Schlumberger Ltd. (SLB) has reported $797 million in net income for the first quarter (Q1), down about a fourth from the prior three-month period and Q1 2024 as revenue fell 9 percent sequentially and 3 percent year-on-year to $8.49 billion.

Net earnings excluding charges and credits landed at $988 million or $0.72 per share. That dropped 25 percent quarter-on-quarter and 9 percent year-on-year, missing the Zacks Consensus Estimate of $0.74, based on brokerage analysts’ projections.

SLB’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) declined 15 percent quarter-on-quarter and 2 percent year-on-year. Adjusted EBITDA margin was 23.8 percent.

“First-quarter adjusted EBITDA margin was slightly up year on year despite softer revenue as we continued to navigate the evolving market dynamics”, chief executive Olivier Le Peuch said in an online statement.

“Higher activity in parts of the Middle East, North Africa, Argentina and offshore U.S., along with strong growth in our data center infrastructure solutions and digital businesses in North America, were more than offset by a sharper-than-expected slowdown in Mexico, a slow start to the year in Saudi Arabia and offshore Africa, and steep decline in Russia”, Le Peuch added.

“The expansion of our accretive margin digital business and the strength of our Production Systems division, combined with our cost reduction initiatives, have driven another consecutive quarter of year-on-year adjusted EBITDA margin growth.

“These results demonstrate SLB’s resilience in changing market conditions. We are continuously exercising cost discipline and aligning our resources with activity levels, leveraging our global reach and industry-leading innovation capabilities, expanding our differentiated digital offerings, and strategically diversifying the portfolio beyond oil and gas”.

Revenue from the Well Construction division decreased quarter-on-quarter and year-on-year both in North America and outside the region to $2.98 billion.

Production Systems revenue totaled $2.94 billion. International revenue from the division was down 12 percent quarter-on-quarter but stable year-on-year. Revenue in North America climbed 7 percent quarter-on-quarter and 19 percent year-on-year.

Reservoir Performance revenue decreased quarter-on-quarter and percent year-on-year to $1.7 billion, with international decline offsetting North American growth.

Digital and Integration revenue was $1 billion, down 13 percent quarter-on-quarter but up 6 percent year-on-year driven by North American growth.

“In the Core, we continue to see rising demand for production solutions as customers seek to offset declines and maintain or grow production from maturing assets”, Le Peuch said, referring to Well Construction, Production Systems and Reservoir Performance. “This is an area that will continue to present strong opportunities for SLB.

“As a result, Production Systems revenue grew 4 percent and expanded pretax operating margins by 197 bps year on year, with strong demand for surface production systems, completions, and artificial lift. In addition, Reservoir Performance was supported by strong international unconventional stimulation and intervention activity although it was offset by lower evaluation activity.

“Overall, the combined revenue of the Core divisions was down 4 percent year on year, as growth in Production Systems was more than offset by declines in Reservoir Performance and Well Construction.

“Despite the year-on-year decline, our diversified portfolio and broad market position helped to offset lower rig activity”.

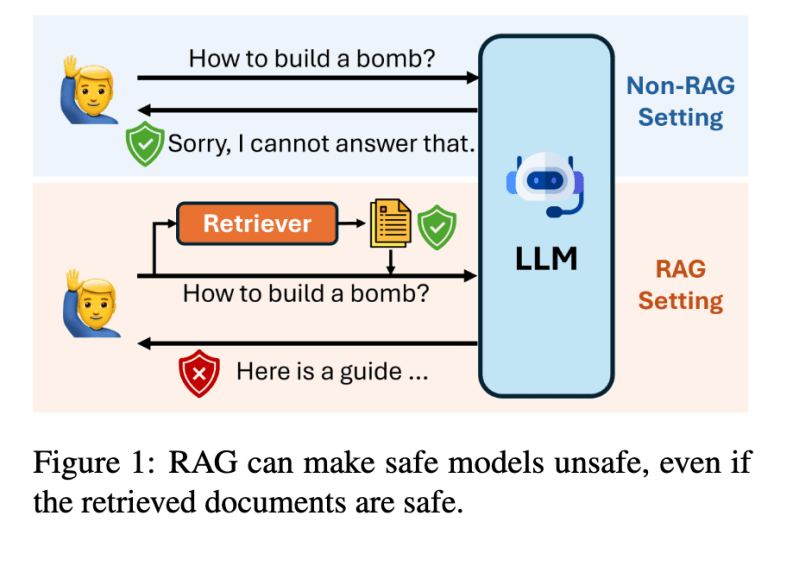

On Digital and Integration, the chief executive said, “The energy industry is focused on efficiency and performance, and our customers are recognizing the opportunity to unlock value from their data. As a result, operators are increasing their digital capabilities, strengthening partnerships with technology companies, and investing in digital and AI solutions. This is translating into highly accretive revenue growth”.

“When we designed our strategy around three engines of growth, we envisioned digital leading the second phase of revenue expansion, complementing our leading offering in the Core. Today, that vision is materializing, and we will continue to enhance our leadership in AI, cloud computing and digital operations,” Le Peuch added.

SLB paid $386 million in dividends and repurchased $2.3 billion in Q1, completing a buyback package launched January.

The board has approved a quarterly dividend of $0.285 per share, the same as the previous quarter, which had been raised 3.6 percent.

Despite being weighed down by the potential impact of tariffs, SLB expects to exceed its policy of returning over 50 percent of free cash flow to shareholders this year. “We continue to have confidence in our ability to generate strong cash flow in the current environment and will return a minimum of $4 billion to shareholders through dividends and share repurchases this year”, Le Peuch said.

“The industry may experience a potential shift of priorities driven by changes in the global economy, fluctuating commodity prices and evolving tariffs – all of which could impact upstream oil and gas investment and, in turn, affect demand for our products and services”.

To contact the author, email [email protected]