PetroChina Company Limited has reported a revenue of RMB 753.11 billion ($103.5 billion) for the first quarter, with a net income of RMB 46.81 billion ($6.4 billion), up 2.3 percent year-on-year.

The company said in a media release that it sustained growth in oil and gas output while bolstering momentum in new energies. It said it enhanced cost management in oil and gas production, as well as improved the structure of its overseas assets.

Oil and gas output rose 0.7 percent year-on-year to 467 million barrels of oil equivalent (MMboe). Domestic production rose 1.2 percent year-on-year to 418 MMboe.

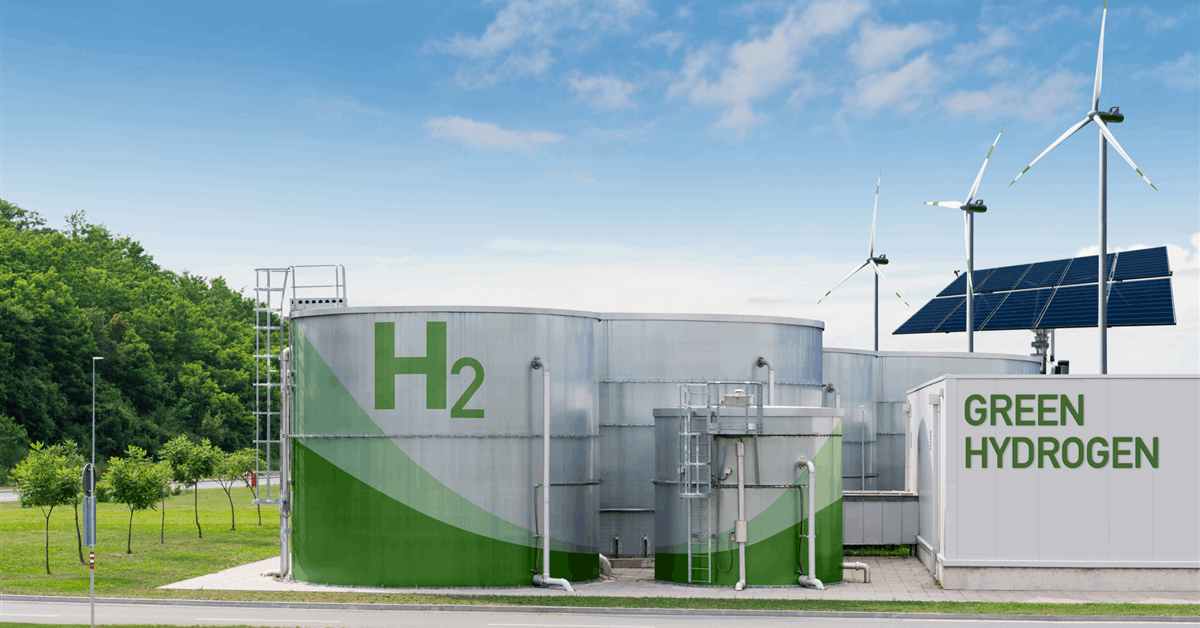

Wind and solar power generation grew 94.6 percent to 1.68 billion kilowatt-hours.

The oil, gas, and new energies business reported an operating profit of RMB 46.09 billion ($6.3 billion). The company responded to market demand by advancing refining and chemical upgrades, optimizing production plans, and focusing on specialty refined products and new materials to boost high-value-added product sales, it said.

The company said it is advancing its refining and chemical operations with key projects Jilin and Guangxi Petrochemical, and Dushanzi Petrochemical Tarim Ethane-to-Ethylene.

In Q1 2025, it processed 337 million barrels of crude oil, with refined product output at 28.57 million tons. Ethylene output reached 2.27 million tons, chemical commodities totaled 9.96 million tons, and new materials surged by 37.5 percent year-on-year to 0.80 million tons.

The company’s chemicals and new materials business generated an operating profit of RMB 5.39 billion ($741.2 million), supported by improved marketing and steady market share growth. It enhanced coordination in product dispatch and inventory management, adopted flexible marketing strategies, and promoted retail sales, maximizing efficiency across the industrial chain. The company said it has also advanced non-fuel businesses and proprietary products, improved its integrated energy service network, and expanded international trade capabilities.

Natural gas marketing boosted volume and profitability by leveraging the integrated industry chain, PetroChina said. It said it optimized procurement and sales distribution, strictly controlling costs and promoting market-oriented sales. Efforts intensified to develop high-quality direct sales, industrial, and gas power customers, achieving growth in sales volume and profitability. It sold 86.44 billion cubic meters of natural gas, a 3.7 percent year-on-year increase. Domestic sales reached 69.91 billion cubic meters, up 4.2 percent year-on-year. The marketing business generated an operating profit of RMB 13.51 billion ($1.8 billion).

The company said it will advance talent empowerment, quality and efficiency enhancement, low-cost development, cultural leadership, and digital-intelligent transformation.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR