our own investments,” McGrail said.

He emphasised the role that strategy will play in the nascent energy company, saying it was “formulating strong views” on how to best help the sector, while admitting it must be narrowed down.

Speaking on the sidelines of an event in Westminster in March, McGrail said it was the responsibility of a different government department to take stakes in defunct energy companies. But the withdrawal of Hornsea 4 reduces the secured capacity of that auction by 2.4 GW – more than half of the 5.34 GW awarded.

A state energy company originally capitalised with £8.3bn of government funding would seem the obvious choice to help rescue the ailing project.

McGrail said the UK had a “best-in-class entity” in the Climate Change Committee, advice to the 2040s, and a framework that provides the private sector with a “good degree of insight” that allows businesses to plan.

“It also helps frame and develop comparatively stable policy environments compared to other countries,” he said.

“What industry wants and the only way to deliver the energy transition… is the collaboration with the private sector, and that the private sector delivers the vast majority of the capital.”

McGrail is hoping that the Great British Energy Bill will be rolled out “as soon as possible”. The bill, which seeks to establish GB Energy as a publicly owned company, returned to the House of Lords in April.

GB Energy made its first investment earlier this year in a community solar power project on school and NHS hospital rooftops. McGrail said it has already built a large pipeline of potential projects.

“Ultimately, the appetite is really, really strong. We have a very large pipeline of opportunities… where people are approaching us,” he said.

McGrail said he sees co-investment in projects as another route to market. Collaboration with the private sector and “continuity” on policy is key. He indicated that he might put his hat in the ring for the permanent role, comparing it to being asked if he wants to be the next prime minister.

Crucially, GB Energy still needs to work out “where we are going to go”, without confusing the market.

As McGrail said, GB Energy will ultimately be judged by its actions. In his view, these include job creation, support for the energy transition and stimulation for new factories and ports.