But the concern for enterprise IT leaders is whether Nvidia’s financial stakes in UALink consortium members could influence the development of an open standard specifically designed to compete with Nvidia’s proprietary technology and to give enterprises more choices in the datacenter. Organizations planning major AI infrastructure investments view such open standards as critical to avoiding vendor lock-in and maintaining competitive pricing.

“This does put more pressure on UALink since Intel is also a member and also took investment from Nvidia,” Sag said.

UALink and Synopsys’s critical role

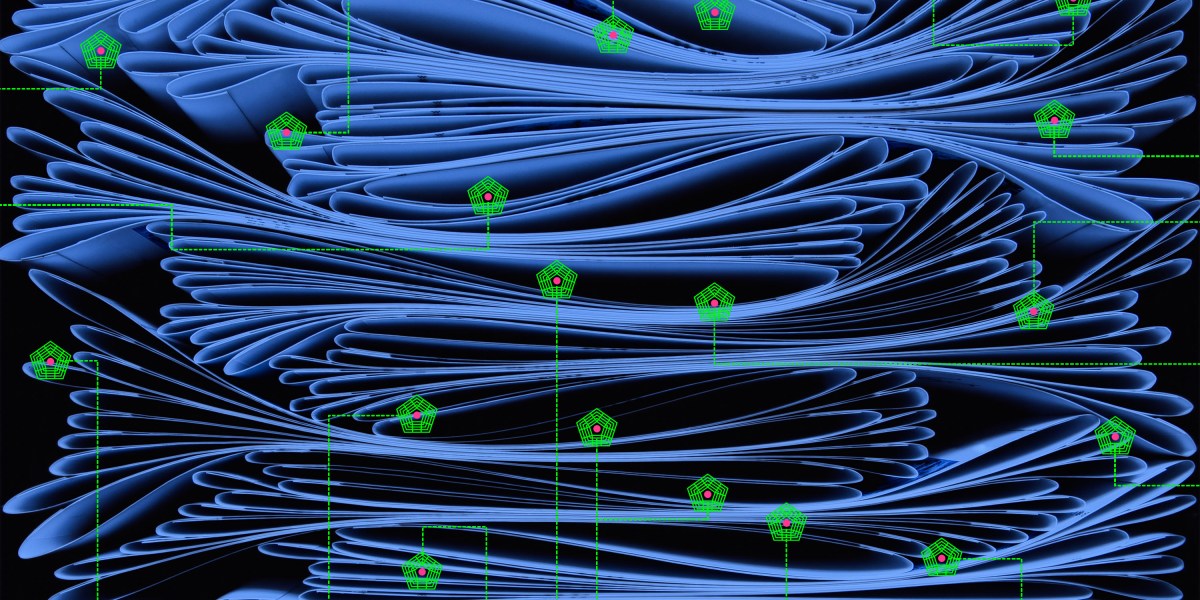

UALink represents the industry’s most significant effort to prevent vendor lock-in for AI infrastructure. The consortium ratified its UALink 200G 1.0 Specification in April, defining an open standard for connecting up to 1,024 AI accelerators within computing pods at 200 Gbps per lane — directly competing with Nvidia’s NVLink for scale-up applications.

Synopsys plays a critical role. The company joined UALink’s board in January and in December announced the industry’s first UALink design components, enabling chip designers to build UALink-compatible accelerators.

Analysts flag governance concerns

Gaurav Gupta, VP analyst at Gartner, acknowledged the tension. “The Nvidia-Synopsys deal does raise questions around the future of UALink as Synopsys is a key partner of the consortium and holds critical IP for UALink, which competes with Nvidia’s proprietary NVLink,” he said.

Sanchit Vir Gogia, chief analyst at Greyhound Research, sees deeper structural concerns. “Synopsys is not a peripheral player in this standard; it is the primary supplier of UALink IP and a board member within the UALink Consortium,” he said. “Nvidia’s entry into Synopsys’ shareholder structure risks contaminating that neutrality.”