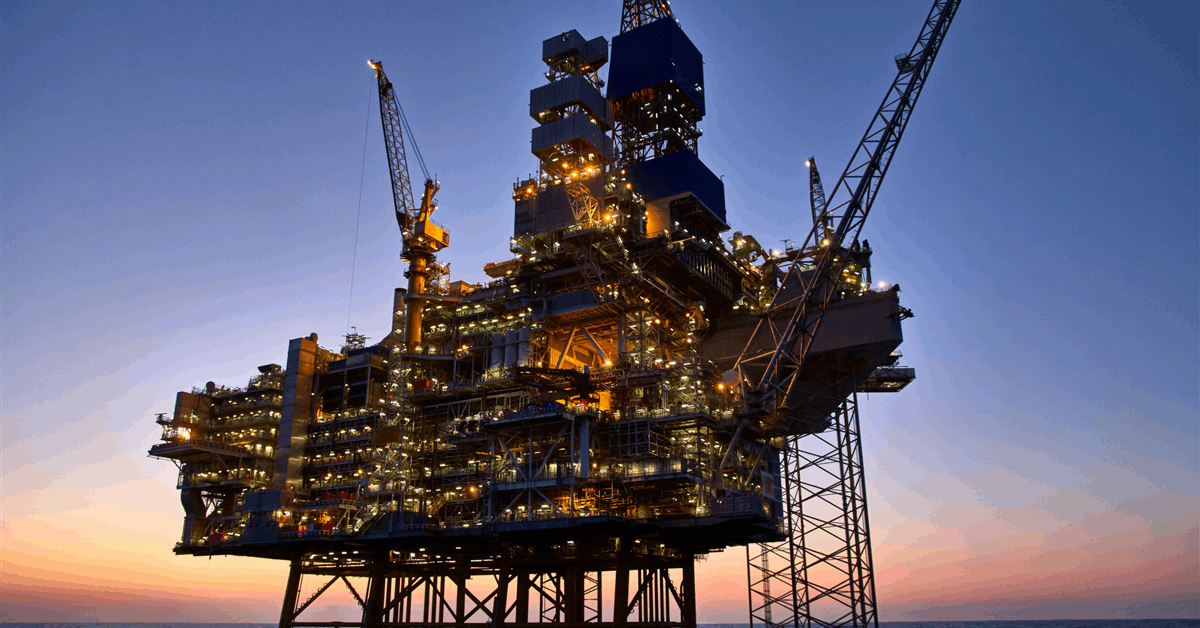

Monumental Energy Corp said Wednesday it has agreed to fund New Zealand Energy Corp’s (NZEC) share of workover costs to restart flows at several wells in the Waihapa/Ngaere field in the onshore Taranaki basin.

“These workovers will follow the same royalty structure as that established for the successful Copper Moki programs, whereas Monumental will earn a 25 percent royalty on NZEC’s production share after full recovery of its capital investment, which will be repaid from 75 percent of NZEC’s net revenue interest”, Vancouver, Canada-based Monumental said in a press release. Monumental is a shareholder in NZEC.

L&M Energy will shoulder the remaining part as NZEC’s equal partner in the campaign, Monumental said.

The workovers involve the Waihapa-H1 well and the Ngaere 1, 2, and 3 wells.

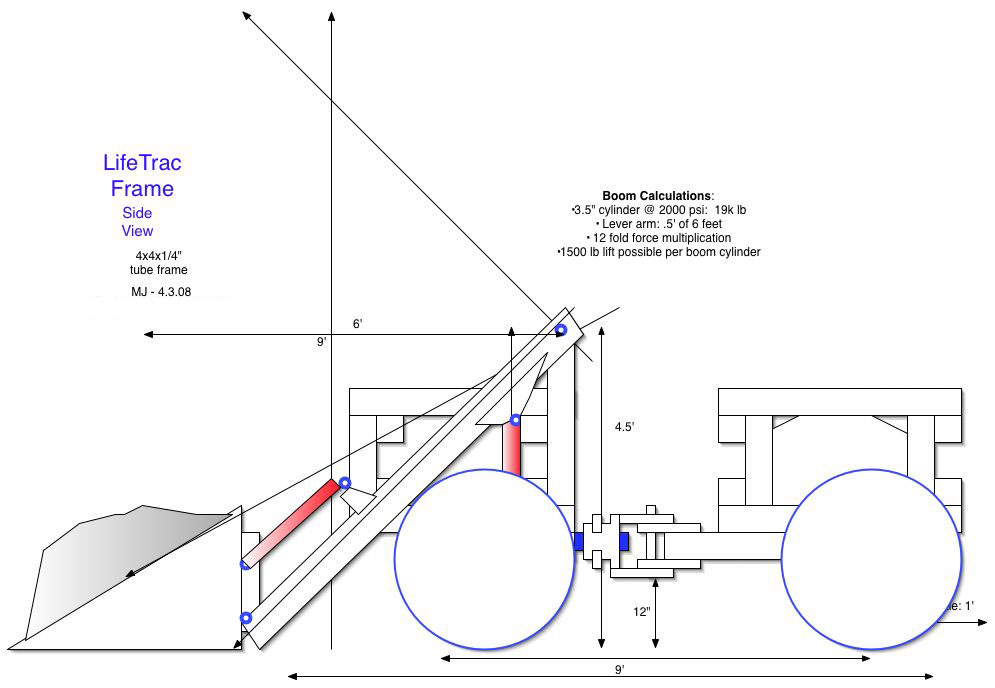

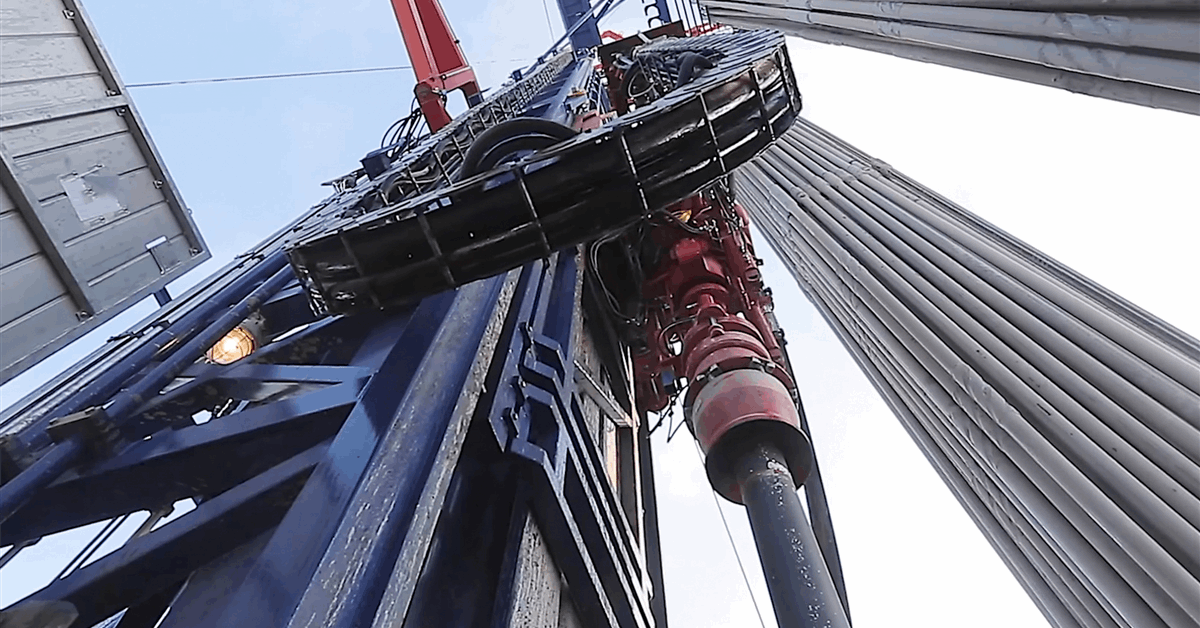

“The Waihapa-H1 well, drilled in the early 2000s, initially flowed oil at rates of approximately 1,500 barrels per day from fracture porosity within the Tikorangi horizontal section”, Monumental said. “Production ceased due to a collapse in the upper section of the wellbore.

“A workover program proposed to return the well to production includes jetting clean-out and the installation of new tubing. The well site is located approximately 600 meters from, and easily connected to, the Waihapa production facility.

“The Ngaere 1, 2, and 3 wells historically produced oil from the Tikorangi Formation. However, a review of electric logs and drilling data has identified multiple shallower, hydrocarbon-charged sand intervals in each well that present opportunities for additional oil and gas production. A field redevelopment program has been designed to access and produce these bypassed pay zones.

“The steel casing in each well will be perforated at the target intervals, followed by production testing. All three wells are connected via existing pipelines to the Waihapa production and export facilities, allowing for immediate oil and gas sales upon successful completion.

“In the event of success, anticipated flow rates per well are expected to range from the tens to low hundreds of barrels of oil per day”.

Monumental vice president for corporate development and director Max Sali said, “This participation represents the continued advancement of Monumental’s strategy to generate non-dilutive, cash-flow-generating opportunities through partnerships in proven production assets”.

In late July Monumental restarted production at the Copper Moki-1 well, marking the completion of its workover campaign in Taranaki’s Copper Moki field with the earlier reactivation of Copper Moki-2, according to announcements by the company.

It said in an update August 19, “Both Copper Moki-1 and Copper Moki-2 have been onstream for almost a month delivering a combined production rate of approximately 125 barrels of oil per day. These rates continue to trend upward as pump speeds are gradually increased to optimize flow while preventing sand from entering the borehole”.

“In addition to oil production, both wells are now exporting associated gas to the neighboring Waihapa Production Station for processing and sale”, Monumental added.

Copper Moki started production 2011. Flows halted 2022, according to data from New Zealand’s Business, Innovation and Employment Ministry.

Monumental noted in the update, “At the time of the original drill program at Copper Moki, New Zealand faced a gas surplus, and the field remained isolated from the gas network. Today, the field has been fully integrated into the gas infrastructure, presenting a meaningful revenue opportunity that was previously unavailable”.

“CM-1 and CM-2 were originally shut-in due to mechanical issues over time, rather than any reservoir-related concerns. The wells required only standard maintenance, and equipment upgrades to resume production”, Monumental added.

Last year Monumental agreed to fund the workovers in NZEC’s Copper Moki. Monumental is entitled to 75 percent of revenue, net of production costs, until its investment is recovered. Afterward, it will receive a 25 percent net revenue interest or royalty in the permit, according to NZEC’s announcement of the deal October 28, 2024.

To contact the author, email [email protected]