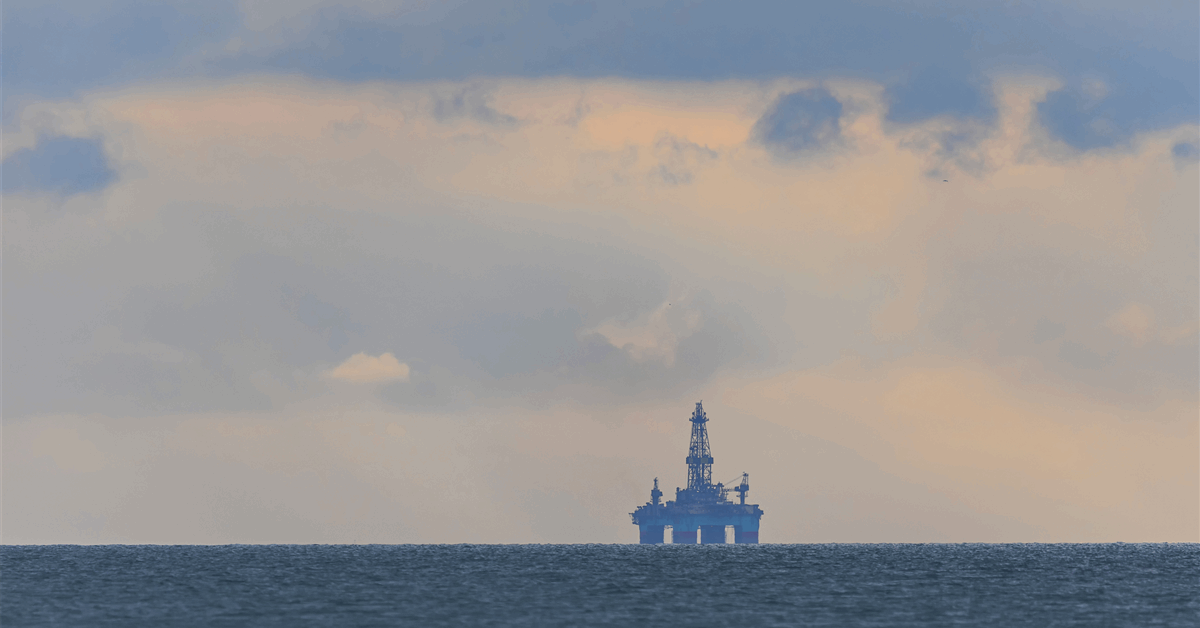

The Marula-1X well in Block 2913B (Petroleum Exploration License 56) offshore Namibia has turned up dry after a drilling campaign that reached a total depth of 6,460 meters (21,195 feet). Africa Oil Corp. said that the well targeted Albian-aged sandstones within the Marula fan complex, some 47 kilometers (29.2 miles) south of the Venus-1X well.

The well was drilled by the Deepsea Mira semi-submersible drilling rig, Africa Oil said in a media release. A comprehensive analysis of the well results is now underway. The well will now be demobilized.

Impact Oil & Gas Ltd. has a 9.5 percent interest in Blocks 2912 and 2913B in Namibia’s Orange Basin. Africa Oil, through its 39.5 percent interest in Impact, has an effective interest of approximately 3.8 percent in these blocks. Block 2913B contains the Venus light oil discovery.

Block 2913B spans about 8,215 square kilometers (3171 square miles) with water depths reaching 3,000 meters (9842 feet). Impact became the Operator of the license in 2014, initially acquiring 2D seismic data followed by 3D seismic data, which delineated the Venus prospect. In 2017, TotalEnergies joined Impact and Namcor, contributing deep-water drilling expertise to the joint venture. In 2019, QatarEnergy became part of the joint venture.

“The farm-down agreement between Impact and TotalEnergies that was completed last year provides full carry of Impact’s exploration and development costs on Blocks 2912 and 2913B through to first commercial production from these blocks. This presents us with an attractive opportunity set to test different geological plays on these blocks at no upfront cost”, Africa Oil President and CEO Roger Tucker said.

“The initial data from the Marula-1X well confirms a disappointing outcome for the Marula prospect. However, the full suite of well data acquired will be integrated into the evaluation to realize the block’s full potential”, Siraj Ahmed, Chief Executive Officer of Impact, said.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR