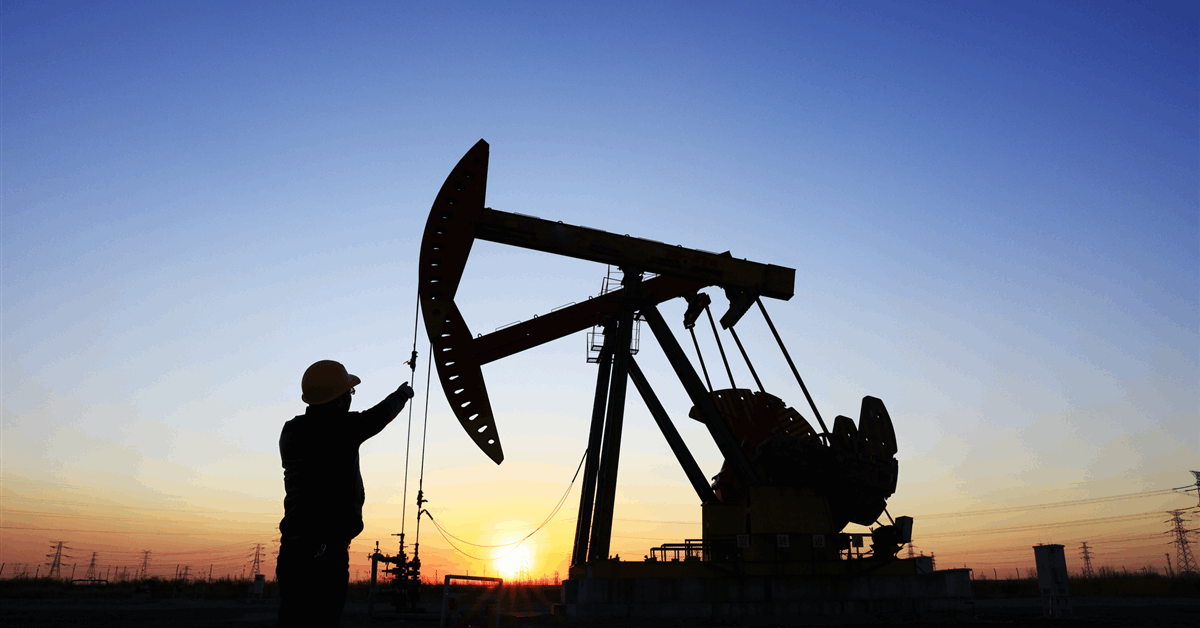

Pembina Pipeline Corp said Monday it had signed a 12-year agreement allowing Ovintiv Inc to use 0.5 million tonnes per annum (MMtpa) of liquefaction capacity at the under-construction Cedar LNG on Canada’s West Coast.

“Pembina has now remarketed the full 1.5 mtpa [million tonnes per annum] of its Cedar LNG capacity to third parties and further demonstrated its commitment to delivering growth and executing its strategy within the company’s long-standing financial guardrails and prudent risk profile”, Calgary-based Pembina said in an online statement.

It owns 49.9 percent in the project. The Haisla Nation, who host Cedar LNG on tribal territory, holds 50.1 percent. According to the developers, Cedar LNG is the world’s first liquefied natural gas facility primarily owned by Indigenous people.

Expected to start operation 2028, the project has a declared capacity of 3.3 MMtpa.

“The agreement enables the export of 0.5 mtpa of LNG, under which Pembina will provide transportation and liquefaction capacity to Ovintiv over a 12-year term, commencing with commercial operations at Cedar LNG, anticipated in late 2028”, Denver, Colorado-based Ovintiv said separately.

“It provides Ovintiv, one of Canada’s largest natural gas producers, with access to additional export markets, complementary to the company’s existing portfolio of natural gas transportation arrangements. Export from the west coast of Canada offers the shortest shipping distance to Asian LNG markets from North America”.

Meghan Eilers, midstream and marketing executive vice president at Ovintiv, said, “Today’s announcement marks a significant advancement in our strategy to expand market access and maximize the profitability of our Montney gas resource through participation in global LNG markets”.

Pembina senior vice president and corporate development officer Stu Taylor said, “Ovintiv is a significant customer to Pembina across our natural gas processing and transportation, and NGL transportation, fractionation and marketing businesses”.

Pembina added in its statement, in which it also announced a capital investment projection of CAD 1.6 billion ($1.16 billion) for 2026, “Pembina has revised its expectation for the annual run-rate adjusted EBITDA contribution from Cedar LNG to US$220 million to US$280 million, net to Pembina. This range is comprised of low-risk, long-term, take-or-pay cash flows on Cedar LNG’s base contracted capacity of 3.0 mtpa, together with potential incremental cargos of up to 0.3 mtpa, and additional upside participation under certain commodity price scenarios”.

“The revised range reflects an approximately 10 percent increase in the base contribution from the 3.0 mtpa of contracted capacity, compared to Pembina’s estimate when the project was originally sanctioned. Further, the revised range represents a higher base level of secured cash flow and incremental upside participation without commodity downside risk”, Pembina said.

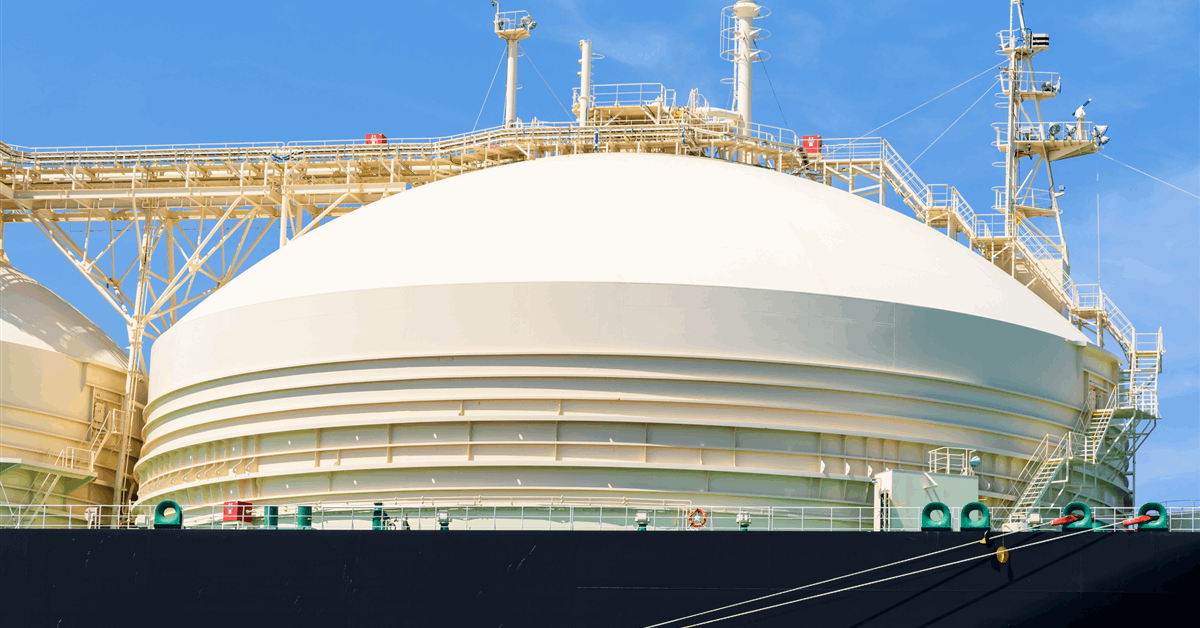

Construction of the project’s floating LNG vessel was nearly 30 percent complete at the end of last month, according to Pembina.

Pembina and the Haisla Nation reached a final investment decision on Cedar LNG last year, earmarking around $4 billion, as announced June 25, 2024.

Recently Pembina signed a 20-year agreement allowing Petroliam Nasional Bhd (Petronas) to use one MMtpa of liquefaction capacity at Cedar LNG.

“The agreement is a synthetic liquefaction service structure for 1.0 mtpa of capacity, under which Pembina will provide transportation and liquefaction capacity to Petronas LNG Ltd over a 20-year term”, said a joint statement November 5.

“It enables Petronas to access an additional natural gas export outlet for its sizeable Canadian upstream investment, while providing Pembina with a stable long-term, take-or-pay revenue stream and the potential for value enhancement”.

Earlier this year Petronas shipped its first share from the Shell PLC majority-owned LNG Canada project, as announced by the Malaysian state-owned oil and gas company July 7. Petronas owns 25 percent in LNG Canada, which has a declared capacity of 14 MMtpa. Like Cedar LNG, LNG Canada is in Kitimat, British Columbia.

Cedar LNG has also secured a 20-year agreement for take-or-pay liquefaction tolling services with Calgary-based ARC Resources Ltd for 1.5 MMtpa.

On March 11, 2025, ARC said it had signed an agreement committing 100 percent of its offtake from Cedar LNG to Exxon Mobil Corp.

To contact the author, email [email protected]