Santos Ltd on Thursday reported a four percent quarter-on-quarter decrease in output to 21.3 million barrels of oil equivalent (MMboe) as a decline in Western Australia offset increases across the rest of Santos’ portfolio.

Sales volumes fell 10 percent sequentially to 21.5 MMboe in the third quarter “mainly due to maintenance activities in Western Australia, lower crude oil volumes due to timing of liftings and lower third-party gas purchases”, Adelaide-based Santos said in a statement on its website.

Santos narrowed its 2025 production forecast from 90-95 MMboe to 89-91 MMboe and sales guidance from 92-99 MMboe to 93-95 MMboe. The projection downgrade “is primarily due to the slower-than-anticipated start-up of the BW Opal FPSO, and the impact of floods on Cooper Basin production with recovery efforts extending into the fourth quarter, where 155 wells are still offline due to flood water levels receding slower than expected”, it said.

“On 12 October 2025 first gas into the export pipeline was achieved and first production at Darwin LNG is expected in the coming weeks. The delay was driven by the later-than-planned departure of the BW Opal from the Singapore shipyard and the resolution of software issues affecting the safety systems identified during commissioning”.

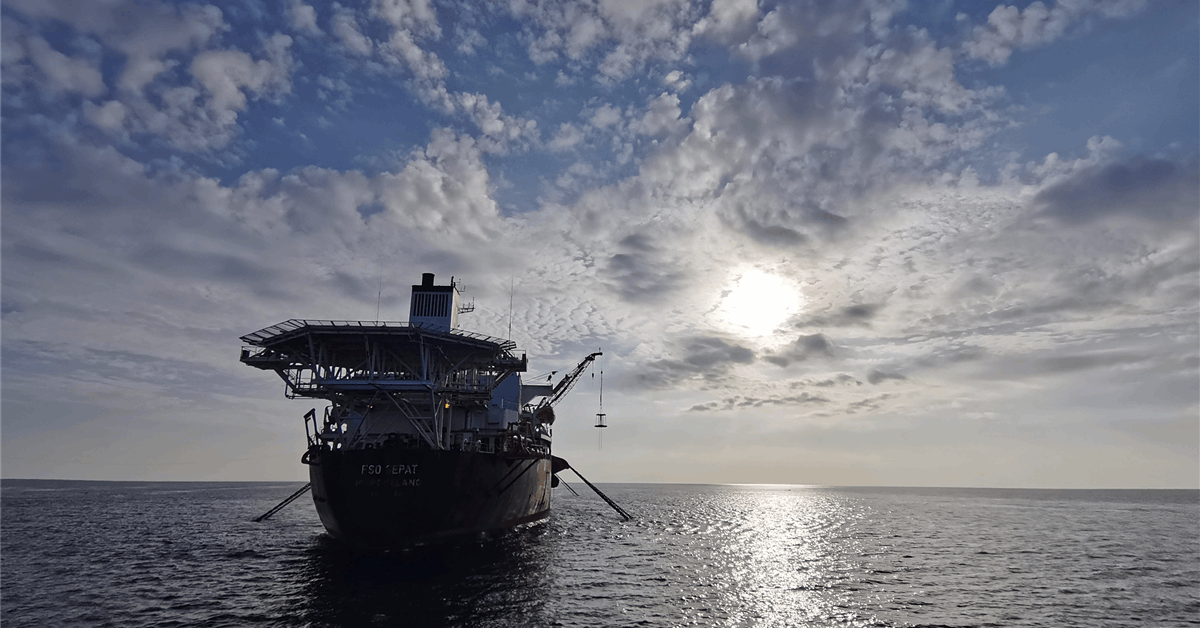

Santos said September 22 Darwin LNG’s new source field, Barossa, had started producing natural gas through floating production, storage and offloading vessel BW Opal and that the liquefaction facility had received reauthorization from Australia’s Northern Territory.

The Darwin LNG life extension project can produce up to about 3.7 million metric tons a year of liquefied natural gas (LNG), according to Santos.

Darwin LNG’s previous source field, Timor-Leste’s Bayu-Undan, stopped exporting gas to the liquefaction facility late 2023 due to depletion, though Santos said 2024 Bayu-Undan would continue sending gas to the Northern Territory until the end of that year. In its quarterly report July 16, 2025, Santos confirmed Bayu-Undan ceased production May 2025.

The new source field extends Darwin LNG’s production life by two decades, according to Santos. Santos plans to drill up to eight subsea wells.

“Barossa LNG remains on track to ship its first LNG cargo in the fourth quarter of 2025”, Santos said Thursday.

In Alaska, phase 1 of the Pikka oilfield development was more than 95 percent complete, Thursday’s statement said. “The project remains on track to meet accelerated first oil guidance in the first quarter of 2026, with ramp up to a plateau of 80,000 bopd (gross) expected in mid-2026”, Santos said.

In July-September Santos produced 10.2 MMboe in Papua New Guinea, 4.5 MMboe in Western Australia, 3.7 MMboe in Queensland and New South Wales and 2.9 MMboe in the Cooper Basin.

Sales gas delivered for liquefaction totaled 68.5 petajoules in Q3, while domestic sales gas totaled 42.6 petajoules. Liquefied petroleum gas production was over 19,000 metric tons. Crude oil and condensate totaled 1.07 million barrels and more than 975,000 barrels respectively.

Q3 sales revenue stood at $1.13 billion, compared to $1.29 billion for Q2 and $1.27 billion for Q3 2024. LNG accounted for $689 million, domestic gas $267 million, condensate $85 million, crude $74 million and LPG $15 million. All except condensate declined quarter-on-quarter.

Santos’ realized prices fell quarter-on-quarter for oil-indexed LNG “primarily due to three-month lagged JCC”, Santos said. “This was partially offset by consistent realized prices from JKM-linked LNG sales”.

Realized prices for East Coast gas and LPG also fell quarter-on-quarter. Year-on-year, all except West Coast gas realized prices fell.

Free cash flow from operations was around $300 million for Q3.

“With around $1.4 billion of free cash flow from operations generated year-to-date, Santos is well positioned to deliver strong shareholder returns with imminent production growth as we bring Barossa LNG online and move closer to the start-up of Pikka,” said managing director and chief executive Kevin Gallagher.

“Moomba CCS continues to perform to expectations, with more than 1.3 million tonnes (gross) of CO2-equivalent safely and permanently stored in its first year of operations”, Gallagher added.

“A final investment decision was made for the Cooper Midstream Simplification project, which will drive cost savings by simplifying the processing configuration at Moomba Plant and Port Bonython. This initiative supports our long-term strategy to maintain profitable Cooper Basin operations.

“Momentum is also building around our Narrabri Gas Project, with strong market interest reflected in recent MOUs and ongoing engagement with key stakeholders. Narrabri is the key to solving east coast gas supply concerns and would be a competitive supply source for local industry for decades to come”.

To contact the author, email [email protected]