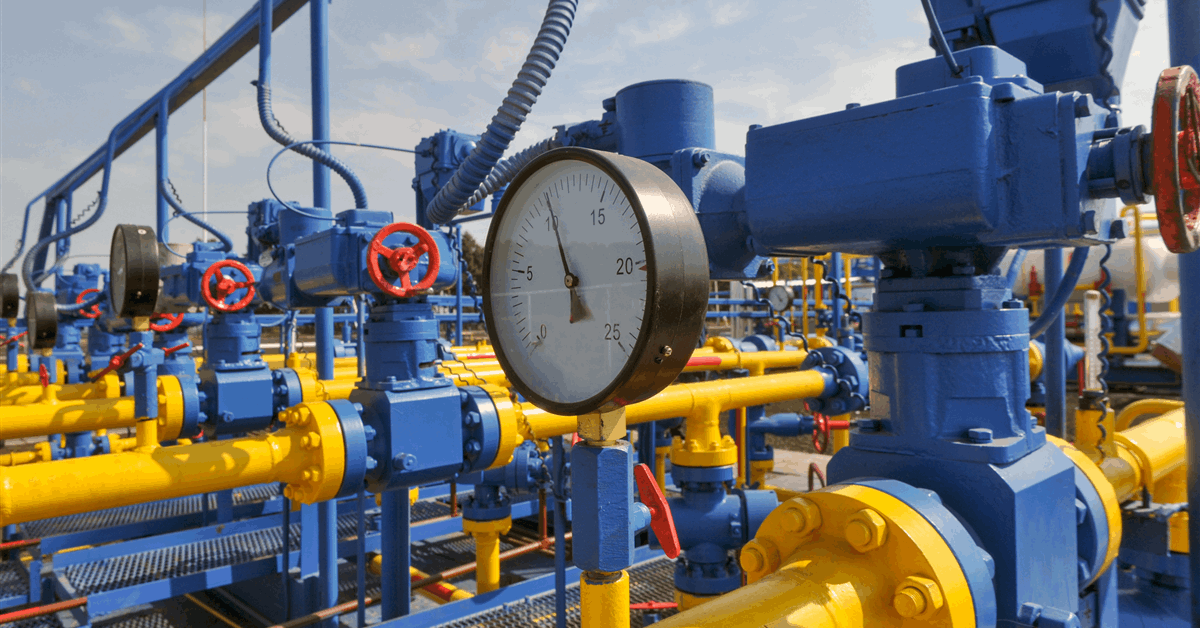

The first ship in a 30 billion-kroner ($2.7 billion) plan to store emissions under the North Sea arrived in Norway as the country seeks to transform nascent carbon-capture technology into a commercial business.

The Northern Pioneer will be one of four vessels transporting waste carbon dioxide from industrial sites to a storage facility outside Bergen. From there, the gas will be pumped into a saline aquifer more than a mile below the seabed.

The so-called Longship project is due to be the world’s first large-scale carbon capture and storage hub for industrial emissions. Countries across Europe — most notably Germany but also Nordic nations — are betting on CCS to clean up polluting sectors such as cement, fertilizers and steel. Yet the technology is complex and costly, and remains largely at the demonstration phase.

Norway has sought to position itself as a leader in the space, committing billions in public funding to the Longship venture, and the project is an important test of what’s feasible.

The ship can carry as much as 8,000 tons of fluid carbon dioxide.

The Northern Pioneer, which was built in Dalian, China, is powered primarily by liquefied natural gas. It can carry as much as 8,000 tons of fluid carbon dioxide, according to owner Northern Lights, a joint venture split between oil companies Equinor ASA, Shell Plc and TotalEnergies SE.

A Heidelberg Materials AG cement plant south of Oslo is set to begin capturing waste carbon toward the middle of the year. It’ll be the first customer of the Northern Lights’ project, whose first phase is due to inject and store as much as 1.5 million tons of CO2 a year.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg