Tax savings worth hundreds of millions for North Sea oil and gas companies are the “main driver” of deals like Repsol and Neo Energy.

CMS partner Norman Wisely, who worked on the tie-up between Repsol and Neo, said the firms could save “hundreds of millions in tax” following the deal.

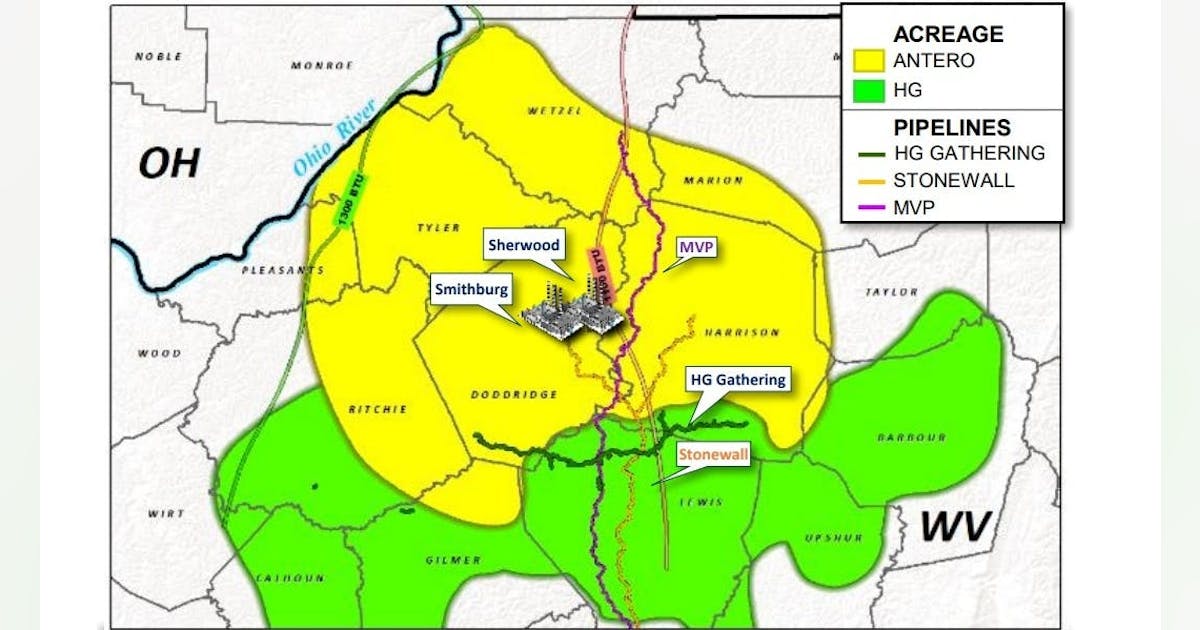

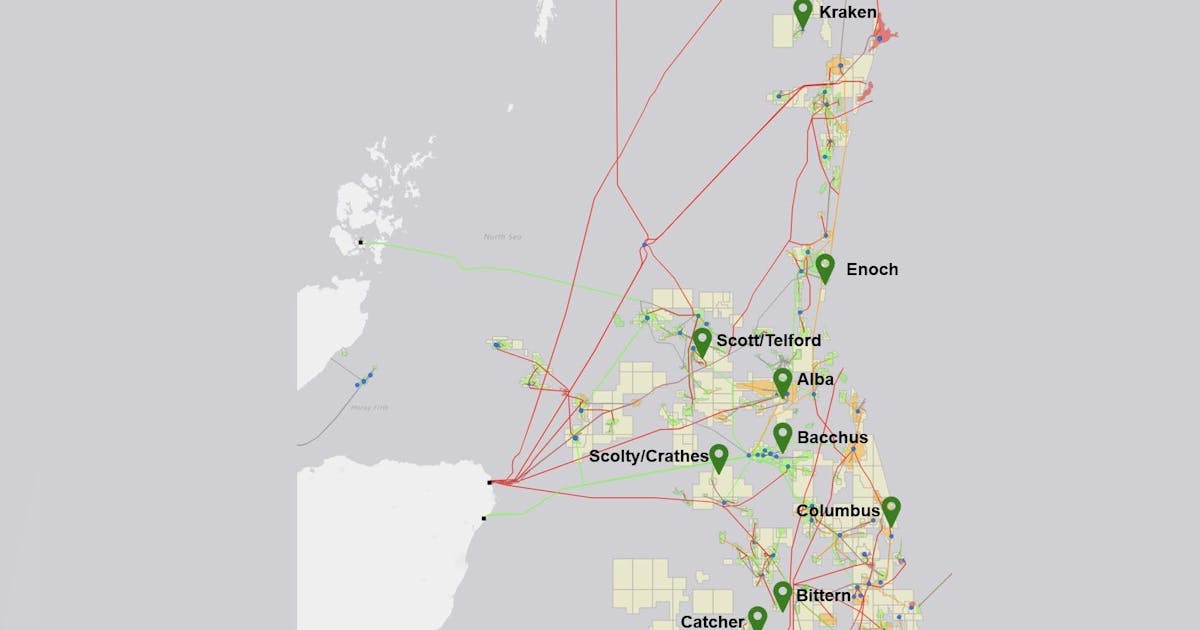

The two businesses will combine their North Sea oil and gas producing assets, with Neo claiming 55% ownership of the new Neo Next Energy, while Repsol takes ownership of the remaining 45% stake.

As the Spanish energy giant retains $1.8 billion in decommissioning liability, the Aberdeen-based operator stands to gain, Wisely explained.

Meanwhile, the Madrid-headquartered company will no longer have to report carbon emissions from the North Sea in the same way, due to having relinquished its status as an operator to that of a minority shareholder in the firm, which is expected to have a combined production of more than 130,000 boe/d this year.

Wisely explained the structure of the deal means the new entity will be able to take advantage of tax relief on the costs associated with decommissioning ageing North Sea rigs and infrastructure.

Decom discounts

Repsol is thought to have one of the largest decommissioning liability portfolios in the North Sea, including the Fulmar, Saltire and Tartan platforms.

The combined group will target “synergies” from the combination worth over $1 billion, a law firm acting for Repsol has said.

Slaughter and May, which acted for Repsol‘s E&P division that will own the stake in the new North Sea business, said the Spanish firm will commit to spend up to $1.8bn, which represents around 40% of the decommissioning liabilities.

“Repsol will retain $1.8bn of decom liability. So that is a debt effectively that is being paid into the company [Neo Next],” Wisely told Energy Voice.

© Ryan Duff/DCT Media

© Ryan Duff/DCT MediaHe added it is the joint venture Neo Next “that would be actually spending the cash and therefore it would be the entity that’s entitled to tax relief off the back of that|”.

The $1.8bn being stumped up by Repsol for decommissioning does not cover all of the firm’s ageing North Sea assets. Following the combination, both firms will spread the cost based on their ownership stake.

Wisely added that there are “a lot of tax synergies between the two companies” which made the deal appealing.

“I think they reckon that it’s going to see them around, potentially, hundreds of millions in tax by combining the two entities.

“So, that’s one of the main drivers for the deal.”

A deal to benefit both parties

Businesses that have made losses on assets or invested in decommissioning stand to receive tax relief, which “are beneficial to the other party” in a tie-up, the CMS partner explained.

He added the “tax synergy” included deploying historic losses against profits.

“Presumably one of the companies was making money and needed to sort of shelter the losses.”

The Spanish energy giant also stands to gain from holding less than 50% of the new UK entity as it will not be required to report emissions from the country.

© Supplied by DC Thomson

© Supplied by DC Thomson“Like many oil and gas companies, you know, as soon as you drop below sort of 50% shareholding you don’t have to account for or report carbon emissions and things like that,” Wisley continued.

“So, it makes sense to financially invest – if you’re Repsol – into an oil and gas company without them having to account for carbon emissions and things like that.

“From an ESG perspective, it kind of makes sense for oil companies to do that.”

‘A company that actually does quite a lot in the UK’

The Norwegian private equity-backed Neo Energy has slammed the breaks on its Buchan development due to the UK’s political and fiscal climate, however, Neo Next may be unlocking further investment.

When asked about Buchan, Wisely said: “I think the only thing I probably could say is that, from my understanding, this is going to be a company that actually does quite a lot in the UK.

“So, it’s not just going to sit there with existing production and things like that.

“I think there’ll be further mergers, acquisitions, field developments and things like that.”

As a result, people are “excited” to be involved in the upcoming Neo Next, Wisely he added.

The combination follows a trend in the North Sea of operators combining assets to shelter from high tax bills and reduce risk of further UK investment.