What will 2025 bring for the UK offshore wind sector?

There is wide expectation the UK government will make announcements in coming days and weeks which will be critical to several key offshore wind projects and thus set the tone for the future of the industry here and around the world.

The most hotly anticipated change is that planning rules will be relaxed so that projects facing delays in the consenting process will be eligible to apply for government funding, which would be a revolutionary change in approach.

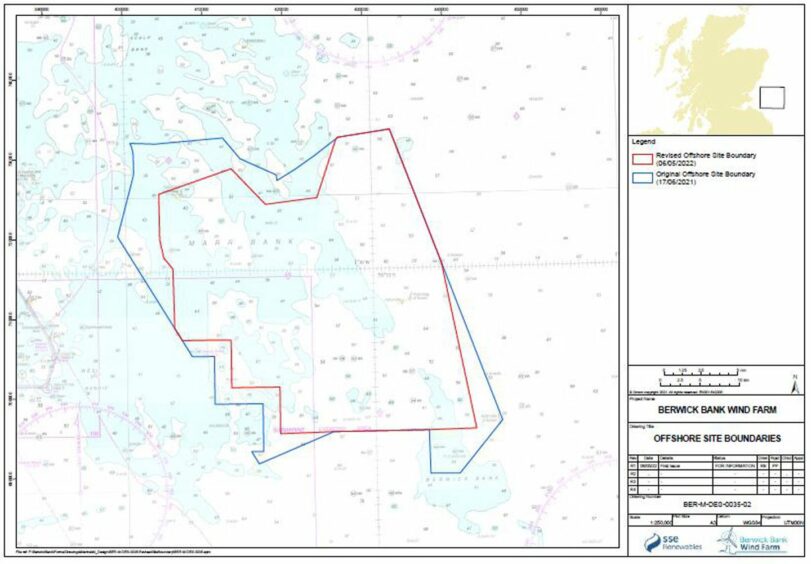

The impact of this for offshore wind mega schemes like Berwick Bank, which has been mired in the Scottish Government planning system, cannot be overstated.

Planning delay means the 4.1GW Berwick Bank scheme missed out on the 2024 funding round, known as AR6. Progress on this key development, which will be the largest in the UK when it’s built, is essential to hopes that the UK and Scotland achieve lofty ambitions to deliver 60 GW of offshore wind by 2030, including 5 GW of production capacity from floating wind.

© Supplied by SSE Renewables

© Supplied by SSE Renewables © Supplied by SSE Renewables

© Supplied by SSE RenewablesFor Adrian de Andres, director for renewables growth at energy consultancy Xodus, this year will be critical for clarity on finance, planning and grid connections for the UK’s offshore wind sector.

“The last 24 months has been tough, 2023 was even tougher,” he says, pointing to a triumvirate of macroeconomic pressures including high inflation, high interest rates, supply chain bottlenecks that have caused delays to several UK wind projects.

“Those three elements basically put a lot of pressure on business cases and a lot of projects that, perhaps before, had a sensible return. But with all of those macroeconomic changes, they no longer had sensible returns.

“So that’s why, in general, the sector has gone through a bit of a slowdown.”

Reasons to be cheerful

However, de Andres says there are reasons to be cheerful in the sector in 2025, especially if interest rates start notching downwards.

“The lower the interest rates, the better for the business cases. The problem for offshore wind is that it is so expensive from a capex perspective, you need to borrow so much money, that a small change on the interest rates has a huge impact on your business case.”

De Andres, who rejoined Xodus in October as director for renewables growth after four and a half years at Ireland-based developer Simply Blue, is hopeful that Sir Keir Starmer’s Labour Government is making the right noises to maintain investor faith in the sector.

“Undoubtedly the new Labour government has strong targets for net zero and they’ve been very vocal about the role that offshore wind can play on that journey to net zero.

“It’s also clear through different goals or policies they are putting forward that they want to enable that happening.”

January will mark three years since the Scottish Government triumphantly unveiled its ScotWind scheme which, along with the smaller innovation and oil and gas (Intog) initiative, enabled 19 offshore wind projects set to deliver over 30GW of capacity, half of the UK’s overall target.

© Shutterstock / Tom Buysse

© Shutterstock / Tom BuysseThe major event on the calendar for several offshore wind projects this year will be the next funding round through the Department for Energy Security and Net Zero’s (DESNZ) announcement of allocation round 7 (AR7).

Funding round delay

Timing for its arrival is uncertain and has been subject to delay. The challenge for government has been ensuring it spends enough cash on the strike price which underpins the contracts for difference (CFD) mechanism needed to secure billions of pounds of private investment while also delivering on promises to consumers the energy produced will be affordable.

Before AR7 can be unveiled, government has promised to deliver details of the clean industry bonus.

This will affect the funding criteria which are expected to support more innovative and complex schemes, but which will ultimately be more expensive for government as well as energy users.

“If the CFD is a bit later, there may be more projects that have secured consent and that are available to feed into the CFD round. At the moment, it’s difficult to predict,” says de Andres.

In the run up to Christmas, investment sentiment in UK offshore wind started seeing shifts – particularly from oil and gas majors.

For example, BP hived off its UK offshore wind portfolio into a “capital light” joint venture with Jera, Japan’s largest power generation company, in a move to address rising fears the sector is vast money pit with risky returns.

© BP

© BPDe Andres describes recent energy industry investment trends in the burgeoning offshore wind sector as the “FOMO”, or the “fear of missing out”, years. Increasingly, traditional energy boards are taking different approaches to risk profiles, with some placing more emphasis on the oil and gas assets they know will meet shareholder expectations.

Oil and gas ‘FOMO’

“Because of the macroeconomic conditions, interest rates being extremely low, there was an over-excitement in general for offshore wind,” he says of the “FOMO years”.

“Now that the conditions are a bit tougher, I think all parties, from oil and gas companies, utilities and developers, have realised that investment cases are tough.

“It’s expensive. You need to expense quite a lot of capital for quite a long time. Those periods of return are quite long.

“I think every company has realised this over the last two years, and different companies are taking different strategies.”

However, he believes oil and gas businesses will continue to focus on offshore wind.

“At the end of the day, every company has shareholders on top, and they need returns.

“But what we have seen with some of the oil and gas players is that they have perhaps put more emphasis on their traditional assets, and that has probably been because of pressure on short-term returns.

“That doesn’t mean they won’t do renewables. I think they will keep doing renewables. But everything in energy goes in cycles.”

One ray of sunshine hoped for in 2025 is the light of clarity on the UK’s £8.3 billion plan for Great British Energy. Although, as with most industry specialists, de Andre eagerly anticipates more detail on what its role will be.

GB’s cluttered landscape

Part of the murk around the government-backed initiative is due to how the UK is becoming a cluttered landscape of public sector bodies involved in delivering the transition to a clean, decarbonised energy system. This includes the newly privatised National Energy System Operator (NESO) as well as the bodies that are instrumental to licencing, planning and funding green energy projects, from the Crown Estate, the Crown Estate Scotland, to Mission Control, to the National Wealth Fund – and last but not least, GB Energy.

“GB energy, as with everything, the devil is in the detail,” says de Andres. “We need to wait for that detail. What has been outlined is the different roles that GB Energy could take, as an investor, potentially as a developer, also as an enabler.

“I’m aware that there’s a lot of discussion going on between government and GB Energy and the industry, and a lot of feedback happening there. So we need to see exactly where that lands.”

In principle, however, he believes GB Energy will overall be positive for the offshore wind sector, but he is also concerned that there should be “no overlap with other public bodies”.

He adds: “The landscape of public bodies is quite significant. It is important that role is clarified so that everyone understands who does what, exactly.

“We also have, for instance, the national wealth fund that has been created recently. But we need to understand basically who is doing what. I think will get to that detail within the next six months for sure.”

© Supplied by National Grid

© Supplied by National GridMeanwhile, Britain needs to deliver the biggest upgrade to the grid since the 1950s. The private sector National Grid (LON:NG) recently unveiled “unprecedented” plans to invest £35 billion in its electricity-transmission business over the five years to March 2031, supported by public sector NESO, which recently confirmed UK government’s mission to decarbonise the electricity grid by 2030 is “achievable”.

Staggered connection to grid

NESO will be responsible for ensuring how and when offshore wind projects will be connected.

Currently the timeline for projects connecting to the grid is being updated, which means more uncertainty for investors.

“At the moment, if you check the connection register, there’s loads of connections on the same precise date,” says de Andres.

“Over the next six months, we are going to see that landscape in terms of updating those connections and seeing when exactly they fall.”

He added: “NESO’s task is not easy. There’s a lot of gigawatts to be connected. And not only that, you need to transport a lot of that energy from north to south. So the level of infrastructure building that needs to happen over the next eight to 10 years is absolutely amazing.

“Those connection dates are going to be very important for projects, because for the last couple of years, there has been a bit of uncertainty.

“From a development point of view, there’s only so much that you can invest before you know when the end goal is.

“That connection date is, of course, going to drive your FID (financial investment decision) date, but it’s also going to drive when you will apply for CFD.

“Having that security on those connections is going to be absolutely fundamental to project programs and basically the level of activity that projects do over the next few years.”

Perhaps the biggest question is whether 2025 will also deliver a much-needed dose of reality to the sector. Many project developers are clinging to what is increasingly being seen as fantastical deadlines in order to meet the government’s net zero targets, although many will privately admit many are “shifting right”.

De Andres expects realistic deadlines to start “staggering” in the run up to 2030 and 2035 target dates.

He says: “There’s a reality that for a lot of those projects to be connected, there needs to be significant reinforcement onshore and significant interconnectors built.

“Those pieces of infrastructure will drive grid connections. Of course, there will be some that will be pre-2030 and there will be others that will be by 2035.

“But I think what we are going to see is a staggering.

“You cannot get 30GW complete by the first of December of 2030. That will not happen.”

Time to act is now

What would he like to see happen in the sector in 2025?

“There has been a lot of talking over the last few years. I think it’s the moment to act in 2025.

“If I had a magic wand, then I would have all projects in the UK given sensible grid connection dates. I would then also have visibility over CFDs, both in terms of requirements, but also volumes and budget. And perhaps, if I could have that visibility, not only over the next year, but over the next two or three years, I think that will definitely be very important for investors.

“And then, of course permitting timelines. At the moment, we are looking at commitment of about nine to 12 months from regulators normally.

“Trying to stick to those timelines will be important for developers. Waiting is expensive for development.”

Recommended for you

What would zonal electricity pricing mean for Scotland?