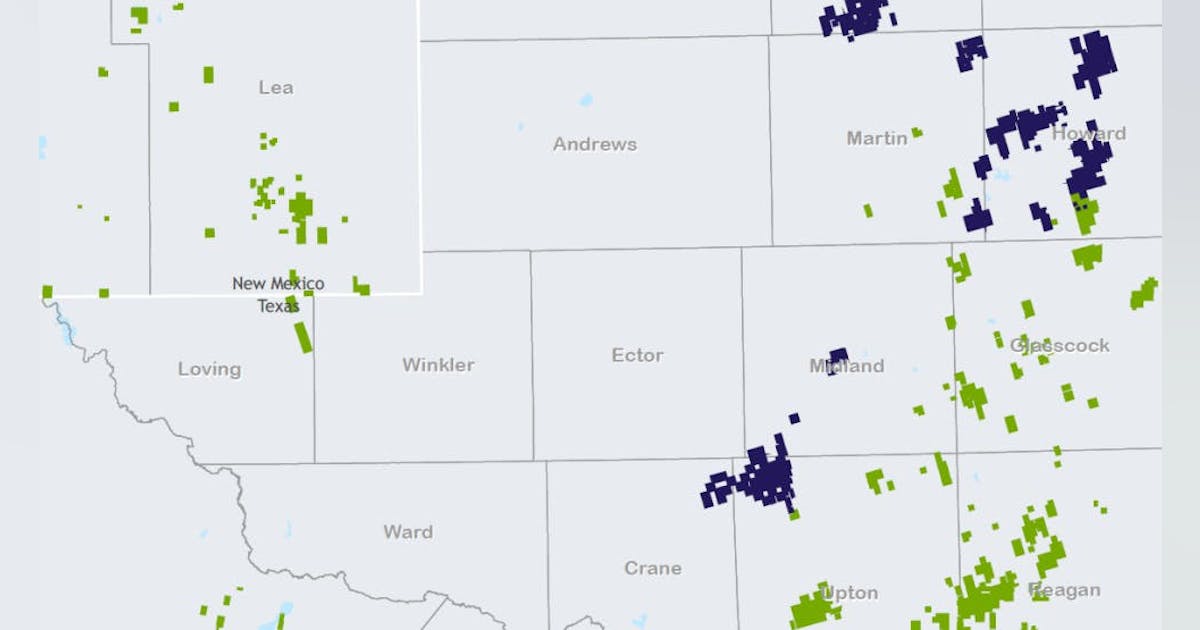

The directors of SM Energy Co. and Civitas Resources Inc. have agreed to merge the two companies and create a top-10 independent company that will produce more than 500,000 boe/d from four US basins.

The companies’ deal calls for Civitas shareholders to receive SM stock worth roughly $2.7 billion early next year. SM chief executive officer Herb Vogel will be the combined company’s leader before handing the reins to Beth McDonald—a transition plan SM announced 2 months ago (OGJ Online, Sept. 8, 2025)—at the beginning of March.

In a statement accompanying the Nov. 3 news, McDonald said the planned merger—which had been rumored for several weeks—“establishes a company with transformative scale in the highest-return US shale basins.” The combined company’s production in the second quarter would have been 526,000 boe/d, nearly half of which came from the Permian basin. Assets in Denver-Julesburg basin (28%), South Texas (15%), and Uinta basin (9%) would have rounded out the combined company’s output.

Civitas leaders under the direction of interim chief executive officer Wouter van Kempen—who was appointed 3 months ago when the company’s board pushed aside Chris Doyle (OGJ Online, Aug. 7, 2025)—had committed to improving the company’s operational efficiency and rallying its poor share performance. Asked on a conference call why Civitas’ directors struck the SM deal, van Kempen was matter-of-fact.

“In the end, you can never time deals in a perfect way and you never know what shows up at what time,” van Kempen said. “In the end, this is the right time do this. This is the right opportunity. This makes both companies a lot stronger.”

Investors appeared less than thrilled about the deal news: Around 12 p.m. noon US Central Time Nov. 3, shares of Civitas (Ticker: CIVI) were essentially flat while those of SM (Ticker: SM) were down more than 5% on more than double their average full-day volume.

On the conference call, executives of both companies touted the benefits of the planned union. In terms of production, they said combined organization will leapfrog peers Permian Resources Corp. and APA Corp. Coming together also will over time allow for $200-300 million in cost cuts, about half of which would stem from improved drilling and completion operations. And financially, the combined entity’s cash flows will let McDonald and her team pay down a lot of debt.